Rahul Gandhi has said that the “Indian economy is dead” borrowing rhetoric straight from the Trump playbook. Yet, behind this dramatic claim lies a stunning contradiction: the same “dead economy” has handsomely enriched him. According to his own election affidavit, nearly ₹10 crore of Rahul Gandhi’s assets are invested in Indian stock markets and mutual funds. These investments have earned him a staggering 29% return in just over a year. If India’s economy were truly lifeless, how does one of its loudest critics continue to profit so lucratively? This isn’t just hypocrisy it’s a case of deep-rooted Congress double standards at play.

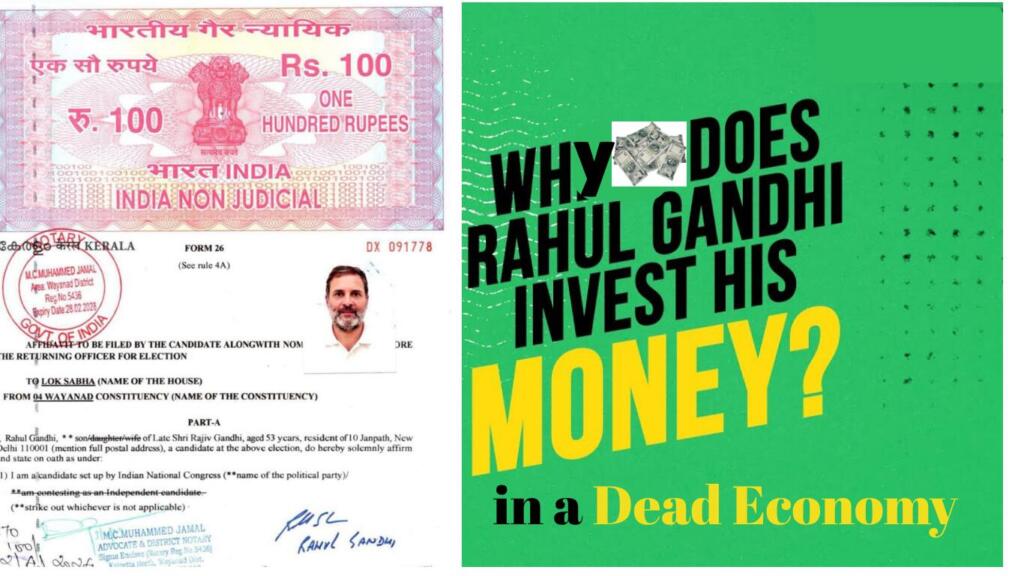

The Affidavit That Tells a Different Story

In April 2024, during the parliamentary elections, Rahul Gandhi submitted his nomination papers along with a detailed affidavit of his assets. The document reveals that he holds movable assets worth ₹9.25 crore, 90% of which are invested in market-linked instruments like mutual funds and company shares. His immovable assets, both inherited and self-acquired, amount to over ₹11 crore. Interestingly, while his public speeches often describe the Indian economy as “non-functioning” or “dead,” his financial disclosures tell a very different tale—one of faith in the same market he mocks.

From ₹8.14 Crore to ₹10.5 Crore : In a ‘Dead’ Economy?

In March 2024, Rahul Gandhi’s share and mutual fund investments were worth ₹8.14 crore. Today, they are estimated to be worth ₹10.5 crore—indicating a 29% return in a span of just over a year. These gains weren’t from offshore tax havens or secret Swiss accounts, but from the very Indian economy he disparages. Among his top stock holdings are blue-chip companies like Titan, Asian Paints, ICICI Bank, Bajaj Finance, Nestle India, and ITC. Several of these stocks have posted double-digit growth under the Modi government’s economic stewardship. It raises a fundamental question: If the economy was truly as “dead” as Rahul claims, would it really be reviving his portfolio so dramatically?

Public Rhetoric vs Private Gains

Rahul Gandhi’s public messaging has often been filled with gloom and doom about India’s economic condition. He has spoken about unemployment, inflation, and institutional collapse—but failed to acknowledge the strong market performance or the global recognition of India’s resilient economic growth. This becomes even more hypocritical when he continues to retain and grow his market investments, silently reaping the benefits of the very system he publicly trashes. This stark contrast between his rhetoric and his personal financial strategy exposes the Congress party’s double speak—not just on economics, but on trust in Indian institutions as a whole.

Congress’s Long History of Hypocrisy

The Congress party has long spoken against capitalism, stock markets, and the corporate sector—frequently positioning itself as a pro-poor, socialist alternative. But Rahul Gandhi’s investment portfolio suggests otherwise. Not only does he have ₹8+ crore parked in shares and mutual funds, but his top holdings are in India’s most trusted corporate giants companies that have flourished under pro-market policies. This double-faced approach—one for public consumption and another for personal benefit is not new. It’s just another reminder of how the Congress ecosystem says one thing to the masses while silently enjoying the benefits of the reforms they once opposed.

The Real Question : Why Invest in What You Call ‘Dead’?

If India’s economy is as broken as Rahul Gandhi claims, why has he invested nearly ₹10 crore in it? Why hasn’t he pulled out his money from Indian equities and mutual funds? The truth is simple: Rahul Gandhi doesn’t walk the talk. He criticizes “Modi-nomics” on stage while his wealth multiplies under it in silence. The Indian economy, led by the Modi government, is not just alive—it’s thriving. And if even Rahul Gandhi trusts it with crores of rupees, perhaps it’s time the Congress stops peddling doom and gloom narratives that are disproven by their own leader’s bankbook.