Petrodollar had it too good for too long. Just because it dominated the world’s energy market meant that whatever evil emerged out of it was forgiven by western superpowers. But, its good days are inching towards the end. Under the able leadership of PM Modi, India is working on a strategy to end its hegemony

PM Modi hints towards ending Dollar domination

India is celebrating Azadi ka Amrit Mahotsava. For this purpose, the Ministries of Finance and Corporate Affairs have organized a week-long celebratory event. During the inauguration of the event, PM Modi emphasised that India’s financial system has the potential to become a key part of international trade.

According to PM Modi, to escalate the status of products of Indian financial system in the world market, India needs to create awareness about its financial inclusion platforms. He stressed the need of translating India’s domestic success into the international market by extending its services to other countries.

Time to go global

He then stated that the time has come when our strengthened financial markets and institutions should strive to become the backbone of international trade.

Citing India’s success in the last 8 years, PM Modi said “It is necessary to focus on how to make our domestic banks, currency an important part of international supply chain and trade. We have shown in the last 8 years that if India collectively decides to do something, then India becomes a new hope for the world. Today, the world is looking at us not just as a big consumer market but looking at us with hope and confidence as a capable, game-changing, creative, innovative ecosystem,”

Read more: Why the world should move away from petrodollars and go back to the gold standards

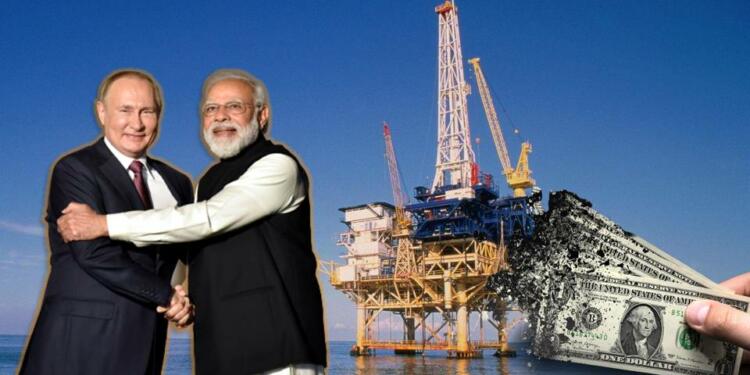

Russia, India, and China are hitting hard at Petrodollar

At the time of speaking, no news organization decoded the larger meaning of PM Modi’s speech. Ever since the Ukraine-Russia crisis started to unfold, the legitimacy of the Petrodollar has taken a hit. It is because Russia and other countries around the world use the Dollar for their international trade. Apparently, by imposing sanctions on Russia, the United States thought that it would be able to tighten its noose around Russia.

But, this time, it was a different ball game altogether. Russia started to look for other alternatives. To bypass the Dollar, Russia and India explored Rupee-Rouble trade and the Barter system of trade. Similarly, Russia also engaged China in Yuan-Rouble trade. In fact, shunning Dollars, China and Russia have increased their Yuan-Rouble trade by 1067 per cent.

Given the resistance from Russia, China, and India, it is getting tough for the US to sustain stability in its economy on Petrodollar’s earnings. That is because Petrodollar is the engine of the US economy. Petrodollars are simply revenues from Crude oil export collected in dollars. The fact that more and more countries are now ditching Dollars for bilateral trades means that the USA will lose huge revenues it generates from Dollar trade. A major chunk of this loss will be in the form of the Petrodollar, because in modern times, Asia is the centre of the global oil trade rather than Western countries. It is the Indian subcontinent that is setting the rules of the game.

Read more: “Let not Dollar supremacy be compromised”, Manmohan Singh pleads to PM Modi

Tough times ahead but India can do it

However, the road ahead is not easy for India. Besides China fighting tooth and nail to capture the space being vacated by the USA, India’s legitimacy in the financial market is still a big worry for the country. Currently, products dominating the Indian financial market like UPI, and RuPay Debit card among others have been punching below their weight. They have not advertised themselves in the international market. Though RuPay has taken some initiative, UPI’s marketing in the market is still unchartered territory. Only when the products of India’s financial spectrum gain proper market share, India will be in a position to drive international trade on its own terms. And trust me when I say, it can happen very-very fast.

Read more: RuPay was really struggling and then came Narendra Modi

The road ahead is simple. Firstly, India needs to push its wonders into the international market. Then it should take advantage of its consumer base. It needs to tell countries to not engage in Dollar trade. Almost every Dollar circulating in Global trade has been once used in the oil trade, making it a Petrodollar. It will only stop when countries start a plan to phase out Dollar. India has started it, others need to follow.