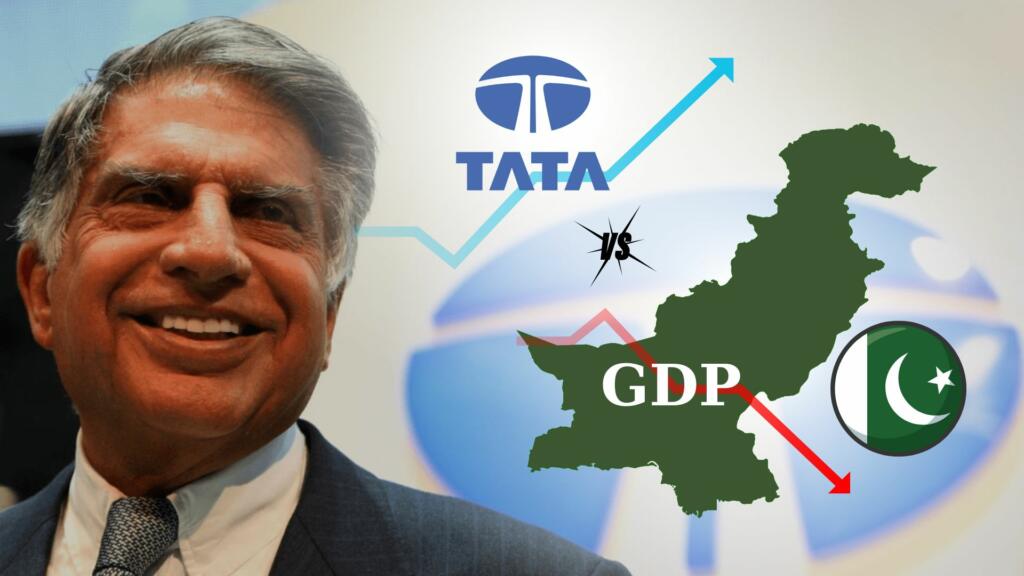

In the global economic theater, two distinct narratives unfold the meteoric rise of India’s Tata Group and the formidable challenges faced by Pakistan’s economy. Tata Group, India’s largest conglomerate, boasts a market capitalization surpassing the GDP of its neighbor Pakistan, emblematic of its unrivaled dominance. Spearheaded by flagship companies like Tata Consultancy Services (TCS), Tata Motors, and others, Tata Group’s stellar performance underscores its prowess in driving market dynamics. Conversely, Pakistan grapples with economic hurdles, including natural disasters and mounting debt obligations. As Tata Group charts a path of growth and influence, Pakistan seeks strategies to navigate its economic landscape and secure stability amidst adversity.

Tata Group’s Market Dominance

Tata Group, India’s largest business conglomerate, has emerged as a formidable force in the global market landscape, epitomized by its staggering market capitalization of $365 billion. This figure not only underscores the conglomerate’s commanding presence but also surpasses the entire Gross Domestic Product (GDP) of neighboring Pakistan. At the heart of Tata Group’s success story lies the stellar performance of its flagship companies, spearheaded by Tata Consultancy Services (TCS).

TCS, valued at approximately ₹15 lakh crore or $170 billion, stands out as the jewel in Tata Group’s crown. As India’s second-largest company, TCS has played a pivotal role in driving the conglomerate’s market dominance. Its relentless pursuit of excellence in the field of information technology services has yielded substantial returns, contributing significantly to Tata Group’s overall market capitalization.

TCS is not the sole contributor to Tata Group’s remarkable surge. Other key entities within the conglomerate, including Tata Motors, Trent, Titan, and Tata Power, have also delivered outstanding performances over the past year. These companies have witnessed robust rallies, further bolstering Tata Group’s market value. Impressively, eight Tata companies, including the newly-listed Tata Technologies, have doubled their wealth in this period, reflecting the conglomerate’s diverse portfolio and strategic investments.

Also Read: From Reserves to Revenue: India’s Oil Cavern Lease with Abu Dhabi

Performance Analysis of Tata Group Companies

Over the past year, Tata Group companies have showcased remarkable performance across various sectors, contributing to the conglomerate’s impressive market dominance. Tata Motors, a key player in the automotive industry, has witnessed a substantial surge in returns driven by robust demand for its vehicles, innovative product offerings, and strategic expansions into new markets. Trent, the retail arm of Tata Group, has capitalized on changing consumer trends and expansion strategies, resulting in significant wealth growth. Titan, renowned for its jewelry and watch brands, has benefited from increased consumer spending and brand loyalty, leading to notable returns.

Tata Consultancy Services (TCS), the crown jewel of Tata Group, has continued its stellar performance, leveraging its expertise in IT services and digital transformation to deliver exceptional results. Its consistent revenue growth and expansion into new geographies and service offerings have propelled its market value to new heights.

Insights from ACE Equity analysis further validate the impressive wealth growth of Tata Group companies. The data highlights the substantial gains made by these entities, with many witnessing significant increases in market capitalization and shareholder wealth. This analysis underscores Tata Group’s ability to generate value for its stakeholders and maintain a competitive edge in dynamic market conditions.

Pakistan’s Economic Challenges

The economic trajectories of India and Pakistan present a stark contrast, particularly evident in the vast difference in their GDP magnitudes. India, with a GDP of approximately $3.7 trillion, stands as one of the world’s largest economies, boasting significant growth prospects and a diverse industrial base. In contrast, Pakistan struggles with economic challenges, reflected in its comparatively modest GDP estimated at around $341 billion. This significant gap underscores the disparity in economic size and potential between the two neighboring nations.

Various challenges, including the devastating impact of external factors such as floods have marred Pakistan’s recent economic performance. Despite commendable growth rates of 6.1% in Fiscal Year 2022 and 5.8% in Fiscal Year 2021, the country’s economic outlook has been dampened by natural disasters, resulting in substantial losses amounting to billions of dollars. These events have exacerbated existing vulnerabilities and hindered efforts to achieve sustained growth and development.

The urgency for Pakistan to secure funds is underscored by the looming pressure of external debt payments, which amount to $25 billion, commencing in July. With dwindling foreign exchange reserves hovering around a precarious $8 billion, Pakistan faces significant challenges in meeting its debt obligations and ensuring financial stability. The country’s debt-to-GDP ratio surpasses the worrisome threshold of 70%, raising concerns about its ability to service debt and manage fiscal sustainability effectively.

Moreover, the exhaustion of a $3 billion program from the International Monetary Fund (IMF) further complicates Pakistan’s financial situation, necessitating swift action to secure additional funding sources and address structural imbalances. Failure to do so could exacerbate economic vulnerabilities, undermine investor confidence, and prolong the country’s path to recovery.

In conclusion, the juxtaposition of Tata Group’s market dominance and Pakistan’s economic challenges paints a vivid picture of divergent trajectories within the South Asian region. Tata Group’s remarkable success signifies not only India’s economic prowess but also its potential to catalyze growth and innovation across borders. Meanwhile, Pakistan’s struggle underscores the urgency for comprehensive reforms to address structural imbalances and secure financial stability. As both entities navigate their respective paths forward, collaborative efforts and strategic interventions will be crucial for fostering regional prosperity and resilience. By learning from each other’s experiences and leveraging collective strengths, South Asia can chart a course towards sustainable development and inclusive growth for all stakeholders.