India’s Defense Industry, which has grown substantially in recent years, seems headed for even better days. India’s defense market presents an attractive and significant opportunity for Indian and foreign companies across the supply chain. India has the third-largest armed forces in the world and 31.5% of its budget is spent on Defense related capital acquisitions. India is one of the largest importers of conventional defense equipment with ~60% of its requirements met by imports.

Growth in domestic demand should continue to be robust; the government has a clear vision for an India’s Defense industry, the country’s attractiveness to global defense companies is rising due to shrinking global defense budgets, and there is tremendous export potential in engineering services and component sourcing.

However, the way forward is not without some significant obstacles. In particular, the government’s new purchasing procedures must prove their mettle, and broadening and shifting the nation’s strategic alignments will be challenging. For their part, defense firms will have to learn to manage some uniquely Indian requirements.

If the government and its partners embrace the challenge, India will soon have a vibrant India’s Defense industry capable of meeting not only its domestic needs but also the needs of other nations. That would give India a greater self-reliance, and contribute to a stronger trade balance and substantial job creation.

The defense expenditure is broadly divided into two categories:

Revenue It includes expenditure on pay and allowances, maintenance and transportation and all stored expenditures on utilities.

Capital It includes creation of assets and expenditure on procurement of new equipment.

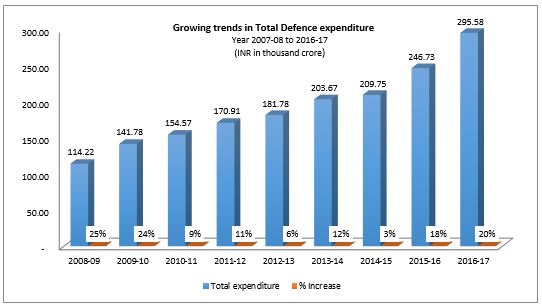

As a % of GDP, India has been able to maintain defense expenditure within a range of 2% to 3%, in line with other major developed countries, signifying a fairly steady focus on defense within the economy till date. The following chart below gives an idea about the India’s defense budget over the past few years.

INDIA’S DEFENSE SPENDING

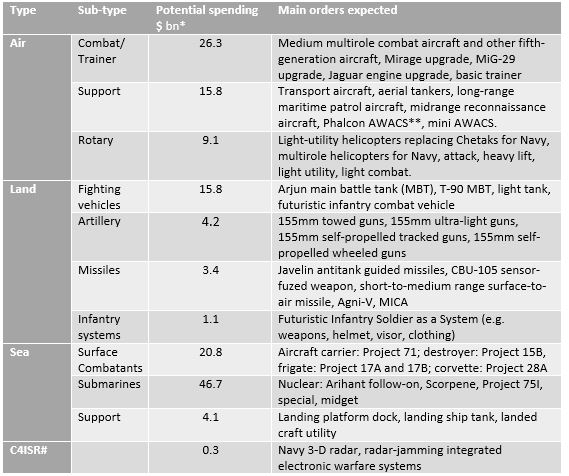

India’s spending is expected to be ~$150 bn in the short term with the Naval platforms expected to account for the largest share, driven by the need to augment the depleted strength of equipment (particularly submarines and aircraft carriers) and by the new strategic naval mandate for “blue water” capabilities, which will require nuclear sub-marines, additional aircraft carriers, and landing platforms.

The following table summarizes the size of spending in India’s defense sector:

HEAVY IMPORT DEPENDENCE

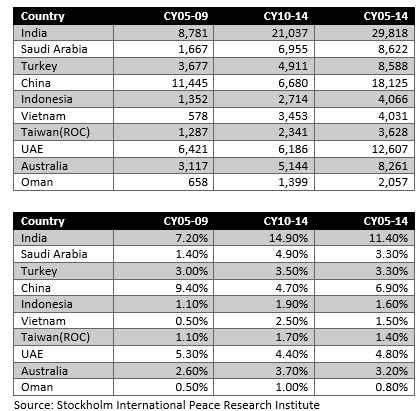

India has the 7th highest defense expenditure budget, but it is the world’s largest importer of defense equipment. In fact, India’s share of imports in the world’s total defense imports has consistently increased in the past decade as shown below. On the contrary, several emerging markets such as China, South Korea, Poland and Egypt have reduced dependency on imports.

India’s share of total defense imports increased consistently (US$mn, constant 1991 prices)

The Government is pushing for India’s Defense Sector to be under MAKE IN INDIA. Accordingly, a lot has been done in the past 2 years. At the recent Defense Expo, the new Defense Procurement Procedure 2016 was unveiled. The following article gives a synopsis of the DPP Policy.

