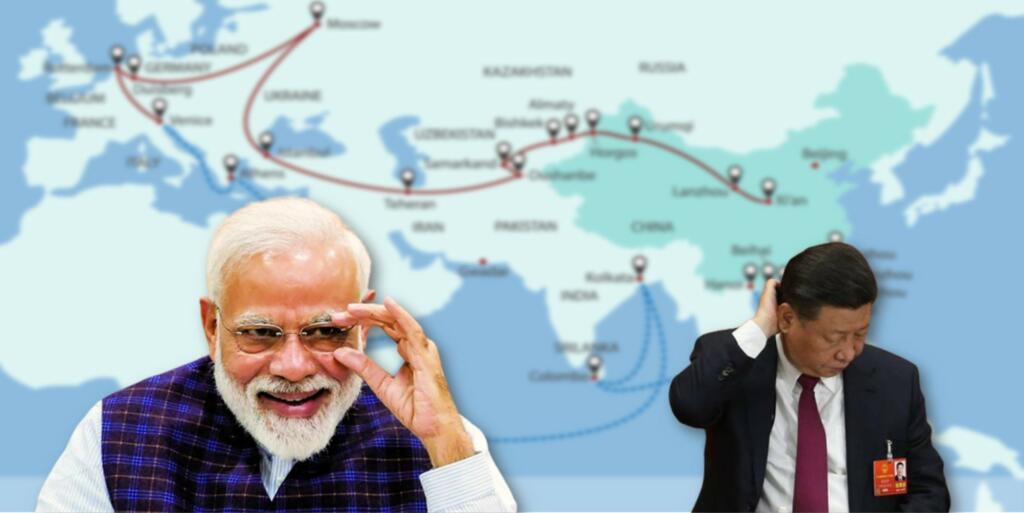

Chinese debt trap: There is a famous phrase: penny wise and pound foolish. In the trap of short-term benefits, individuals, organisations and even nations take steps that will inevitably hurt them in the longer run. Apparently, the Chinese Communist Party has been exploiting this very fact. It has lured short-sighted ‘sell’ out leaders of the world with its deep pockets. However, its wishful thinking of reviving the ancient silk route has been broken by the pragmatic approach adopted by the Modi government.

The Chinese debt Trap and global Chinese debtors

The Belt and Road Initiative (BRI) is the dream project of Chinese President Xi Jinping. To push his ambitious project, the Chinese despot has been providing loans to lower- and middle-income countries for their infrastructural needs. The 2-km long Sinamalé Bridge in Maldives that interconnects several islands of the archipelago was built with Chinese funding.

However, it’s not that simple as these ‘corrupt’ pro-Chinese stooges have presented in their nation. Apparently, these infrastructure loans under the BRI project are a perfect recipe for disaster. The communist regime never lets the terms, conditions and heavy interest rate it charges, come out in the public domain. Plus, with its fat cheque book, China blinds the host nation from even conducting a cost-benefit analysis or the judicious requirement of the project.

Also Read: India’s agro-diplomacy is putting the final nail in the coffin of China’s BRI

Then the dragon waits for the chickens to come home to roost. These unwise and injudicious infrastructure projects were doomed from the very beginning and thus completely pushing the host nation into the Chinese debt trap.

Evidently, Sri Lanka, Pakistan and Maldives are among the nations that are completely submerged in Chinese debt. As per Forbes, Pakistan owes an external debt of $77.3 billion to China. While the Chinese debt on Maldives accounts for 31 percent of its Gross National Income (GNI).

Also Read: Jaishankar tears into China over BRI

After analysing the World Bank data, Forbes found out that globally 97 countries are under Chinese debt. The worst five among them are Pakistan ($77.3 billion), Angola ($36.3 billion), Ethiopia ($7.9 billion), Kenya ($7.4 billion) and Sri Lanka ($6.8 billion).

The world’s low-income countries owe 37 percent of their debt to China in 2022. Contrary to that they only owe 24 percent in bilateral debts to other countries.

India tactfully buries China into its own debt trap

Right from the beginning, India has been vocal in explaining to the world that the Chinese BRI project is nothing but a tool of neo-colonialism. In 2015, the Modi government extensively started giving out funding through Lines of Credit (LOCs) to nations in Asia, Africa and Latin America among other regions.

Later, the Modi government announced a new scheme called the Indian Development Assistance Scheme abbreviated as IDEAS. With the IDEAS scheme, India has effectively countered the Chinese disguised debt trap. Further, India has been successful in increasing geo-economic influence.

Also Read: As China’s BRI fizzles out, India’s TDC begins taking shape

Through IDEAS, India has provided more resources and attention to the infrastructure development needs of other nations and stopped them from going into Chinese folds any further than they are.

As per official data, the Indian government has given more than 300 Line of credits (LOCs) to other nations. With these assistance funding from India approximately 600 projects are ongoing in other nations. For example, in contrast to Chinese debt funded Sinamalé Bridge, India gave $500 million in the form of loans and grants to complete the Greater Male Connectivity Project in Maldives.

As per the Indian Ministry of External Affairs, India has given loans worth $ 32.5 billion to other nations. Further, the Modi government has almost doubled the ‘development aid’. Evidently, up till 2014, India gave $55 billion to other nations as development assistance or loans. But within a span of just eight years, the Modi government has disbursed $107 billion to counter the power of Chinese fat cheques.

With these prudent and pragmatic infrastructure assistance, India has successfully demonstrated that there is a vast difference between Chinese loans with hidden conditions and India’s development assistance. On account of vociferous opposition from India, these host nations are now declining the arbitrary Chinese “mode of alternate payment”, that is, leasing land for 99 years.

Additionally, more and more countries have started to question the judiciousness of Chinese proposed projects in their nations. Further, many of these Chinese debtors have been giving hard time to the Chinese communist regime in loan repayment and asking for loan waiver and deferment. As a consequence, Chinese debts are going down the drain and turning into NPAs or bad loans thus straining its own economy.

Support TFI:

Support us to strengthen the ‘Right’ ideology of cultural nationalism by purchasing the best quality garments from TFI-STORE.COM