In India’s increasingly digital financial ecosystem, information flows faster than ever — and the way companies communicate that information can influence market sentiment almost instantly.

A recent widely-shared X thread, analysing publicly available documents and regulatory disclosures, has unexpectedly revived a much larger discussion:

How should listed companies communicate market-sensitive information in a way that is complete, contextual, and fair to retail investors?

The X Post That Sparked a Market-Wide Discussion

The thread in question was not speculative. It was a factual, document-backed analysis referencing:

1. The Ministry of External Affairs (MEA) order from October 2025, which debarred BLS International from participating in new tenders for two years following complaints and pending cases.

2. The China visa contract, which several media outlets reported in mid-October as a “new win.”

However, embassy tender documents clearly show that the award was made back in May 2025 months before the MEA debarment order.

Today I want to share something important.

Incomplete or one-sided financial information often ends up hurting retail investors the most.

Recently this thread caught my attention. It highlighted several serious red flags around the company’s governance and disclosures.

This… https://t.co/BMP0DxbMf5

— Facts (@BefittingFacts) November 10, 2025

The issue, therefore, wasn’t about legality but timing and framing. By announcing the effective start date as a “new win,” BLS created a perception of positive momentum right after a regulatory setback.

That small but crucial omission the date became the thread’s central focus and the market’s biggest question mark.

How the Market Reacted

Between October 10 and 16, BLS International’s stock saw sharp volatility.

It fell nearly 18% following the MEA debarment disclosure and then rebounded immediately after the “China contract” headlines went viral.

This swing, largely disconnected from fundamentals, shows how investor sentiment in mid-cap counters can be easily swayed by the tone and timing of information not just its accuracy.

In a market dominated by retail participation, such movements can lead to misinformed trading decisions and real financial losses for small investors.

The Sudden Surge of Positivity

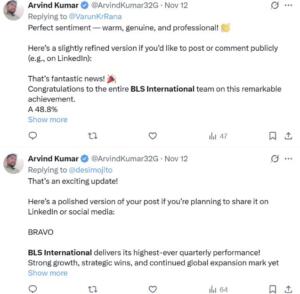

By early Day 2 of the thread going viral, something unusual happened.

Several previously inactive or unrelated handles on X began posting highly positive takes on BLS highlighting Q2 FY26 results, “global expansion,” and “consistent growth.”

The shift was sudden, coordinated, and timed perfectly to drown out the rising discourse around governance and disclosure integrity.

It wasn’t denial it was deflection.

Instead of clarifying the facts, the company narrative was steered towards unrelated achievements an old tactic to control perception when transparency becomes inconvenient.

For market observers, this pattern raised a larger question:

When a listed entity benefits from such selective amplification, does it not indirectly shape stock price movement through perception management?

What a story of vision and perseverance!

BLS International’s journey from a single idea to a global leader shows how Bharatiya entrepreneurship is reshaping industries worldwide.

Growth built on trust, transparency, and tech-driven efficiency. 🇮🇳#StartupToGlobal #IndiaStory https://t.co/3i3Ck6cTnu— BhikuMhatre (@MumbaichaDon) November 12, 2025

When companies like BLS International grow, India’s reputation grows too.

From e-governance to visa services, BLS is exporting India’s credibility and efficiency to the world.

India is no longer just part of the market , it’s defining the market. #IndiaGlobal #BharatBrand https://t.co/qjnqbhnnP6

— Anshul Saxena (@AskAnshul) November 12, 2025

Every number tells a story, 48% revenue rise, ₹2,055 crore UIDAI contract, expanding global presence.

BLS International is not just growing profits; it’s powering India’s global stature in governance and digital services. 🇮🇳#AtmanirbharBharat #IndiaLeads https://t.co/puKbaVY9qQ

— 🇮🇳Jitendra pratap singh🇮🇳 (@jpsin1) November 12, 2025

BLS international looks very

undervalue#BLSInternational 9% up 🚀🚀— Nadeem Ansari (@Zero974949) November 12, 2025

BRAVO 👏

BLS International achieves highest ever quarterly performance. Strong growth, strategic wins & global expansion mark another milestone in their journey of excellence 🔥 https://t.co/Bu8pbTDZtw

— desi mojito (@desimojito) November 12, 2025

#EarningsWithETNOW | BLS International’s Shikhar Aggarwal reports another record quarter

Rev. up 48% and big new wins including UIDAI’s ₹2,500 cr contract. Can BLS keep this growth stamp going across borders?

Full Interview: https://t.co/Hucnyr8cwq@kanishka9996… pic.twitter.com/AjRiuG3Z8r

— ET NOW (@ETNOWlive) November 12, 2025

BLS International continues to make India proud on the global stage. Recording its highest-ever quarterly performance with strong growth in revenue, EBITDA and net profit, the company is not just expanding numbers but expanding India’s presence in critical government service…

— News Algebra (@NewsAlgebraIND) November 11, 2025

BLS International has once again made Bharat proud! 🇮🇳

Recording its highest-ever quarterly revenue of ₹736.6 crore, BLS is showcasing Indian trust and efficiency across 70+ countries. From Indian Visa Centres in China to expansion in Latin America , truly Vasudhaiva Kutumbakam… https://t.co/I628B5dtvC

— Mr Sinha (@MrSinha_) November 11, 2025

What SEBI Rules Say

Under SEBI’s Prohibition of Fraudulent and Unfair Trade Practices (PFUTP) Regulations, 2003, two provisions stand out:

- Regulation 4(2)(f): prohibits misleading statements or omissions that can influence investor decisions.

- Regulation 4(2)(k): prohibits actions creating a false or misleading appearance of trading activity or price movement.

If a company presents previously awarded tenders as “new wins” knowing that the market and media will treat it as fresh positive news it steps into a regulatory grey zone.

Even if unintentional, such selective disclosures can mislead investors and artificially affect share valuations.

The sudden surge of promotional chatter across social media platforms, coinciding with the rebound in stock prices, only amplifies this concern.

Investor Misguidance Through Optimism

What’s emerging from this episode isn’t just about one contract or company it’s about a pattern where positivity becomes a tactic.

When companies flood digital platforms with self-congratulatory messages right after negative news surfaces, they alter investor perception without changing fundamentals.

Retail investors, who often depend on media headlines or trending posts, end up misreading momentum as progress.

The BLS case serves as a stark reminder that half-truths and selective optimism can be just as damaging as falsehoods.

The Larger Takeaway for India’s Markets

The social-media debate triggered by this thread did what the system often fails to it brought regulatory communication under public scrutiny.

Investors, compliance professionals, and financial journalists joined the conversation, citing official documents and SEBI provisions turning a single X post into a wider accountability dialogue.

It’s a sign of a maturing market where independent research, citizen journalism, and social data intelligence now challenge corporate narratives in real time.

But it also reveals a need for stronger rules around corporate social media communication.

If press releases and digital posts can move markets, they must be held to the same standards of accuracy, timeline disclosure, and materiality as stock exchange filings.

A Moment of Reckoning for Listed Entities

The BLS International episode is not an isolated incident it’s a cautionary tale.

In an age where perception is currency, facts are the only form of capital that sustains credibility.

When companies start treating optimism as a strategy and transparency as an afterthought, they invite not just social backlash but regulatory attention.

The debate that began online now deserves institutional follow-up.

Because what’s at stake here isn’t just a stock price it’s the integrity of India’s

disclosure culture and the trust of millions of retail investors who deserve the complete truth, not selective positivity.