Before beginning with the actual article let me clarify that:

1.) The historical data and future analysis in the article is based on the IMF World Economic Outlook – Oct 2017 update data

2.) Amounts have been expressed in USD, unless explicitly specified

Backstory: Noted Economist and NITI Aayog Member Bibek Debroy recently said India can be a 6.5 Trillion Economy by 2030. However, we believe that Bibek Debroy estimate is far too conservative for India. India is capable of reaching 30 Trillion by 2040. Yes, that’s right. If India needs to be influential in both foreign policy, geopolitics, and wishes to create a sustainable future for its populace, India needs to grow faster. There is nothing holding back India expect India, as rightly pointed out by American Investor Charlie Munger.

For the sake of brevity, let’s assume that India reaches 6.5 Trillion by 2030 and 10 Trillion by 2040. What do these GDP numbers imply?

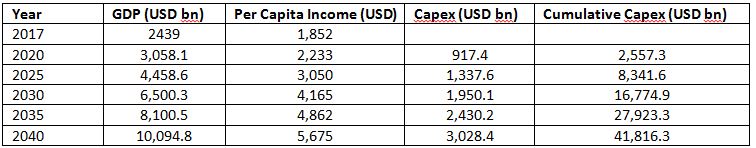

India’s GDP as on 2017 (IMF data) was 2.4 Trillion and thus, a target of 6.5 Trillion by 2030 implies an annual growth rate of ~7.83% and 10 Trillion by 2040 implies a 10-year growth rate of 4.5%. On a compounded annual growth basis (i.e. a simple growth over long term), a target of 10 Trillion by 2040 (over next 24 years) implies a long-term GDP growth rate of 6.4%, a number far lower than the historical (past 24 year) growth rate of 9.04%.

Having set the context, I believe there is a huge scope for the Government to target a more than 9% growth rate over the next 24 years; and there is ample historical evidence which shows that it is achievable.

Let me throw in a few facts before we deep dive into numbers:

1.) During 2002-18, India’s GDP grew at an average growth rate of 10.8%, while China grew at 14.9%.

2.) During 2002-17, the cumulative GDP created by China is 100 Trillion (i.e. sum of GDP number from 2002 to 2017), while India created GDP of 23.5 Trillion (sum of GDP numbers from 2002 to 2017)

3.) China has maintained an Investment rate (fixed capital formation) to GDP of 43.9% for a period of 15 years, while India has maintained average Investment rate of 33.7%. Simply means, that of the Rs. 100 GDP for the year, China has made investments worth Rs. 43.9 and India has made investment worth Rs. 33.7.

4.) China’s forex reserves are 3.4 Trillion, while India’s GDP is 2.4 Trillion. No point comparing India & China’s forex reserves.

5.) California state’s GDP is 2.5 Trillion, which is more than India’s GDP.

The above statistics were shared to give the user a perspective of where we stand, and what we are aiming at. India aims to dominate the geopolitics and foreign policies but that can only be possible with economic might. This needs to be achieved fast; and there can be no two ways about it. And that’s what I am going to explain:

This article is segregated in three sections:

1.) Journey of two nations: India vs China

1.1> Comparing growth trends

1.2> Comparing GDP trends (absolute numbers)

1.3> Comparing share in global GDP

1.4> Comparing incremental growths vis-à-vis developed nation & group of nations

1.5> Overview of capital formation trend

1.6> Overview of per capita income

2.) Is it possible to achieve 30 Trillion by 2040?

3.) Concluding remarks, with insights from Mr. Charlie Munger

1.) Journey of two nations: India vs China

1.1> Comparing growth trend

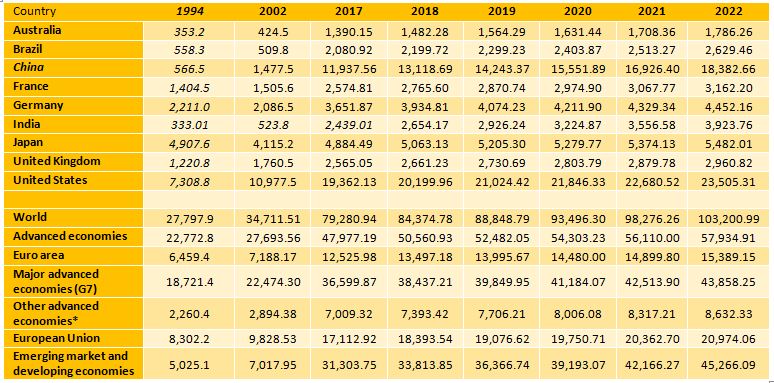

Firstly, let us look at the GDP numbers of key economies during the period 1994 to 2017

