The International Monetary Fund (IMF), the international organization which looks after global monetary cooperation, financial stability and facilitates international trade around the world has hailed the decision by RBI to increase policy Repo rate by 0.25 points. “We welcome the Reserve Bank of India’s decision to increase the policy rate by 25 basis points, In the context of rising inflation and additional upside risks to the forecasts due to higher oil prices, exchange rate depreciation and other domestic factors, the IMF thinks that this was an appropriate step by the RBI on Wednesday”, IMF Spokesman Gerry Rice told reporters during his bi-weekly news conference.

The Reserve Bank of India (RBI) increased the policy repo rate to 6.25 percent from the previous 6 percent after a period of almost four and a half years. The last rate hike came in January 2014 during the reign of Raghuram Rajan, when rates went up from 7.75% to 8%. According to economists in the industry, the main reason behind a rate hike was the expectation that inflation will go up in the upcoming months due to various reasons like rising fuel prices. The main job of RBI is to keep inflation under check rather than focusing on economic growth, therefore if it has to make a tradeoff between growth and inflation it is expected to go with combating inflation. Dharmakirti Joshi, Chief Economist at Crisil said “Various indicators like inflation expectation surveys, crude prices or exchange rate depreciation were pointing towards inflation risks. RBI action today is a reaction to rising inflation threat.” It should be noted here that fuel prices have gone up very fast in recent months, which constitutes a significant percentage of Consumer Price Index (CPI), the main base of calculating inflation rate.

The hike in policy repo rate will have a serious implication on day to day life of ordinary civilians, because this rate decides the rate of interest at which people and companies will get loans from the banks. With this, all types of loans like home loans, personal loans and car loans will see a rise in interest rates. A majority of banks and housing finance companies had already hiked their loan rates recently ahead of the RBI policy, which indicates that they were expecting a hike from the RBI. For instance, banks and Housing Finance Companies such as the State Bank of India, HDFC, ICICI Bank, PNB, Bank of Baroda, UBI, and Kotak Mahindra Bank have raised their rates ranging from 5 bps to 20 bps. Home loans, which are among the most basic necessities, will be affected most due to the rate hike by RBI because they are taken for a longer period of time and pegged to policy rates.

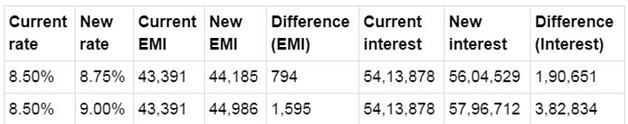

Let’s suppose, Delhi-based Arun Tiwari is looking for a home loan of Rs 50 lakh for buying a house worth Rs 60 lakh. If he takes a housing loan of Rs 50 lakh at 8.50% interest, this would imply an EMI of Rs 43,391. Over 20 years, Mr. Tiwari would be paying Rs 54, 13,878 as interest. A 25 bps increase in the interest rate would increase the EMI to Rs 44,185 and the total interest paid to Rs 56, 04,529. A 50 bps rate hike, on the other hand, would increase the EMI to Rs 44,986 and the total interest payable to Rs 57, 96,712. That’s Rs 1,90,651 more in case of a 25 bps rate increase and Rs 3,82,834 more in case of a 50 bps rate hike.

Despite the IMF welcoming the move, the government is not happy with the increase in policy repo rate because higher rates will make it costlier for the government to borrow from the market to meet its spending. It will also hurt the recently picked up economic growth of the country because the costlier loans to people and the industry means fewer market activity. The government has fixed the fiscal deficit of the country to 3.3 percent due to low collection resulting from policy rate increase. The fiscal deficit target is also under pressure due to problems in accumulating money from disinvestment as the government has not been able to disinvest its share in companies like Air India because no one is bidding for it. Therefore the rate increase has added many problems for the current government which will be facing elections in the upcoming months.