India moved a step closer towards implementing the goods and services tax (GST), the most ambitious tax reform, after the centre and the states struck a consensus on the tax slabs under GST. It has increased the likelihood of the GST’s implementation on April 1, 2017.

On Thursday, GST council (comprising union and state finance ministers) agreed upon a four-tier rates structure – 5%, 12%, 18% and 28% for various items and services. These tax rates are slightly different from the tax rates of 6%, 12%, 18% and 26% proposed in October by the central government.

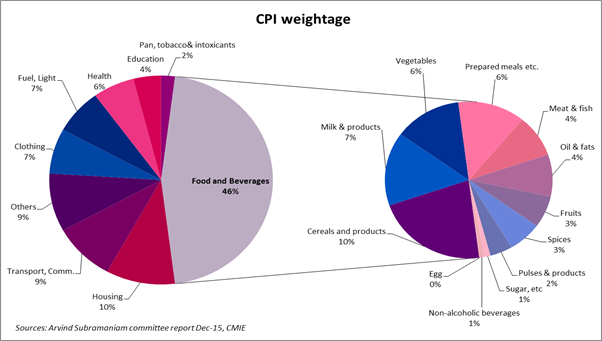

The main highlighting point is that essential items including food grains such as rice and wheat, which presently constitute roughly 50% of the consumer inflation basket, will be taxed at a zero tax rates. Hopefully, it will ease market concerns over inflationary pressure stemming from the GST.

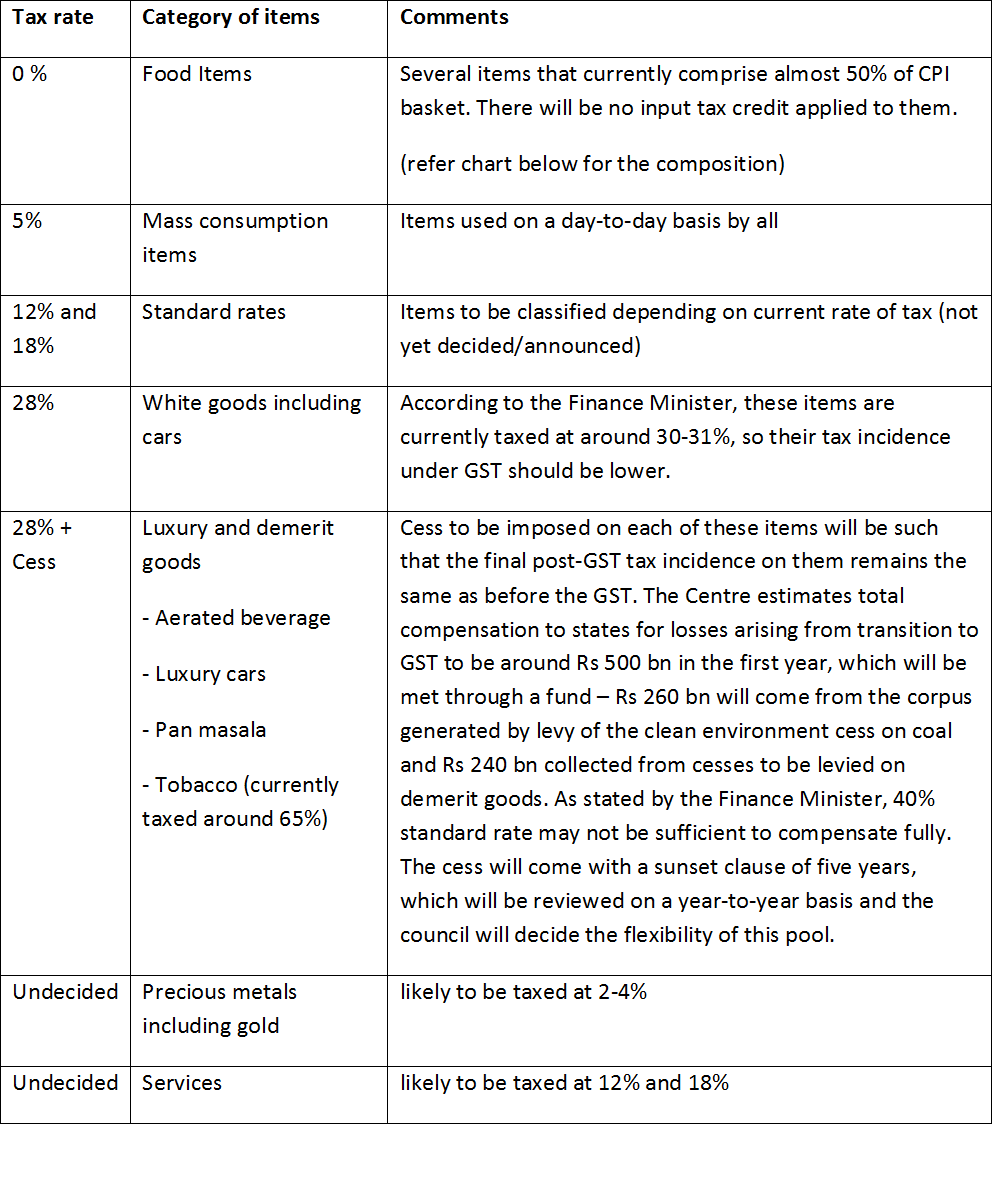

While a detailed item‐wise list yet to be finalised, the rate structure finalised by the GST council is as follows:

Threshold limits:

Firms with a turnover of less than INR 2mn will be exempt from the purview of GST, with the exception in the North-eastern states, where a lower exemption limit of INR 1mn will apply.