DEFENSE – NEW DEFENSE PROCUREMENT PROCEDURE 2016

Ministry of Defence (MoD) released Defense Procurement Procedure (DPP) 2016 during the DefExpo with a thrust on higher indigenization in congruence with the ‘Make in India’ program.

The policy aims to create a major role for the private sector in India’s defense manufacturing.

• The new DPP is aimed at easing the procurement processes. The highlight of the new DPP is a new category to promote indigenous design and development and domestic manufacturing including Government funding for Research & Development (R&D) and recognition of the Micro, Small and Medium Enterprises (MSME) in technology development

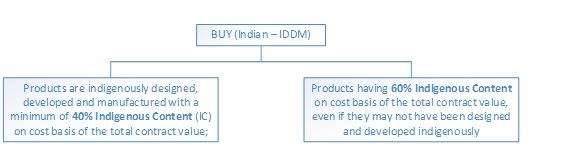

• Mandatory to have 40% local content in case the design is also indigenous. In case, the design is not Indian, 60% local content will be mandatory. The L-1 bidder would no longer win a defence contract automatically, if another bidder were offering an obviously superior product at a marginally higher cost. However, the enhancement in price cannot exceed 10% of the cost

• The Acceptance of Necessity (AoN) validity has been bought down to six months from earlier one year. Moreover, the defense service concerned now will have to submit a draft RFP along with its AoN proposal for approval.

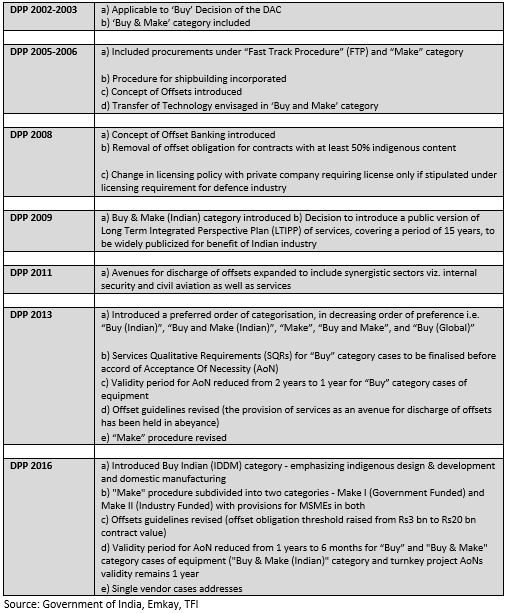

Before we get into the nitty-gritties, lets us see a small table showing evolution of the DPP in India.

EVOLUTION OF DPP

So, here we go and look at the new DPP in detail

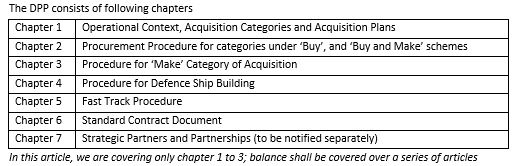

SUMMARY OF THE DPP 2016

AIM OF THE DPP:

The aim of the DPP is to ensure timely procurement of military equipment, systems, and platforms as required by the Armed Forces in terms of performance capabilities and quality standards, through optimum utilization of allocated budgetary resources; while enabling the same, DPP will provide for the highest degree of probity, public accountability, transparency, fair competition and level-playing field. In addition, self-reliance in defense equipment production and acquisition will be steadfastly pursued as a key aim of the DDP.

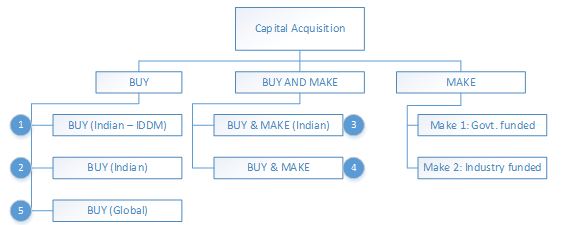

Lets delve and dig deeper into the mode of purchases envisaged in the DPP:

Capital Acquisitions

The following table illustrates the mode of capital acquisition proposed

Note:

‘Make’ category is the Most Preferred category and after this the numbers above show preference of the Government towards acquisition. IDDM means Indigenous Design Development and Manufacturing.

What does BUY (Indian – IDDM) mean?

The Indigenous Content percentage i.e. 40% or 60% shall also be individually part of the each component of cost comprising of:

1. Basic cost of equipment

2. Cost of manufacturer recommended List of spares (MRLS)

3. Cost of special maintenance tools (SMT)

4. Cost of special test equipment (STE)

What does BUY INDIAN mean?

Procurement of products having a minimum of 40% IC on cost basis of the total contract value, from an Indian vendor

What does Buy and Make (Indian) mean?

