What is the meaning of Leave Encashment?

Meaning of Leave encashment : The amount received by an employee, reimbursing them for unused leave, they are entitled to at any time or after their resignation or retirement is leave encashment.

As we know, Labor law entitles every person working, who is paid salary has certain days of leave to utilize. The law makers in our country, for the convenience of employees has made provisions to compensate the employees who haven’t utilized such leave.

Leave encashment and Income tax

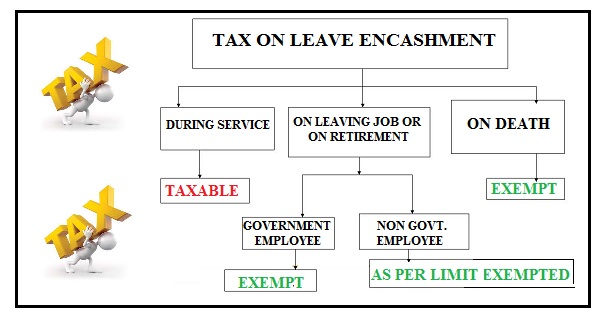

According to Income tax Act, 1961 the amount or cash received by any employee as leave encashment is taxable.

Leave encashment on received while in service – Leave encashment received by an employee during service is completely taxable under the head “income from salary”. The exception to this rule is that there is exemption available and such exemption can be claimed under section 89 of Income tax Act, 1961. An employee may bring forward his or her leave, which has not been taken for a year, and claim compensation for this leave.

Leave encashment received on resignation or retirement- Upon their resignation or retirement the employees can claim leave encashment:

In the event of an employee’s death, the salary of the employee’s accumulated leave is paid to the employee’s legal heirs.

Any amount received by government employee (state or central) as leave encashment is entirely exempted from being taxed. However, if the employee resigning or retiring is from private sector, the amount receive by him is taxable and can claim exemption during computation under section 10 (10AA) of the Income Tax Act,1961.

Also Read : Arrest of Delhi based YouTuber : Ishan LLB vs. Madrassa Board

Leave encashment calculation with example and meaning

Mr. Z is resigning after 8 years of service.

Mr. Z was entitled to 36 days of paid leave per annum from his employer i.e., overall 288 days of leave during his entire service.

Out of the same Mr. Z has already utilized 88 days of paid leave and is left with 200 days of unused leave.

Mr. Z was drawing basic salary + DA of Rs 36,000 per month at the time of retirement and received Rs 2,40,000 as leave encashment.

Leave encashment calculation : Based on 200 days * Rs. 1,200 (salary per day = Rs.36,000/30 days).

Here, it is important note that the income tax is computed according to the running slab rate.

Is Leave encashment taxable?

Yes leave encashment is taxable for non government service employees. The laws relating to taxation of leave encashment precisely state that in the event of resignation or dismissal, employees are obliged to pay tax on the amount of the leave allowance and it is considered income from salary while filing return.

Government employees, whether they belong to the central government or the state government, are not obliged to pay taxes on leave entitlements or income at the time of termination or resignation. If you redeem your holiday while working for a company or authority, it is exempt from tax.

If an employee does not take the leave to which he is entitled, he can take his earned salary, no matter what happens. Such redemption may be made by an employee during his or her time of service, vacation, retirement or for any other reason.

Also Read : Gold Rate In 2013: Drastic change in the market