During the last two decades, India has been able to largely bridge the literacy gap between itself and its developed counterparts. However, an education that provides skills that cater to the job market is still a big headache for states as well as the Union government. Now, the Narendra Modi government has come up with a new solution to address the skill deficit in India.

NSDC to launch skill impact bond

National Skill Development Corporation (NSDC) is a not-for-profit public limited company set up by the Ministry of Finance that has come up with the first of its kind ‘impact bond’ for providing skills to erstwhile unskilled youth of India. The company has decided to collaborate with a consortium of government, semi-government and private sector organisations for technical partnership. The consortium includes HRH Prince Charles’s British Asian Trust, the Michael & Susan Dell Foundation (MSDF), The Children’s Investment Fund Foundation (CIFF), HSBC India, JSW Foundation and Dubai Cares, with FCDO (UK Government) & USAID as technical partners.

Initially, the coalition will be using $14.4 million to enhance the skills of 50,000 young Indians. Out of these $14.4 million, $4 million will be invested by MSDF and NSDC as risk investments to provide upfront working capital to the service providers to implement the programme for four years. Risk investing in this particular scenario simply means that if the outcome is achieved, then risk investors’ funds will be reinvested every year in the project.

Main focus of the bond structure to be on women and girls

The bond has been created by keeping women and girls as the main focus. According to the estimated target, more than 60 per cent of women and girls will be the direct beneficiary of the bond. They will be equipped with skills and vocational training along with availing job opportunities. The training will be provided in sectors like retail, apparel, healthcare, and logistics; but not necessarily limited to these sectors only. NSDC has selected Apollo Medskills Ltd, Gram Tarang Employability Training Services Pvt Ltd, Learnet Skills Ltd, Magic Bus India Foundation and PanIIT Alumni Foundation to impart training

Explaining the significance of the collaboration, A M Naik, chairman, NSDC, and group chairman, Larsen & Toubro Ltd said, “India’s aspirational youth require skills for the jobs that meet the demand of the industry. Core functional knowledge and competencies enhance an individual’s ability to secure and retain a job and improve their potential to earn. SIB is a collaborative effort of NSDC and esteemed global organisations and people who share their vision to improve skilling outcomes in India. This landmark financial instrument applies an entrepreneurial approach to philanthropy and ensures accountability which contributes to the achievement of set objectives The project has the potential to make a transformational impact especially in the lives of women,”

Impact bond – An outcome-oriented instrument

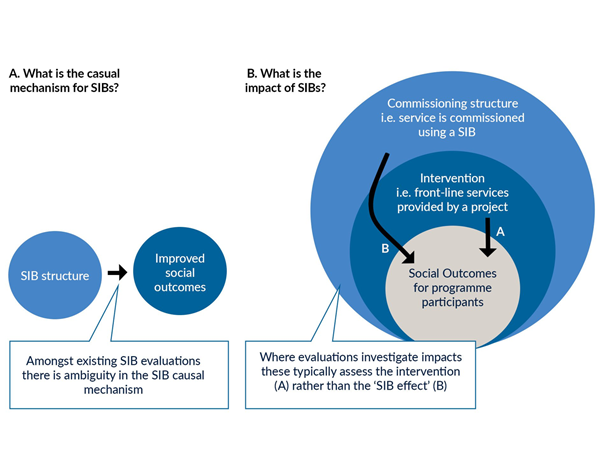

Impact bonds are essentially non-marketable bonds where repayment is dependent on the outcome of the project being funded by the bond. The idea is simple. Earlier the government used to directly collaborate with various NGOs and other not for profit organisations to run its programme. Through impact bonds, the government involves private investors by issuing bond papers to them. In normal circumstances involving bond papers, the government would get some money from the investor promising to pay them a certain amount after a fixed time.

However, in scenarios involving impact bonds, the private investor will have to provide funding to the NGOs working to bring the change on the ground. Once a required set of social impacts is achieved by the collaboration of NGO and private investors, the government will pay the earlier agreed amount to the private investor. This is touted as a better alternative to corporate social responsibility.

SIB – Not the first impact bond

This is not the first time that impact bonds are being used to change the landscape of a particular sector in the country. issue. Bonds like social impact bonds and Developmental impact bonds have already been in operation.

- In 2015, ‘Educate Girls’, an NGO founded by Mumbai-based Safeena Husain, entered into a Development Impact Bond (DIB) contract with the UBS Optimus Foundation and Children’s Investment Fund Foundation (CIFF). The contract was made to enrol the unenrolled and enhance the learning outcomes for already enrolled girls. At the end of three years (duration of the project), the NGO succeeded in enrolling more than 16 per cent of more girls than they had earlier targeted, similarly their target to achieve the learning outcome overshoot the estimated target by 60 per cent.

- In 2020, Pimpri-Chinchwad Municipal Corporation (PCMC) signedan MoU with United Nations Development Programme (UNDP) India to co-create India’s ‘first Social Impact Bond (SIB) with the target of improving healthcare services for local residents, especially with respect to the pandemic.

India – A growing investment destination

Thanks to initiatives like Make-in-India, Aatmanirbhar Bharat and schemes like Production linked incentive (PLI), India has opened the floodgate for the companies to come and invest in India. The country is entering into what can be loosely described as the LPG2 era in terms of liberalised investment policy. The prospects of investing in India get a boost keeping in mind that the world’s largest companies are constantly shifting their bases out of China.

Read more: 2 disastrous COVID waves later, India is back to being the fastest growing economy in the world

A company coming to India will not want to import skilled labour from other countries as it will lead to a high cost of products which in turn will impact its sales. India’s modernised and skilled labour force is the need of the hour and the initiatives like ‘skill impact bond’ are just the right way to ensure quality skill. By shifting the burden on private investors, the government does not need to spend taxpayers’ money in case a scheme fails due to negligence by the middlemen involved. Moreover, the government funds also compelled NGOs to deal with slow bureaucratic hurdles, which will also be removed through this private sector participation.