New Year, New Tax, New Bharat – As India moves into a new year, the Parliament gifted her a new lease of happiness. With the passage of the GST bills by the Lok Sabha, India has taken a giant leap towards economic transformation. There could not have been a better way to mark the beginning of new India.

Thank you, Finance Minister

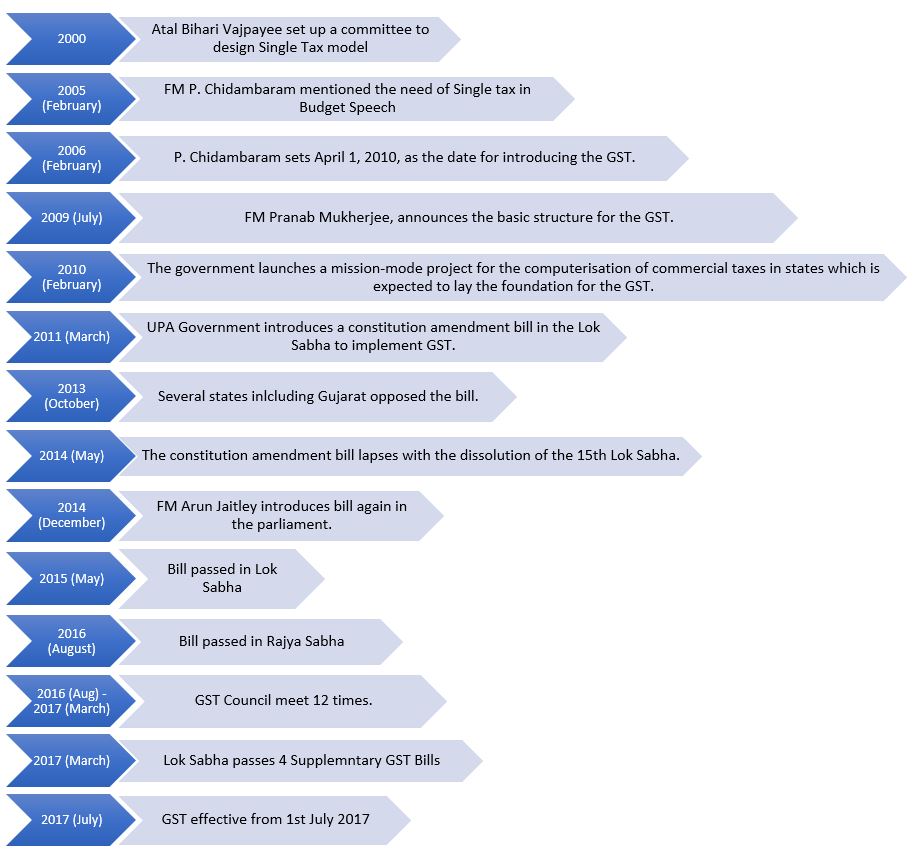

If there is a single gigantic task that any nation has taken in recent times to reform its tax structure, GST is one of them and undoubtedly the most colossal project after AADHAR for 21st century India. It took 16 years, 4 governments and 6 Finance ministers for Goods and Services Tax to become reality in India.

Like him for his extraordinary debating skills or hate him for not being so right aligned but hundred years from now when you write the history of this country, the name Arun Jaitley will find space in bold letters. Reaching out to a consensus for GST with the ministers of 31 different provinces and not necessarily from ally parties, can never be an easy task.

Vajpayee’s Vision

The idea for a single tax was first mooted in 2000. Sixteen years ago, it was then Prime Minister Atal Bihari Vajpayee who envisioned the concept of One Nation One Tax and set up a task team to brain storm the idea.

101st Amendment Act or 122nd Amendment Act?

The GST Bill was introduced in the Lok Sabha by Union Finance Minister Shri Arun Jaitley as Constitution [122nd Amendment] Bill but it was later renumbered as Constitution [101st Amendment] Bill by the Rajya Sabha.

The final number of a Bill is determined as per the date on which it is passed by both Houses of Parliament.

That it is right now there are least 21 Constitution Amendment Bills are still pending before the Parliament. So, GST is 101st Constitutional Amendment Act.

Constitutional Amendment Act

Introducing GST in India required an amendment of the Constitution under article 368.

This requires the bill to be passed by special majority (2/3 majority) in both the houses separately and also ratification from half of the sates.

As the bill intended to change the federal structure of taxes involving states levied taxes it required at least 16 out of 31 provinces with Assemblies (29 states and two of the seven union territories), or more than half the total, need to pass this Bill before it can be sent for President’s assent.

Timeline

Articles Involved

Many new articles were introduced and many were amended to enact GST bill.

Article 246 A (Introduced)

It provides that both parliament and state legislatures shall have concurrent powers to make laws with respect to goods and services tax (GST).

Article 269A (Introduced)

In case of the inter-state trade, the tax will be levied and collected by the Government of India and shared between the Union and States as per recommendation of the GST Council.

Article 279 A (Introduced)

This article provides for constitution of a Goods and Service Tax (GST) Council by the President within sixty days from this act coming into force.

Article 268 (Amended)

It has been amended so that excise duty on medicinal and toilet preparation will be omitted from the state list and will be subsumed in GST.

Article 250 (Amended)

The has been amended so that parliament will have powers to make laws related to GST during emergency period

Article 268A (Repealed)

The article has been repealed so now service tax is subsumed in GST.

GST Council

Article 279A was introduced so as to empower the President to constitute the GST Council which shall make recommendations to the Union and States on the tax on different items to be levied.

This is perhaps the most powerful constitutional body. GST Council is constituted with the Union Finance Minister as Chairman, the Union Minister of State in charge of Revenue or Finance, and the Minister in charge of Finance or Taxation or any other, nominated by each state government. The Members shall choose a Vice Chairman from amongst themselves.

The quorum shall be one half of the total number of members of the GST Council.

Every decision of the GST Council would be taken at a meeting, by a majority of not less than three-fourth of the ‘weighted votes of the members present and voting’, wherein the Central Government would have the weightage of one third of the total vote cast and the State Governments would have a weightage of two-third of the total votes cast.

Voting in GST Council:

WT = WC + WS

= WC + (WST/SP)*SF

WT = Total weighted votes of all members in favour of a proposal

WC = Weighted vote of the Centre. (max 1/3)

This can take two values :

0 (in case the Centre is not in favour of a proposal

1/3 (otherwise)

WS = Weighted vote of the States.

SP = No. of states present and voting

SF = Total no. of States voting in favour of a proposal.

WST = Weighted votes of all the States present and voting (2/3)

Road Ahead

The supplementary GST bills will now be introduced in Rajya Sabha. Since the Lok Sabha passed the GST supplementary bills as money bill, the Upper House cannot reject or amend any provisions of these supplementary bills. SGST bill, another supplementary bill must be passed by each of India’s state legislatures only then the new tax can be introduced.