This article has been co-authored by Prachi Patil

A Treatise on Goods Service Tax – NDA’s Cornerstone on Taxation

Disclaimer: This article is quite heavy and we would request our readers to have a detailed look at the write up. The article gives an overview of the current indirect tax regime in the country and what GST hopes to achieve.

A lot has been discussed on the Goods & Services Tax, and now with the tax expected to be passed in the ensuing budget sessions, we aim to provide our readers a detailed overview of the Current Indirect Tax system, its chargeability, structure and current challenges. The article is segregated in following sections:

Section 1: Overview of the current Indirect Tax structure

Section 2: Issues with the Indirect tax structure

Section 3: Overview of the Goods & Service Tax Regime

Section 4: Commentary on the GST rate, specifically the Revenue Neutral Rate

SECTION 1: OVERVIEW OF THE CURRENT INDIRECT TAX STRUCTURE

India has witnessed substantial reforms in indirect taxes over the past two decades with the replacement of State sales taxes by Value Added Tax (VAT) in 2005 marking a watershed in this regard. However, GST (Goods and Services Tax) Bill has been considered as further significant breakthrough – the next logical step – towards a comprehensive indirect tax reform in the country. Considered one of the major highlights of the government’s reform program, it has been long pending and trending topics.

For nearly ten years, India has been on the verge of implementing GST. But now, with political consensus close to being secured, the nation is on the cusp of executing one of the most ambitious and remarkable tax reforms in its independent history. We thought, this would be a right time to give a sense to our readers what is the hoopla around Goods & Services Tax. Accordingly, we have structured the write up to cover:

- Why GST is important and how are tax systems in other nations

- Bird’s eye view of India’s Indirect tax structure covering central, state and related co-tangled issues

- Proposed GST model

- Revenue neutral rate and key recommendations

- Issues in implementation

- Concluding remarks

Why GST is so hyped into government’s reform program?

Well, in our opinion, implementing a new tax, encompassing both goods and services, to be implemented by the Centre, 29 States and 2 Union Territories, in a large and complex federal system, via a constitutional amendment requiring broad political consensus, affecting potentially 2-2.5 million tax entities, and marshalling the latest technology to use and improve tax implementation capability, is perhaps unprecedented in modern global tax history.

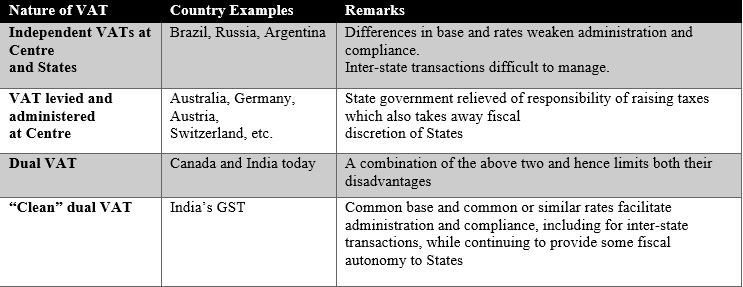

It is easy to overlook the significance and magnitude of GST. A cross-country comparison, especially comparison with the other large federal systems—European Union, Canada, Brazil, Indonesia, China and Australia- that have a VAT (the United States does not have a VAT); will help in this regard. According to the World Bank (2015), over 160 countries have some form of value added tax (VAT), which is what the GST is.

Comparison of Federal VAT Systems

As the table above suggests, Indian GST is expected to minimize the disadvantages of completely independent and completely centralized systems. A common base and common rates (across goods and services) and very similar rates (across States and between Centre and States) will facilitate administration and improve compliance while also rendering manageable the collection of taxes on inter-state sales. At the same time will provide the requisite fiscal autonomy to the States, allowing them to levy additional excise taxes on sin goods (petroleum and tobacco for the Centre, petroleum and alcohol for the States). Even if they are brought within the scope of the GST, the states will retain autonomy in being able to levy top-up taxes on these “sin/demerit” goods.

Before we go into discussion of what exactly GST is and it’s pro and cons, let’s first understand the problems with current tax structure that GST will supposedly get rid of.

