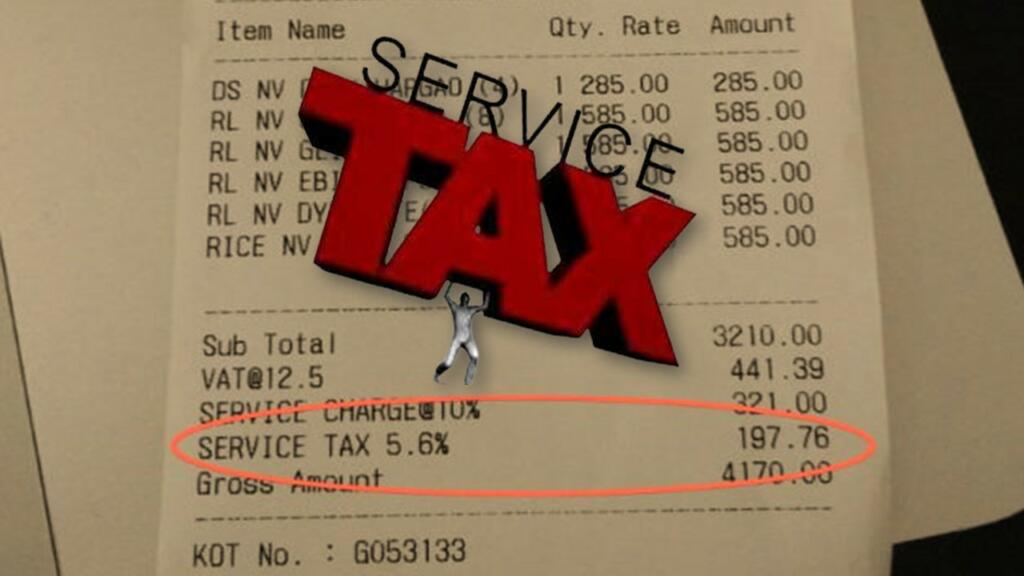

The Customs, Excise and Service Tax Appellate Tribunal (CESTAT) in India recently issued a decision that could have far-reaching consequences for the country’s restaurant industry. The tribunal ruled in March 2022 that service tax cannot be levied on take-away or parcel food items sold by restaurants.

The case involved Haldiram Marketing Private Limited’s appeal of a show cause notice issued by the Commissioner of Central Goods and Services Tax (CGST) on September 28, 2020. The notice demanded payment of a service tax of Rs. 23 crores, which the company had failed to pay for take-away services. The rent received by the company from associated enterprises was also included in the charge.

The Case

The CESTAT ruled that no service tax could be levied on food take-away because it amounted to a sale and did not involve any element of service. The tribunal emphasised that service tax would only apply to services such as dining facilities, washing areas, and table clearing. Because take-away services do not involve any service, the service tax cannot be levied on them because they are merely a sale.

Also read: Home Sweet Rented Home: A Guide to Tenant Rights in India

This decision is likely to have a significant impact on the restaurant industry in India, particularly on the pricing and profitability of take-away food items. It would relieve restaurants from the burden of paying service tax on their take-away sales, which could result in a significant cost savings for the industry. This could also lead to more restaurants offering take-away services, as it would no longer be subject to service tax.

Furthermore, this decision clarifies the interpretation of the law regarding the imposition of service tax on take-away food items. This would help restaurants avoid future legal disputes or confusion, as well as promote tax compliance.

Also read: Supreme Court makes it absolutely clear to High Courts – Online proceedings won’t stop

Finally, the CESTAT decision is a significant step forward for India’s restaurant industry. It relieves restaurants of the burden of paying service tax on take-away food items and encourages tax compliance.

This decision may have far-reaching implications for the pricing and profitability of take-out food items, and it will be interesting to see how the industry responds to it in the future.

Support TFI:

Support us to strengthen the ‘Right’ ideology of cultural nationalism by purchasing the best quality garments from TFI-STORE.COM

Also Watch:

https://www.youtube.com/watch?v=P3gU8TaIAIA