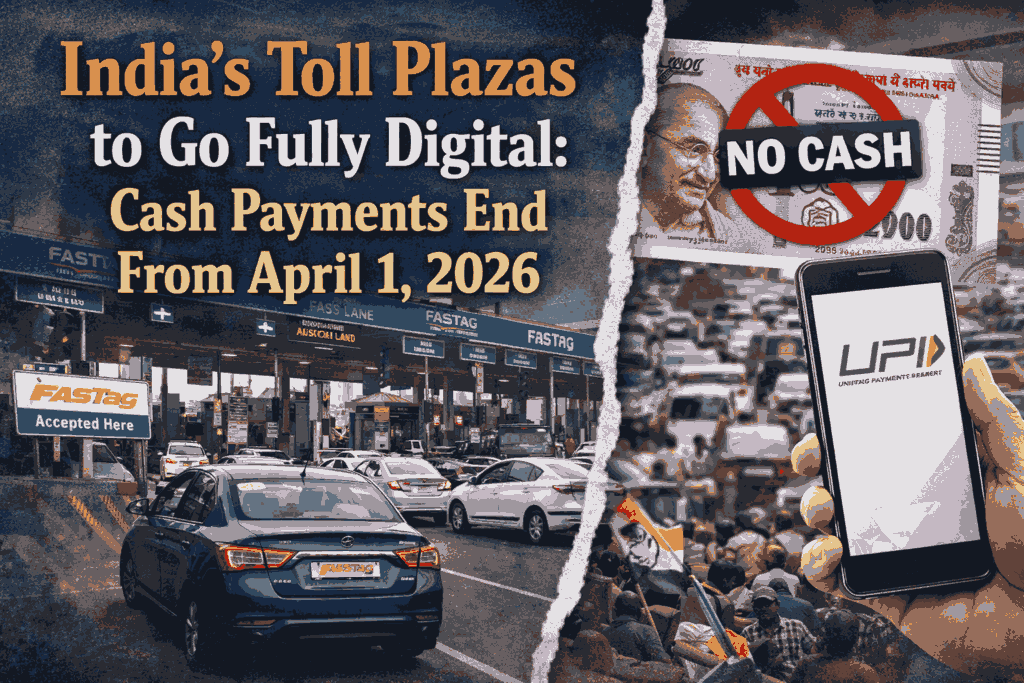

India is embarking on a major transformation of its highway infrastructure as the government prepares to end cash payments at Toll Plazas across the country starting April 1, 2026. Under the new directive from the National Highways Authority of India (NHAI), cash or manual toll payments will no longer be accepted at national highway toll booths. Instead, motorists will be required to use digital payment systems such as FASTag and UPI at every toll point on the national highway network. This move, officials say, will usher in a new era of seamless travel, reduced congestion, and enhanced transparency in toll collection.

The decision to shift entirely to digital payments at Toll Plazas stems from years of gradual adoption of electronic toll collection systems. FASTag, an RFID-based payment mechanism linked to prepaid accounts and bank accounts, has already become the dominant mode of payment across most highways. With reported usage exceeding 95% of all toll transactions, authorities believe the digital ecosystem is mature enough to support a full transition. The government sees this as an opportunity to further improve travel efficiency while reducing the reliance on cash handling and human intervention.

Under the new guidelines, vehicles without a FASTag or compatible digital payment system will not have the option of paying with cash at Toll Plazas. Previously, a cash lane existed at toll points, though fewer and fewer commuters used it as digital payments proliferated. Now, with the planned phase-out of cash lanes, all vehicles must have a working FASTag or ready access to UPI to ensure smooth passage through toll booths. Authorities have advised motorists to prepare well in advance of the deadline to avoid disruptions on their journeys.

Officials emphasise that the transition will improve efficiency at Toll Plazas. Manual cash transactions often cause delays and long lines of vehicles during peak travel times and holiday seasons. The process of counting cash, making change, and recording payments manually can slow down traffic and contribute to congestion on busy highways. Digital payments, on the other hand, are processed instantly, allowing vehicles to pass through toll points without stopping for long durations. This is expected to cut down travel time significantly, especially on major inter-state corridors.

In addition to faster travel, digital tolling brings greater transparency to revenue collection at Toll Plazas. Every transaction processed via FASTag or UPI leaves a digital trail, enabling better tracking of toll revenue and reducing the potential for disputes. This electronic record-keeping is expected to curb leakage and improve accountability in toll operations. The shift also aligns with India’s broader national mission of promoting digital payments and reducing dependence on cash in the economy.

Motorists who have yet to adopt digital toll payments are being urged to obtain and activate FASTag before the April transition. FASTags are typically issued by banks and fintech payment providers and can be affixed to a vehicle’s windshield for automatic toll deductions. Once linked to a prepaid account or bank account, the tag enables seamless toll payments as the vehicle passes through Toll Plazas. Meanwhile, UPI systems offer another convenient digital avenue, especially for drivers who may not use FASTag regularly but still require contactless payment options.

Law enforcement and highway authorities are also preparing for the transition. On major corridors, signage and public information campaigns have been rolled out to inform drivers about the cashless tolling policy. Automated tolling systems are being tested and upgraded to ensure minimal technical glitches once cash payments are discontinued. Furthermore, helplines and support services have been set up to assist motorists experiencing issues with digital payments at Toll Plazas.

Commercial transport operators are among the groups most affected by the change. Truckers and logistics companies frequently traverse several Toll Plazas on long haul routes, and many have already embraced digital payments to save time. Fleet owners appreciate the predictability of cashless toll costs, as electronic payments integrate directly with expense tracking and fleet management systems. However, smaller operators and independent drivers have raised concerns about the initial cost of acquiring FASTag and maintaining account balances, prompting calls for additional awareness drives and support.

Public reaction to the digital tolling shift has been mixed. While many commuters welcome the prospect of faster journeys, some express concern over potential teething problems in the early days of implementation. Critics warn that network outages or technical issues at digital toll points could create confusion or unintended delays. Nevertheless, authorities remain confident that robust digital infrastructure and contingency systems will mitigate such risks, and they stress that the long-term benefits far outweigh the short-term challenges.

The phasing out of cash at Toll Plazas also dovetails with India’s push toward a unified and interoperable payment ecosystem. By standardising digital payment methods across highways, the government hopes to create a seamless user experience for drivers irrespective of their location. This also aligns with the national goal of expanding digital financial inclusion, encouraging more citizens to adopt and benefit from modern payment technologies.

As India prepares for this significant shift starting April 1, 2026, the focus remains on ensuring that motorists are well informed and ready for the transition. Authorities have reiterated that Toll Plazas will no longer entertain cash payments once the deadline arrives, and any vehicles arriving without valid digital payment methods could face delays or be directed away from automated lanes. The government has emphasised its commitment to working with stakeholders and the public to ensure a smooth transition and to usher in a more efficient era of highway travel.

In the coming months, the true impact of the cashless tolling policy at Toll Plazas will become evident. If successful, India’s fully digital toll system may serve as a model for other nations seeking to modernise their road infrastructure and embrace the digital economy. Many see it as a bold step in streamlining transport logistics, enhancing commuter convenience, and reinforcing the role of technology in public infrastructure—forever changing the way Indians travel on their highways.