The Constitution (122nd Amendment) Bill, 2014 or simply the GST Bill, is passed with a unanimous 203 AYES. The Bill took about 10 years to get passed as it went through multiple rounds of negotiations and re-negotiations. The passage of the bill by way of Constitutional amendment has gotten the ball rolling for moving the biggest tax reform in the country since 1991.

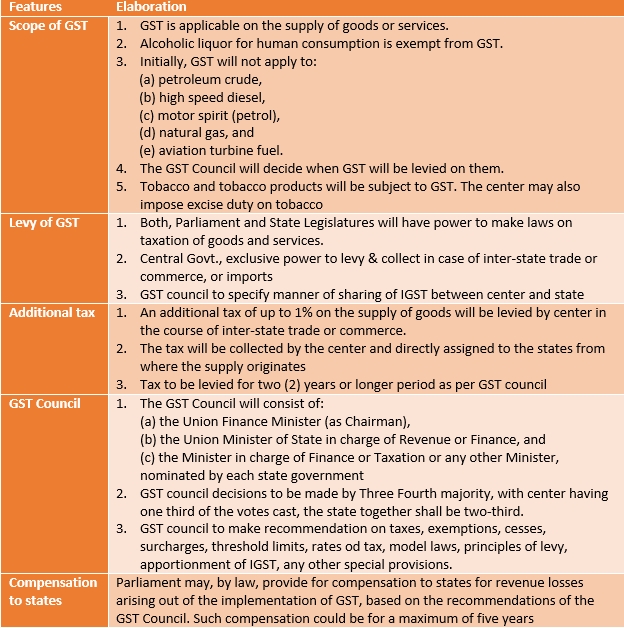

Key features

Road Ahead

- The bill will go back to the Lok Sabha for its assent on the new amendments brought in by the Government

- The bill will have to be ratified by the 50% of the State Assemblies and then receive the President’s assent

- The GST council comprising of the state Finance Ministers, and the Union Finance Minister, will be set up. It will decide on what the tax rate will be under GST, the revenue threshold below which traders will be exempted from the levy and also the administrative processes under GST.

- The model central GST law and the integrated GST law will be tabled in Parliament for its approval. All State legislatures will also need to get the state GST law passed.

- Subsequent to the passage of the bills, the rules will be notified for finalizing the processes under GST.

- Simultaneously, the information technology network will also have to be readied to ensure a seamless registration, tax payment, return filing and refund system across all states.

Major Challenges

- Arriving at a consensus on the tax rate under GST is going to be an uphill task, with states unlikely to agree to a standard rate of 18% recommended by a committee constituted by the Central Government

- Lowering the exemption levels for traders with revenues of less than Rs. 10.0 Lakhs will increase administrative costs for the center.

- No consensus on administration of traders below Rs. 1.5 crore. States are demanding exclusive control over traders with annual revenue of Rs. 1.5 crore; the CBEC strongly opposes this move, fearing loss of control over majority of the traders

- States have no experience in collecting tax on services, an intangible item

- Compliance for Service Industry will increase

- Manufacturers will have to re align their supply chain, as it is important that every supplier files tax returns, so that input credit can be claimed.

Highlighting the challenge faced by the NDA in implementation, Jaitley quipped to former finance minister P. Chidambaram, To implement GST is a headache and to be a former finance minister is a luxury.

Frankly, this is a historic bill and converts India into a single market place. Till date, each levied different taxes on each product. All, these hassles will be reduced. Once the Act is in place, it can boost the GDP by 1% to 2%.

The GST rollout deadline is 1st April 2017, and it shall be a herculean task for Mr. Jaitley and team to ensure that the bill is passed by then.

Sources:

http://www.prsindia.org/billtrack/the-constitution-122nd-amendment-gt-bill-2014-3505/

http://www.prsindia.org/uploads/media/Constitution%20122nd/Brief–%20GT,%202014.pdf