Current Indirect Tax Structure: bird eye’s view

Current indirect tax structure is highly complex with separate, sometimes overlapping, taxes administered by various central, state, and local jurisdictions. India follows two layer structures of indirect taxes currently. Certain taxes are levied by the Union Government and certain taxes by the State Government. Moreover, certain taxes levied by the State Government are assigned to Local bodies so as to provide them independence as well as autocracy. Therefore, in effect, there are 3 layers of taxes in India.

![CropperCapture[82]](http://static.tfipost.com/wp-content/uploads/2016/07/CropperCapture82.jpg)

CHARACTERISTICS OF INDIRECT TAXATION ON CENTRAL AND STATE LEVEL

The taxes at Central and State level have following key characteristics or issues, depending on each of the point below:

![CropperCapture[83]](http://static.tfipost.com/wp-content/uploads/2016/07/CropperCapture83.jpg)

SECTION 2 : ISSUES WITH EXISTING INDIRECT TAX STRUCTURE

The issues in Indirect taxes are segregated under the following heads:

- Multiplicity of Indirect Tax

- Different / multiple taxation events

- Multiple taxable value

- Multiple tax rates for same products over different jurisdictions

- Uncommon threshold limits

- Challenges in exemptions & set-offs

- Double taxation conflicts

- Valuation issues i.e. some activities tax on both VAT & Service Tax level

- Litigations & Multiple compliances

The ensuing sections provides in brief on each of the above items.

- Multiplicity of indirect taxes:

Multiplicity of taxes at the State and Central levels has resulted in a complex indirect tax structure in the country that is ridden with hidden costs for the trade and industry. Firstly, there is no uniformity of tax rates and structure across States. Secondly, there is cascading of taxes due to ‘tax on tax’.

- Different Taxable events:

Taxable event is the point of time when a particular tax becomes leviable. It may also be referred as point of taxation. Each indirect tax has its own taxable event.

![CropperCapture[84]](http://static.tfipost.com/wp-content/uploads/2016/07/CropperCapture84.jpg)

The following further provides the information in more technical way

![CropperCapture[86]](http://static.tfipost.com/wp-content/uploads/2016/07/CropperCapture86.jpg)

Because of different taxable events, the same goods attract tax twice or thrice. Moreover, for an enterprise, especially a small or medium size, it becomes very difficult to keep a track of different taxable events which, in turn, may result either in compliance lapses or in over payment of taxes.

- Multiple Taxable values:

Taxable values mean the value on which tax is levied. The values base on which tax may be applied differ from one tax law to other.

![CropperCapture[87]](http://static.tfipost.com/wp-content/uploads/2016/07/CropperCapture87.jpg)

Moreover, certain transactions, may involve goods as well as services. If the price for the composite transaction is quoted as one lump-sum price, the same may result into overlapping of taxes. The reason being, two different authorities will try to tax larger share of the combined price. The issues may emerge sometimes, even if separate values have been provided for such composite transaction.

Different taxable values and different valuation mechanism under different indirect tax statutes, result into double and higher taxation to a great extent due to which the ultimate cost to the end user gets inflated and the consumer suffers merely due to absence of clarity on valuation principles.

- Tax rates for same products in different jurisdiction

- Tax rates in case of different statues for the same goods may be different.

- A product which may be charged at 12.5% VAT/CST in one State, may be charged @ 14% or 5% VAT/CST in some other State.

- The same product may be liable to Local Body Tax (LBT) @ 2% in one City, may be charged @5% in a different City. LBT in any single city has more than 5 tax slabs.

- A manufacturer supplying goods in various States and Cities is required to keep track of all the different rates for his products. He will be also required to keep a track of changes in rates every day, if any, in the states/cities wherein he is dealing.

- The task of such supplier becomes herculean when such supplier is dealing in multiple products classifiable under different tax slabs. One has to carry out classification exercise for each State and City to ascertain the correct rate of VAT or LBT.

- Further, if the product can be classified under more than one category apparently, department, as per his whims and fancies, would try to levy higher rate of tax.

