In the last few years, the external debt of Pakistan has ballooned from around 65 billion dollars in 2016 to 130 billion in 2021. In FY 21 alone, the country took 15 billion dollars of external debt “to mitigate the pressure on the current account deficit, strengthen foreign exchange reserves, enhance external debt servicing capacity and provide requisite financing to water sector development”.

Pakistan’s External Debt (in million dollars)

The external debt of the Islamic Republic is 40% of GDP while the total public debt is around 90% of GDP. The major problem for Pakistan is not the accumulation of government debt because many developed countries including Japan and the United States have far higher government external debt as well as total debt.

Pakistan’s Total Public Debt

The problem with Pakistan is the lack of its debt servicing capability. Given low economic growth, the government revenue is dismal and the government is borrowing money from foreign countries and investors to run its essential operations.

A rate of interest for any debtor is based on its debt servicing capability and given Pakistan’s poor capability to pay back, it gets loans at a very high rate as compared to any other developing or developed country. And most of the government revenue goes into servicing the interest and previous debts, leaving no money for development expenditure.

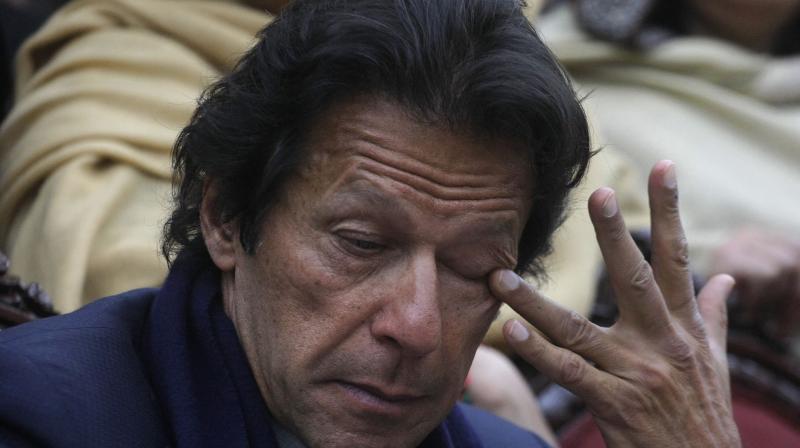

Since Imran Khan came to power, the situation has worsened so much that now its government revenue is not enough to pay even the interest and previous debt. So the country is forced to borrow from one country or lender to pay another.

External debt of India (in million-dollar)

India’s public debt to GDP ratio is 75 per cent and external debt is 20 per cent. In absolute terms, India’s external debt is around 600 billion dollars (5 times of Pakistan – 120 billion dollars)), but India’s GDP (3 trillion dollars) is 9 times more than that of Pakistan (347 billion dollars).

However, as compared to Pakistan, India’s debt-servicing capacity is very high. The tax to GDP ratio of India is around 18 per cent as compared to 9 per cent in Pakistan. India’s tax buoyancy has increased in the last few years in terms of direct taxes as well as indirect taxes while Pakistan’s tax collection is decreasing.

Most of the tax revenues of the Pakistan government go into servicing debt. Pakistan’s government pays 85 paise for every 1 rupee of revenue while for India and Bangladesh, this ratio is only 51 and 20 respectively. Less than 1 per cent of the people (2 million out of 210 million population) in Pakistan pay income tax and all the government plans to increase the tax base have failed.

Pakistan’s economy is in a vicious cycle because the previous, as well as the incumbent governments, are busy with other things rather than fixing the crippling economy. While India is eyeing a golden decade of economic growth with a pickup in the manufacturing and resilient services sector, Pakistan is heading towards bankruptcy.

Since Imran Khan came to power in August 2018, the matters have only worsened for Pakistan. With the world calling out the country’s deep engagement with terror groups on its soil, the currency has shed more than a quarter of its value, inflation is near double-digit, economic growth is at a decade low, the private, as well as public investment, has fallen, the foreign debt is all-time high and almost equal to GDP, the exports have fallen and the imports have risen and forex reserves are dwindling at 6 to 8. billion dollars only. In short, Pakistan is on a downward spiral under Imran Khan.