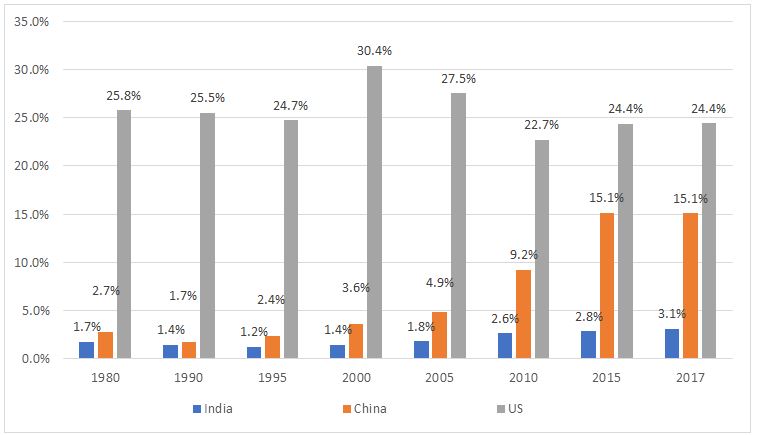

The following table summarizes the key growth parameters of GDP over the key economies and economic pockets:

Note: Numbers in Table are GDP in billion

Source: IMF World Economic Dataset – Oct 2017

As you can see above, India’s GDP in 1994 was 333 Billion, while the GDP for China was 566 Billion and US already at 7.4 Trillion (more than India’s current GDP). Cut to 2017, India’s GDP is 2.4 Trillion, China’s GDP is 11.9 Trillion and US’s GDP is at 20.1 Trillion. In this period, the world GDP grew from 27.8 Trillion to 79.3 Trillion.

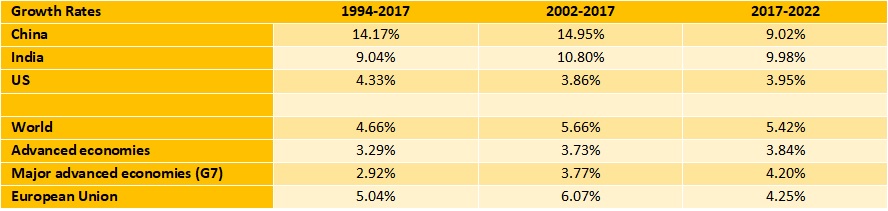

1.2> Comparing GDP numbers (Billion): India vs China

India and China had nearly the same level of GDP (in absolute terms) in 1991-1992. However, you can see, one nation went aggressive and other adopted a slow growth stance. China grew at an astonishing pace of 14.2% during 1994 to 2017, while India grew at 9.0% during the same period. This near 5% gap in growth has translated into a GDP gap of near 5x between India and China.

Note: figures in Chart below are in trillion

Fun fact, China’s forex reserves are 3.4 Trillion, yes TRILLION, that is more than India’s GDP. Let that sink in, that China has forex reserves (or just pure Cash) which are more than India’s GDP.

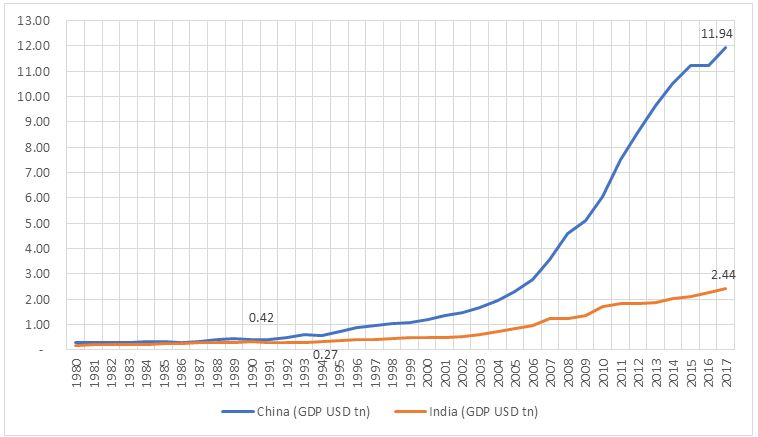

1.3> Comparing the Share in Global GDP

The following chart shows a country’s GDP as the %share of of World GDP.

