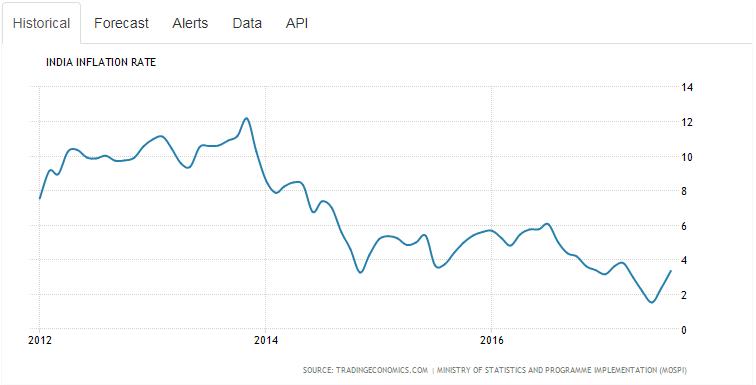

The way to crush the bourgeoisie is to grind them between the millstones of the taxation and inflation – Vladimir Ilyich Ulyanov alias Lenin. What is the greatest achievement of Prime Minister Narendra Modi Cabinet Vis a Vis “lower middle class”? In the numerous reforms we left one thing unnoticed “Inflation Rate”. Let’s look at the numbers:

Source : https://tradingeconomics.com/india/inflation-cpi

On the other hand the rise in petrol and diesel prices has been making news for the last week or so. Change in fuel price indeed has far reaching effects as its impact ranges from daily budget to macroeconomics like inflation numbers.

So, is government “undoing” the good work it has done? Let’s find out:

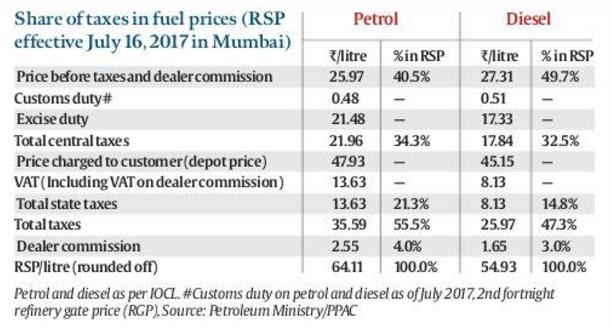

In Mumbai, petrol prices touched Rs 80 a litre while in Delhi; it is over Rs 70 per litre. It was August 2014, when petrol prices breached Rs 70 mark the last time. Back then the crude oil prices was around USD 98 per barrel. But, now the crude oil prices are hovering around USD 50 per barrel.

Why are petrol and diesel so costly?

According to data released by the Indian Oil Corporation for the petrol price build up in Delhi, the fuel costs only Rs 26.65 at the refineries. Dealers get a litre of petrol at Rs 30.70. But, petrol is sold at Rs 70.39 a litre in Delhi. This means Rs 39.41 is charged as tax component and dealer’s commission on every litre of petrol sold in the national capital.

While most of the taxable articles moved under the GST regime, petroleum products are still governed by VAT system. Different states have different rates of VAT applicable on petroleum products.

As per the data available with the Petroleum Planning and Analysis Cell (PPAC), Delhi charges a VAT of 27 per cent on petrol while it is 47.64 per cent in Mumbai, Thane and Navi Mumbai. This explains the difference of about Rs 9 in the petrol prices in the two cities.

What is the solution of this problem?

If petrol is brought under GST, it may cost as little as Rs 38.10 in Delhi at 12 per cent GST rate. In fact, Minister for Petroleum Dharmendra Pradhan has made a statement saying that inclusion of petroleum under GST is the only way for rational pricing.

Under GST, the petrol and diesel prices under the present circumstances will become substantially cheaper.

The GST regime provides for taxation rates of 0, 5, 12, 18 and 28 per cent. Petrol and diesel can’t be expected to be taxed below 12 per cent. At 12 per cent GST, the petrol will be sold at Rs 38.1 in Delhi – almost Rs 32 cheaper than the current rate for one litre of the fuel. At 18 per cent, petrol will be 40.05 a litre in Delhi while at 28 per cent; it will cost Rs 43.44 per litre. If the SUV compensation cess is imposed over and above 28 per cent GST on petrol, it will cost Rs 50.91 in Delhi – still about Rs 20 cheaper than the existing rate. As for diesel, its current price in Delhi is Rs 58.72 per litre. At 12 per cent GST, diesel will sell at Rs 36.65 in the national capital. At 18 per cent GST, diesel will cost Rs 38.61.

At 28 per cent GST, diesel will cost Rs 48.88 in Delhi and if SUV cess is imposed, the customers will have to pay Rs 49.08 for a litre of the fuel – still Rs 9.64 cheaper than the existing rate.

But, bringing petroleum products under the GST involves politics. Under the GST Act, the decision to bring petroleum products under the new taxation regime can only be taken by the GST Council which has heavy representation from states, which are not ready to let go the hen laying golden eggs.

Ahead of the GST launch on July 1, Finance Minister Arun Jaitley had said that the Centre was all for inclusion of petroleum products under the new taxation system and sooner or later the GST Council will have to take a decision on it.

But GST is not a long term solution. Say if GST for fuel is implemented today and the prices are brought down to INR 50 per litre and then oil prices in international market takes a steep raise?

What is the Long term solution?

Two of the very important news in recent past did not get the lime light despite of the strategic importance they carried.

- First 2G (Second Generation) Ethanol Bio-refinery in India to be set up at Bathinda (Punjab).

- Maruti will make electric cars in Gujarat.

E10, a fuel mixture of 10% anhydrous ethanol and 90% gasoline sometimes called gasohol, can be used in the internal combustion engines of most modern automobiles and light-duty vehicles without need for any modification on the engine or fuel system.

By producing 10% of the 2G ethanol we can certainly reduce consumption by 10% and then electric cars. India is making a record of sorts. It is for the first time the country will see a reform without a lag with the advanced countries. While the advanced world moves towards replacing fossil-fuel vehicles with electric ones, India wants to take a leap. It has set for itself an ambitious target of having only electric cars by 2030. The target is, in fact, more daunting than in many advanced countries. For example, Britain will ban the sale of new petrol and diesel cars 10 years after India, from 2040.

That’s why Union road transport and highways minister Nitin Gadkari spoke of bulldozing his way to the target at the annual convention of the Society of Indian Automobile Manufactures (SIAM).