Multiple-rate tax structure and its Inflationary impact

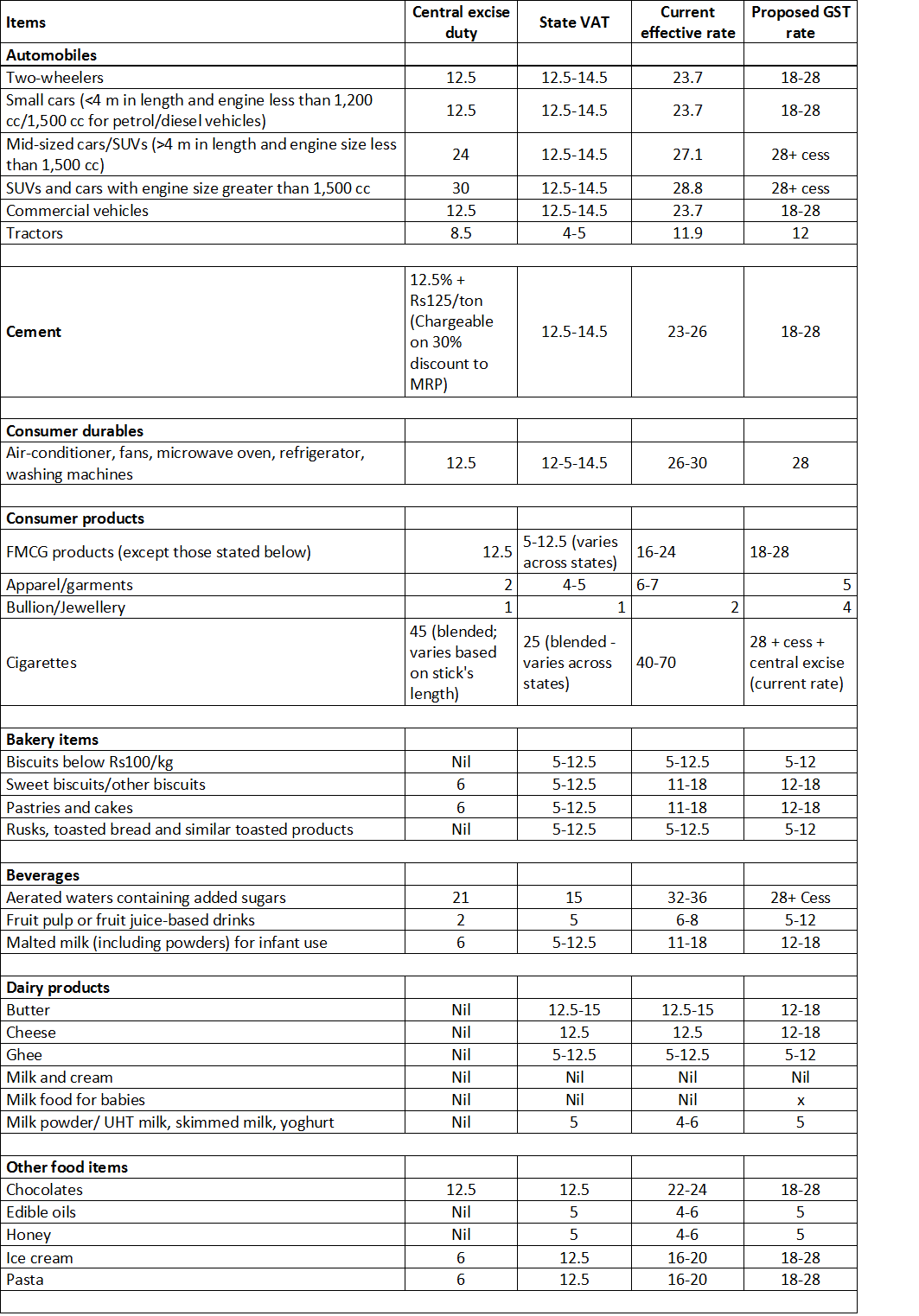

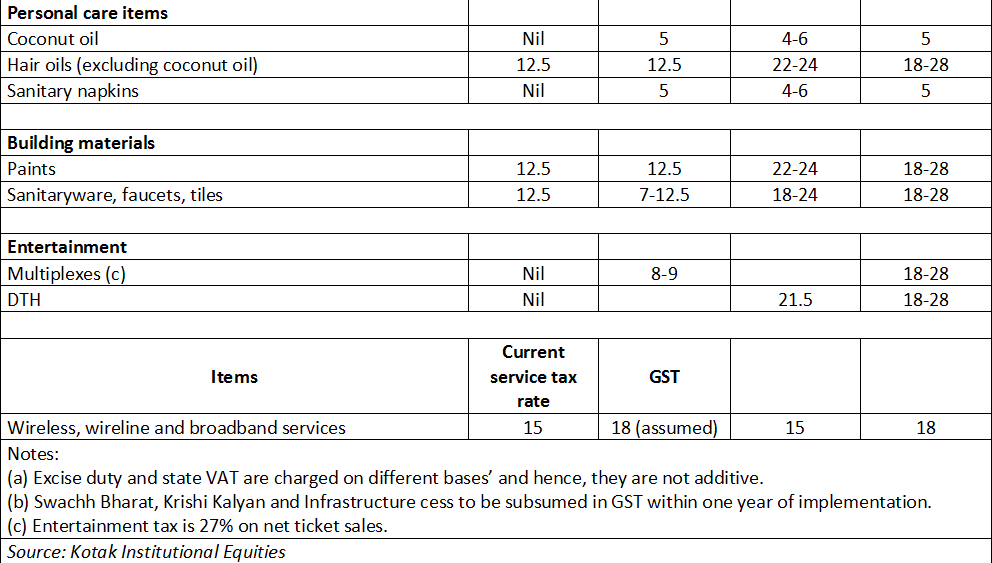

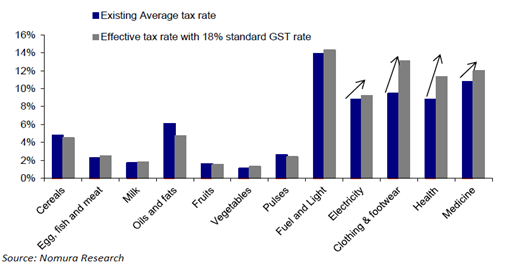

One of the main objectives of GST was to reduce the inefficiencies in the current tax system such as multiplicity of tax rates, elimination of cascading impact, and ease of compliance. GST council’s decision to implement a four-tier tax structure dilutes that objective to certain degree. However, multiple tax slabs are perhaps necessary considering the wide disparity in consumption levels in India. The structure aims to keep the inflationary pressure at minimum after implementation of GST. These proposed GST rates are similar to current ‘overall’ rates for most of the goods. The table below will give you a rough idea.

The chart below compares some of the essential commodities used by a common man.

Although it’s not possible to estimate the exact inflationary impact right now; the broader tax slabs suggest the inflation impact will likely be minimal. Any increase in service inflation due to the rise in the service tax rate (to 18% from the current 15%) would be offset by a fall in consumer goods inflation due to the reduction in taxes on consumer goods. In general, the GST should result in services becoming more expensive and manufacturing becoming cheaper.

Over the long term horizon, the GST should exert disinflationary pressure mainly due to –

- Reduced logistics costs,

- A lower tax burden due to the elimination of a “tax on tax”,

- Seamless input tax crediting between goods and services,

- The elimination of geographic fragmentation of production and higher investment,

- Acceleration in shift from unorganised to organised segment

Upcoming challenges:

It is quite clear the government is aggressively working towards the implementation from 1 April 2017. However, there is a long way to go.