The above chart shows that, during the period 1980-2010, India’s share in World GDP has ranged from 1.7% to 2.6%. In fact, from 2010 to 2017 it increased to 3.1%. The trend from 1980 to 2015 shows that, while India grew at a staggering pace, our growth rate remained in line with the global growth trend. On the contrary, if you look at the trend in China’s share in global GDP, in 2000 they were 3.6% of Global GDP and by 2010 they were 9.2% of World GDP. They have nearly tripled their share in World GDP in a span of just 10 years, while India increased its share from 1.4% to 2.6%. While we have outpaced the global growth, the delta was not that astounding.

Coming to the growth rate trend, during the past 15 years China grew at 14.9%, while India grew at 10.8%. However, going forward China’s growth rate is expected to drop to 9% to 10% range for the next 5 years, while India is expected to have a slight edge in growth as compared China.

1.4> Comparing incremental growth rate across various nations and group of Nations

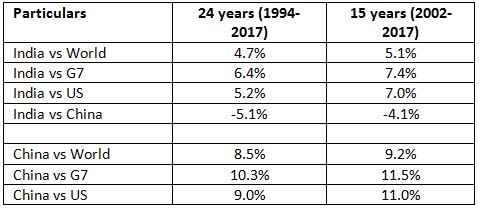

The following table shows the degree of outpace in Growth between India and China:

a.) World growth

b.) G7 country growth

c.) US growth rate

If we look at first row, we see India has outpaced World GDP growth by 5.1% in past 15 years; while China has outpaced global growth at 9.2%; nearly 2x of India’s pace. Simply put, if world economy grew at 5%, India grew at 10% (meaning a 5% outpace); while China grew at 14% (meaning a 9% outpace). This is critical, as emerging economies are capable of faster growth, since there is lot of infrastructure to be built, new jobs are bound to be created and consequently newer consumption trends are likely to rise. Further, as per capita income increases, the GDP growth jumps faster by a mix of capex growth and consumption growth.

1.5> Capital Formation or Investment is the key for GDP growth:

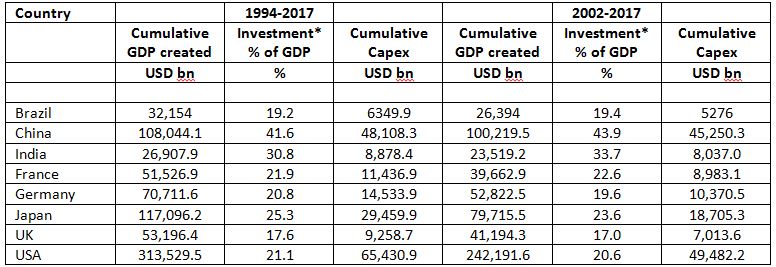

In real numbers, what really changed over the years. More than anything else was the Capital Expenditure, i.e. Investment (as classified by IMF data). The GDP growth rate is driven by both consumption and gross fixed capital formation. This investment, both private and public capex, is the key in achieving a faster GDP growth. In last 15 years, China added 45.5 Billion of capex, while India has added about 8.0 Billion; or in simple terms, China did nearly 5x more Investment than India. This investment has made all the difference. In fact, the investment by China is nearly equal to the spending by US, an economy twice the size of China. Let’s look at how key economies have performed historically on this front:

1.6 Comparing per capita income

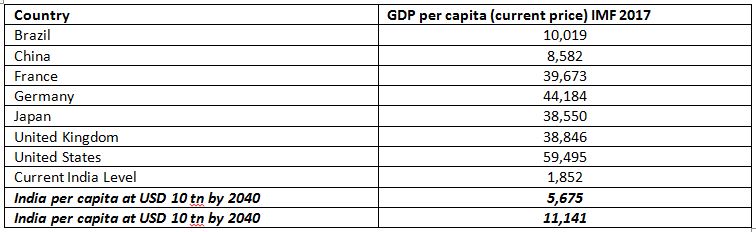

The numbers quoted by Mr. Bibek Debroy, or otherwise Government targets of GDP growth numbers are quite low-ball. We achieve these numbers despite our Governments and not because of our Government. So, as mentioned earlier, a long-term target of 6.4% is quite low, in fact, it is more of a ‘chalta hain’ target than anything serious. The biggest harm in this target (assuming India hits 10 Trillion by 2040), is the per capita income of India shall be only USD 5675. While this may sound like a huge improvement vs current per capita income USD 1853; but it will still be quite low as compared to current per capita income of major economies as under:

With Mr. Bibek Debroy’s estimate about GDP figure, India will have a per capita income of just USD 5675 in 2040, which is less than current Per Capita GDP of any other comparable economy right now. So, even 24 years down the line, our GDP would be less than China’s GDP (11.9 Trillion) and even our per capita income would be lesser than what China’s is today (8582).

2. Do we really need to wait until 2040 to reach 10 Trillion?

We ran three scenarios, looking at what India could achieve by 2040:

1.) Scenario 1: Taking Mr. Bibek Debroy’s numbers as sacrosanct (implied long-term growth 6.37%)

2.) Scenario 2: Taking a growth rate equivalent to historical growth rate (implied long-term growth 9.54%)

3.) Scenario 3: Growing at a pace, equal to China’s from 2005, when the then China’s GDP was equal to India’s current GDP

Let’s see how the numbers stack:

Scenario 1: Taking Mr. Bibek Debroy’s numbers as sacrosanct

In this scenario, India must undertake a capex of 41 Trillion over the next 24 years, and at 10 Trillion by 2040, India’s per capita income reaches 5675, which is less than current per capita GDP of China. This number is far lower than those of other economies as it stands today. So, this growth rate or GDP target should not even be a plan for any government. Moreover, our infrastructure is not that great, hence urgent overhaul and capex are the need of hour. Hence, such low-ball numbers would not suffice for the consumption coming in.

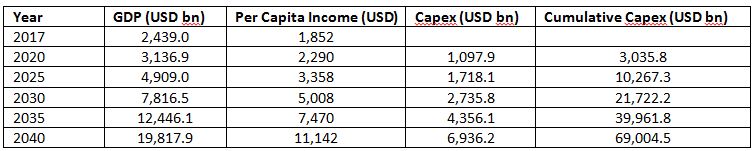

Scenario 2: Assuming a growth rate similar to our historical trend of 9.5%

Under this scenario, India hits a GDP of 20 Trillion, by 2040, and crosses the per capita GDP magic number of 10,000 in the next 24 years. For reaching this numbers India must plan a capex of 10 Trillion by 2025 (i.e. next 10 year), and then capex of 40 Trillion by 2035 and capex of 69 Trillion by 2040.

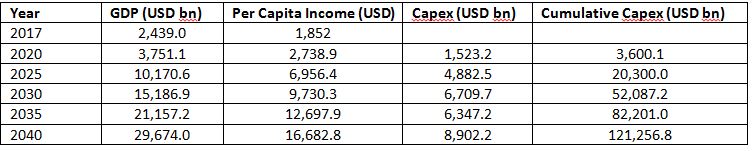

Scenario 3: Growing at a pace at which China grew historically

In 2005, China’s GDP was 2308 Billion (or 2.3 Trillion), which is nearly equal to current India’s GDP of 2439 Billion (or 2.4 Trillion). From 2005, China grew at a staggering pace, reaching 11.9 Trillion today in a span of 13 years. Under this scenario, we assume that India is able to mirror this growth; assuming our Government is able to mirror this, how would the country look like?

Assuming that we are able to grow at China’s pace, India would be a 10 Trillion economy by 2025 (vs Mr. Bibek Debroy’s assumption of 2040); and by 2030 India’s per capita income would be nearlu 10,000 (9730). These numbers are audacious, bold and require a visionary Prime Minister (which seems sorted for now at least) and a visionary team else India will crumble owing to its own weak infrastructure.

Conclusion: Our Governments and Economists (At least the good ones like Mr. Bibek Debroy) need to prepare for targets which are audacious, rather looking at organic growth levels and thinking in terms of constraints currently posed to the economy. India needs faster growth to move its populace out of poverty, make itself financially and territorially secure, and act as an influential player in the global geopolitics. With an unfriendly Dragon right in the neighborhood, that’s five times the economic size of us, we cannot afford to set menial targets for ourselves. If China’s CPEC and OBOR projects succeed in next 10 or even 20 years, China will be a much bigger force than US and a huge threat to India that it is today. India needs to up its game because there is no other option than to perform.