- Again any non-compliance is fraught with heavy interest & penalties.F

- Threshold limits breed complexity & corruption seepage:

- Most of the indirect tax laws provide relaxations with regard to the applicability of such tax laws to small business entity.

- In such an event, credit of input taxes paid on purchases is not permissible. In effect, such small business entity can avoid various compliances. However, even with such beneficial provisions, due to variety of Tax laws, there are issues.

- The threshold limits are different under different tax laws which are further subject to varying conditions, limitations and exceptions. To find out whether one is entitled to claim threshold limit or not, is an exercise in itself. The complexity creates the room for manipulation and eventually, evasion as well as corruption.

- Exemptions, more litigious:

- Exemptions are even more complex as they could be based

- on volume, or

- on kind supplier of goods/services or

- type of recipient of goods/services, or

- on the basis of kind of goods/services.

- Certain exemptions could be conditional whereas, the rest could be unconditional.

- It becomes difficult for a normal businessman to understand the nitty-gritty of various exemptions and keep a track of the same. Moreover, complying with conditional exemption complicates the task, leading to an unending and ever increasing litigation between the assessee and the Department, finally leading to nobody’s gains.

- Set offs

- Set offs are not seamless and uncontroversial either. Each set off provisions available on Statute as on the date comes with variety of “ifs and buts”.

- Eligibility, reductions, retentions and conditions attached to various input credits makes the set off mechanism despaired and ineffective, further leads to either litigation or increased cost of the product.

- Double taxation-conflicts

- In view of confusion between various indirect tax authorities, industry set a funny practice to collect both i.e. VAT as well as Service tax which results in double taxation and a strange situation where the same transaction is considered as sale of goods as well as provision of services.

- It finally results into a higher cost in the hands of end consumer.

- For examples, copy rights transferred to another person attracts VAT whereas; temporary transfer or enjoyment of a copyright is a subject matter of Service tax.

- Valuation issues, especially works contract and real estate related transactions

- There are certain activities under Sales tax laws, which by virtue of deeming fiction, are taxed as goods.

- For example, a works contract, wherein though there is no sale of goods involved, the consumption of materials to execute such works contract is deemed to be sale of goods.

- It is canvassed that the transfer of property in goods involved during the execution of works contracts is the subject matter of sales tax. However, the same activity is also subjected to Service tax.

- The service portion contained in the works contract is taxed under service tax law by virtue of the concept of declared services.

- Litigation:

- Applicability, exemptions, valuation, classification, input credit, penalties etc. are few reasons to name for ever increasing and non-ending litigations.

- During the pending litigation, the assesse is supposed to make a pre-deposit which differs under different tax laws.

- Under major central indirect tax laws, it is 10% of the disputed amount, whereas, in case of LBT it is as high as 100%.

- Compliances:

- The quantum and cost of compliance is in direct proportion to the number of tax laws applicable and complexity therein. With more than one tax law applicable and involvement of huge disparity amongst such tax laws, obviously lead to a fairly huge amount of compliances.

- Each Tax law comes with its own requirements pertaining to registration, statutory record maintenance, payment of taxes, returns, assessments, etc. leading to high manpower requirement and increased legal support.

- This adds to mere increase in the compliance cost without adding a single rupee extra to the coffers of public exchequer.

With this background, lets understand what GST aims to achieve.

The Proposed GST model

As it’s very apparent from the name itself, GST is a comprehensive tax which will be levied on both goods and services. GST is meant to be a single tax which will include all the other indirect taxes on consumption like central and state sales tax, service tax, value added tax etc.

The GST is expected to afford a unique opportunity to simplify and rationalize the current structure and also eliminate these serious anomalies.

The proposed dual GST envisages taxation of the same taxable event, i.e., supply of goods and services, simultaneously by both the Centre and the States. Therefore, both Centre and States will be empowered to levy GST across the value chain from the stage of manufacture to consumption.