- Although tax slabs, compensation to states and threshold limits have already been agreed upon; decisions regarding final classification of each good and service into specific tax brackets and the tax to be imposed on gold will be really challenging to tackle.

- The winter session of the Parliament starts November 16, and the government will try and have the Central GST and Integrated GST bills approved during the session.

- Meanwhile, all states will need to work out their own GST bills and have them approved by the Parliament.

- The setting up of IT infrastructure is another integral component for the implementation of the GST. The government has set up the Goods and Services Tax Network (GSTN), a not-for-profit entity owned by the centre, states and non-government financial institutions, for the IT infrastructure requirements. India’s second-largest software company, Infosys, has been assigned the mandate to develop and run GSTN.

- The training of tax officers and industry will be another challenging task.

I personally think that the consensus on the tax rates in the GST council is a major breakthrough, especially considering that the issue was heavily debated. Two important things to watch for in the near term are parliament’s approval of the GST rates in the upcoming winter session and how various products are categorized under different tax brackets.

In theory, Goods and Services taxes is expected to be a game-changing tax reform in Indian Tax history that will boost growth, lower costs and support the government’s tax revenues. However, the current proposed version seems quite complex. It will take significant time for benefits from G.S.T to materialise, it won’t happen immediately. But over time, as the GST council widens the tax net, minimises the tax slabs and lowers the standard tax rates, the benefits will be substantial. It remains to be seen if the GST regime will be able achieve them.