The areas where India needs a fastest growth is:

1.) Capex related to railways, public transportation, should be key focus

2.) Capex related to infrastructure i.e. roads, ports, highways, ring roads around cities, village connectivity, etc.

3.) Agriculture capex in the nature of expanding warehouses, cold storages, IT infrastructure should be a top priority

4.) Capex related to Space activity

5.) Sharp increase in defense capex including strengthening navy, air force, internal security, etc.

One may argue that such a fast pace can lead to an imbalance in fiscal policies, but fiscal policy defects can self-correct if the gross fixed capital formation (or capex or investment) is on the right track. Moreover, in each area there is a sharp deficit in the ‘requirement today vs supply today’. For example, India needs more roads and rail tracks is a fact; or defense spend is lower is a fact. We just need to correct the same by doing targeted supply / capex, and minimize corruption.

Each state needs to take a visionary development goal. For example, let us just look at Uttar Pradesh. Uttar Pradesh has a population equivalent to Brazil, but Uttar Pradesh’s GDP currently is 230 Billion, while Brazil’s GDP is 2.1 Billion; that’s just 10% of of Brazil despite the same population. This needs to change; based on population and size, each state should be assigned model country numbers to achieve over a period of next 10 years and 20 years.

There can be lot of difference in Brazil’s economic characteristics vs Uttar Pradesh’s. There is oil in Brazil, There are Defense spends; So, even a target of at least 50% of Brazil say 1.0 Billion will change the face of the state and the nation. The Government of Uttar Pradesh needs to use what it has; for example, spend on infrastructure, agriculture, food processing, agriculture insurance, etc. In fact, biggest boost to the Uttar Pradesh state will be river Ganga clean up. The Namami Ganga project itself is pegged at INR 200 Billion or 3.1 Billion. This is nearly 5% of UP’s current GDP. This capex itself is capable of creating a GDP boost of 10 Billion for Uttar Pradesh. The faster the pace of execution, the faster will be the growth in the region.

In February 2017, Charlie Munger (the 93-year young partner of Warren Buffet, and if you don’t know who Charlie Munger or Warren Buffet is, god bless you) spoke to Investors and stated this about India.

‘Now you turn to India. And I would say, I’d rather work with a bunch of Chinese than I would the Indian civilization mired down, caste system, over-population, assimilated the worst stupidities of the democratic system, which by the way Lee Kuan Yew avoided, it’s hard to get anything done in India. And the bribes are just awful. So, all I can say is, it’s not going to be easy for India to follow the example of Lee Kuan Yew. I think that India will move ahead. But it is so defective as a get-ahead…the Indians I know are fabulous people. They’re just as talented as the Chinese, I’m speaking about the Indian populace. But the system and the poverty and the corruption and the crazy democratic thing where you let anybody who screams stop all progress? It mires India with problems that Lee Kuan Yew didn’t have. And I don’t think those Indian problems are always easy to fix. Let me give you an example. The Korean steel company, POSCO, invented a new way of creating steel out of lousy iron ore and lousy coal. And there’s some province in India that has lots of lousy iron ore and lot of lousy coal. Which is there’s not much use for. And this one process would take their lousy iron ore and the coal and make a lot of steel. And they got a lot of cheap labor. So POSCO and India were made for each other. And they made a deal with the province to get together and use the POSCO know how and the India lousy iron ore and lousy coal. And 8 or 9 or 10 years later with everybody screaming and objecting and farmers lying down in the road, or whatever’s going on, they canceled the whole thing. In China they would have just done it. Lee Kuan Yew would have done it in (Singapore). India is grossly defective because they’ve taken the worst aspects of our culture, allowing a whole bunch of idiots to scream and stop everything. And they copied it! And so they have taken the worst aspects of democracy and they forged their own chains and put them on themselves. And so no I do not like the prospects of India compared to the prospects of…and I don’t think India’s going to do as well as Lee Kuan Yew.

This is a reality check for us. When the world’s most influential investor sees such challenges. India needs to do a lot more to keep the faith and especially, ‘needs to learn to get things done’ more than anything else.