1. An initial procurement of equipment in Fully Formed (FF) state in quantities as considered necessary, from an Indian vendor engaged in a tie-up with a foreign OEM

2. Followed by indigenous production in a phased manner involving Transfer of Technology (ToT) of critical technologies as per specified range, depth and scope from the foreign OEM

3. Minimum of 50% IC is required on cost basis of the ‘Make’ portion of the contract

What does BUY and MAKE mean?

1. ‘Buy & Make’ category refers to an initial procurement of equipment in Fully Formed (FF) state from a foreign vendor, in quantities as considered necessary,

2. Followed by indigenous production through an Indian Production Agency (PA), in a phased manner involving ToT of critical technologies as per specified range, depth and scope, to the PA.

What does BUY (Global) mean?

‘Buy (Global)’ categorization refers to outright purchase of equipment from foreign or Indian vendors

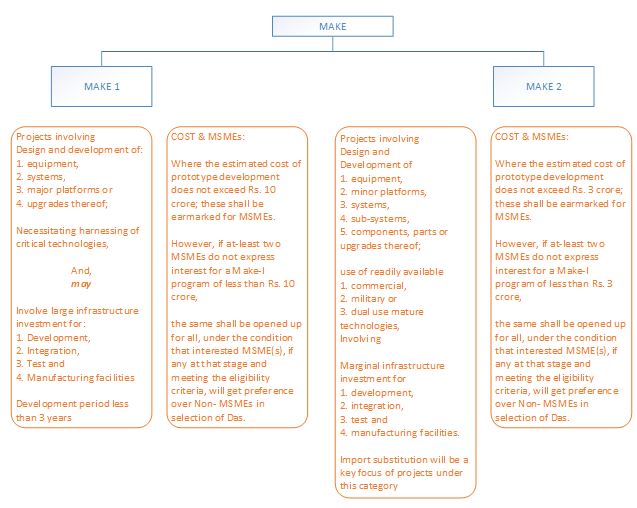

What does MAKE mean?

Acquisitions covered under the ‘Make’ category refer to equipment/system/sub-system/sub-assembly, major components, or upgrades thereof, to be designed, developed and manufactured by an Indian vendor, as per procedures laid out in the policy.

PROCUREMENT PLANNING PROCEDURE

Proposals for acquisition of capital assets flow from the defence procurement planning process, which will cover the long-term, medium-term and short-term perspectives as under:

1. 15 years Long Term Integrated Perspective Plan (LTIPP)

2. 5 years Services Capital Acquisition Plan (SCAP)

3. Annual Acquisition Plan (AAP)

PROCUREMENT PROCEDURE FOR CATEGORIES UNDER ‘BUY’ AND ‘BUY & MAKE’ SCHEMES:

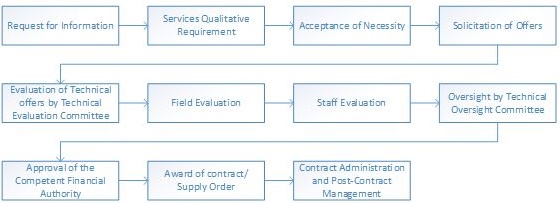

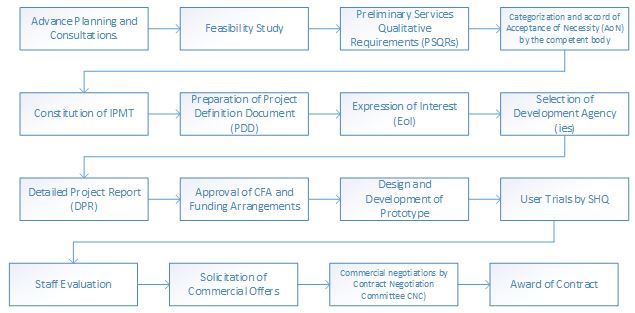

The following shall the procurement procedure:

The each of the above process has further detailed guidelines.

Category wise understanding of MAKE Category:

KEY TAKEAWAYS FROM THE POLICY

As usual the DPP Policy is a huge structural change in and shall go a long way in easing the defense procurement. The thrust on MAKE IN INDIA is a huge long term positive. Taking the private procurement route shall create an erstwhile non-existent industry. However, the order placement for large programs shall take 3 to 4 years and in fact, trickling down the policy to implementation stage shall be a huge challenge. While industry has raised some concerns and there is a silence on blacklisting portion, however we believe the same shall be addressed. No Policy document is sacrosanct from Day 1, we belong to the camp that says “BE CALM AND HAVE FAITH IN PARRIKAR”.

Featured image Courtesy: Hindustan Times

http://www.makeinindia.com/sector/defence-manufacturing