Salient features of proposed GST:

![CropperCapture[89]](http://static.tfipost.com/wp-content/uploads/2016/07/CropperCapture89.jpg)

![CropperCapture[90]](http://static.tfipost.com/wp-content/uploads/2016/07/CropperCapture90.jpg)

![CropperCapture[91]](http://static.tfipost.com/wp-content/uploads/2016/07/CropperCapture91.jpg)

![CropperCapture[92]](http://static.tfipost.com/wp-content/uploads/2016/07/CropperCapture92.jpg)

Structure of Rates for the Goods and Services Tax

Revenue-Neutral rate (RNR) and Standard Rate

RNR refers to a single rate which preserves revenue at the desired level. Thus, if all goods and services in the economy are taxed at a single rate, RNR will preserve fiscal revenue. Nevertheless, given the political and policy considerations, there is likely to be structure of rates.

The “standard rate” under the GST regime is the rate which is applied to most goods and services. In a three-tier structure, the lower bound, known as “low rate” and the upper bound, known as “high/demerit rate or non-GST excise”, will be charged to specific commodities. The rest of goods and services, whose taxation basis has not been explicitly specified, will attract the standard rate.

Recommendations for the tax rate

The aim of the tax rate is be RNR i.e. Revenue Neutral Rate, which means finding a tax rates on which would ensure that the current indirect tax collections remain the same. The recommendations for Tax Rates are segregated on two ways viz.,:

- Based on CEO panel for Revenue Neutral Rate recommendations

- Based on National Institute of Public Finance and Policy recommendations

1] The panel headed by Chief Economic Advisor (CEA) Mr. Arvind Subramaniam was presented with three different approaches for estimating the RNR.

![CropperCapture[93]](http://static.tfipost.com/wp-content/uploads/2016/07/CropperCapture93.jpg)

Key recommendations of the CEA-led panel:

- RNR of 15.0%-15.5%, with preference for the lower bound. It also suggested a three-tier taxation structure with a low rate (on gold and precious metals) of 12%, standard rate of 17%-18% and sin/demerit rate of 40% of goods and services which create negative externalities. Therefore, if there is a single tax rate for all goods and services in the economy it should be preferably 15%, but given the policy and political considerations, a standard rate of 17%-18% is recommended.

- Subramaniam repeatedly emphasised the need and the importance of reducing exemptions as much and also as soon as possible. In the current GST proposal, while petroleum products have been initially kept out of GST purview, real estate and alcohol are completely out. Not only exemptions lead to multiplicity of rates (by breaking up the value-added chain), but they are positively related with the standard tax and negatively related to GST efficiency. The broader the scope of exemptions, the lesser the effectiveness of GST and the higher will be the standard tax rate.

- The panel also suggested elimination of all taxes on inter-state trade including the 1% additional duty. As we had stated earlier, the biggest benefit of GST is that it will make India a single/uniform market. Any sort of restrictions on inter-state trade defeats theentire purpose of GST and makes its efficiency doubtful.

2] National Institute of Public Finance and Policy (NIPFP) proposed that the standard revenue-neutral GST rate could be in the range of 23-25%.

This rate could be in the range of 18-19% if there is only a single GST rate, according to the institute’s calculations. However, if goods and services are taxed at different rates as proposed at present, the standard GST rate will be in the range of 23-25%.

Features and impact of current system with an ideal GST regime:

![CropperCapture[94]](http://static.tfipost.com/wp-content/uploads/2016/07/CropperCapture94.jpg)

![CropperCapture[95]](http://static.tfipost.com/wp-content/uploads/2016/07/CropperCapture95.jpg)

The GST at the Central and at the State level will thus give more relief to industry, trade, agriculture and consumers through a more comprehensive and wider coverage of input tax set-off and service tax set-off, subsuming of several taxes in the GST and phasing out of CST. With the GST being properly formulated by appropriate calibration of rates and adequate compensation where necessary, there may also be revenue/ resource gain for both the Centre and the States, primarily through widening of tax base and possibility of a significant improvement in tax compliance. In other words, the GST may usher in the possibility of a collective gain for industry, trade, agriculture and common consumers as well as for the Central Government and the State Governments. The GST may, indeed, lead to the possibility of collectively positive-sum game.

Provided it can be reasonably well-designed, the Indian GST will be the 21st century standard for VAT in federal systems. It is, therefore, imperative to ensure that the design and implementation of this policy is done right.