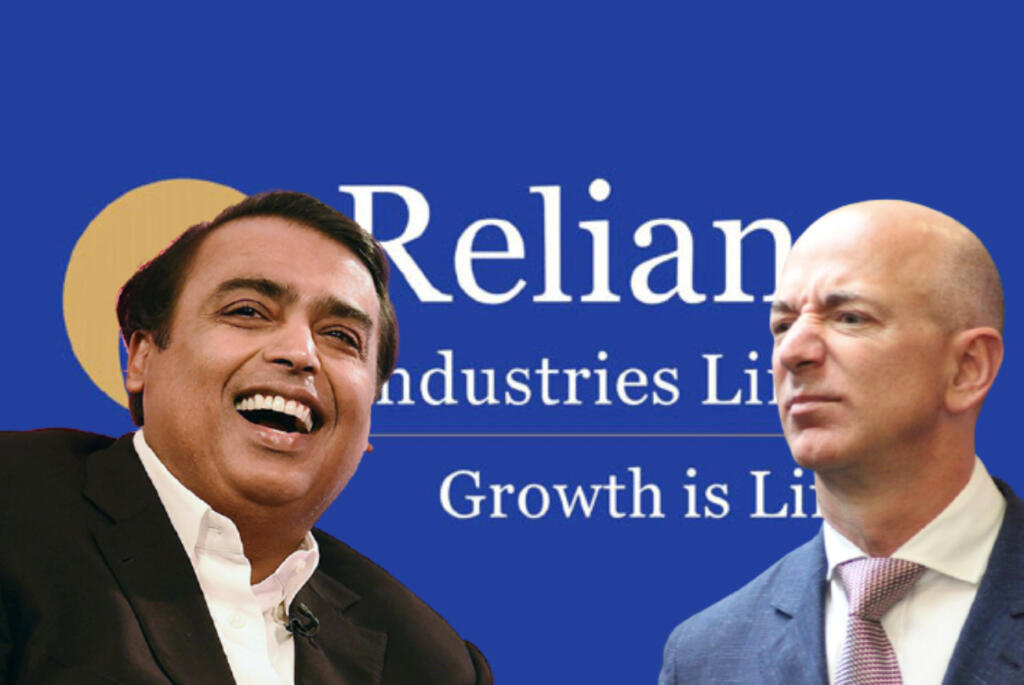

Looking to go toe-to-toe with Amazon in the battle of dominance in the e-commerce sector, Reliance Industries Ltd, led by Mukesh Ambani, has completed a major acquisition. Reportedly, Reliance has bought a majority stake in an Indian robotics startup named Addverb Technologies Pvt, which uses robots to make e-commerce warehouses and energy production more efficient. The deal is estimated to be worth $132 million.

The company based in Noida is one of the rare unicorns in the sector to work in every aspect of robotics viz. from hardware and software to deployment. This makes Addverb an incredibly shrewd acquisition.

To compete with a global behemoth like Amazon, Reliance needs top-of-the-line machinery plus robotics, and Addverb has the capability to arm Reliance with the same.

Reliance has big plans: Sangeet Kumar, co-founder, Addverb

Sangeet Kumar, the startup’s co-founder and chief executive officer is a graduate of the Indian Institute of Technology Kharagpur and he understands the scope of ambition of Reliance.

In a telephonic interview with Bloomberg, Kumar was quoted as saying, “Reliance has huge plans to implement automation across digital warehouses. They have plans to expand warehousing to hundreds of locations in the next two years and when you have that scale, only robotic systems can be effective.”

It’s not the first time that the two companies are collaborating together. Addverb has already designed automation for the conglomerate’s refinery in Jamnagar, Gujarat, as well the giant new solar factories.

Reliance planning to develop 5G robotics technology

With this acquisition, Reliance is planning to build “next level” 5G robotics and battery systems as well as harness carbon fibre to build affordable, advanced robots.

Meanwhile, Addverb is scouting land around Delhi as it envisages building the world’s largest robot-making factory to keep up with the plans of the Mukesh Ambani-led company.

Reliance laying the groundwork

Reliance has been laying the groundwork to take on Amazon for some time now. Its Jio mart has started penetrating the tier-2, tier-3 cities with much more efficiency. Unlike the other e-tailers, Mukesh Ambani had Jio Mart’s concept crystal clear from day one.

The company does not want to sell discounted products online and run huge losses like Amazon and Flipkart. It decided to empower the Kirana store owners, to whom it offers goods at a rate 15-20 percent less than what is offered by salespeople.

Almost two years ago, during the launch of Jiomart, Mukesh Ambani said, “In the very near future, JioMart, Jio’s digital new commerce platform, and WhatsApp will empower nearly 3 crore small Indian Kirana shops to digitally transact with every customer in their neighbourhood. This means all of you can order and get faster delivery of day-to-day items, from nearby local shops. At the same time small Kiranas can grow their businesses and create new employment opportunities using digital technologies.”

Read more: Mukesh Ambani is working with WhatsApp to remove Amazon Fresh from the market

Reliance and its deal with Future Group; Amazon playing the devil

With an eye to capture the market, Mukesh Ambani, in August 2020, cracked a deal that would have established Reliance’s presence in India’s e-commerce market and overturned the competition posed by Amazon and Flipkart.

As reported by TFI, Reliance Retail Ventures Limited (RRVL) bought Kishore Biyani led Future Retail Limited for Rs 24,713 crore. However, Amazon, an investor in Future Coupons that, in turn, is a shareholder in Future Retail Ltd., vehemently objected to the deal.

Fuming that Reliance and Future group were going to destroy Amazon, Jeff Bezos took the Future Group to court on the basis of a non-competitive clause that it has signed with the wholly-owned but unlisted subsidiary of the Future Group.

Amazon, being the devious corporation it is, stalled the deal. In a nutshell, a measly $200 million investment in Future Group in 2019 by Amazon stopped the $3.4 billion deal between Reliance and Future Group.

The switcheroo

However, last month, India’s antitrust agency Competition Commission of India (CCI) suspended Amazon’s deal with Future Group.

The regulator ruled that the US-based company had suppressed information while seeking regulatory approval on investment into Indian retailer Future Group two years ago.

The switcheroo by the anti-trust agency has put Amazon on the backfoot. Already fighting the case in courts, it may now have to file a fresh petition to argue that its deal, in the first place, was valid.

Read More: The Indian govt has snatched the very weapon that Amazon used to sabotage the Reliance-Future deal

Amazon may hold a temporary edge over its rivals, but the rapid strides being made by the Reliance will be making Jeff Bezos uneasy. The future of e-commerce in India looks exciting, and it’s a good news that an Indian company is challenging the monopoly of a greedy American giant.