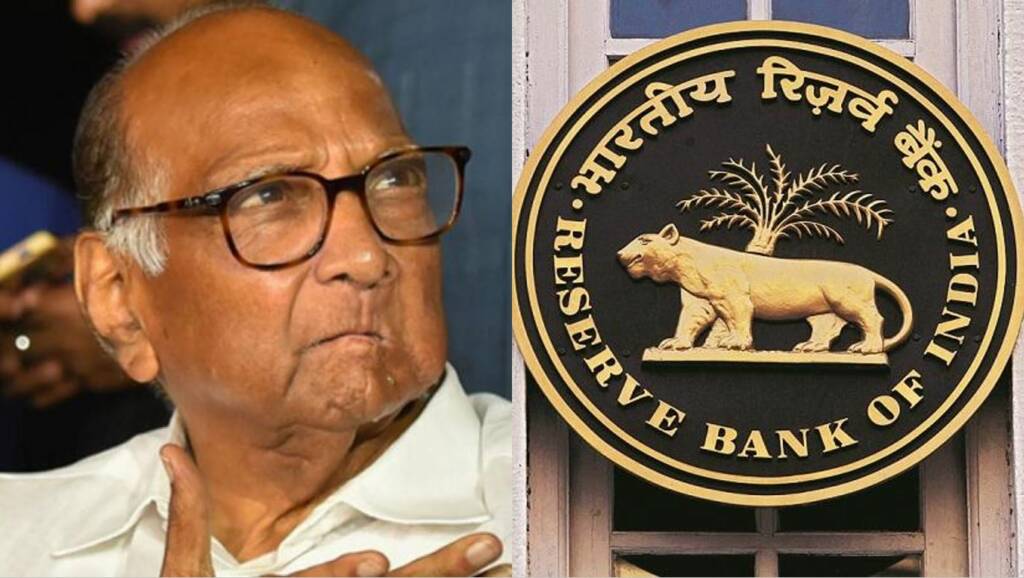

After the PMC bank scam, Prime Minister Narendra Modi’s government brought an ordinance to amend Banking Regulation Act. As per the act, Urban Cooperative Banks (UCBs) were brought fully under the supervision of the Central Bank of India which is RBI. Fast forward a year, the Banking Regulation (Amendment) Act, 2020 has finally been notified for the State Cooperative Banks (StCBs) and District Central Co-operative Banks (DCCBs) with effect from April 1, 2021. However, the enactment of the act has left NCP patriarch Sharad Pawar twisting and turning.

According to news reports, during a party meeting on Wednesday (June 2), the NCP supremo gave his nod to set up a task force to prepare an action plan against the new law. Balasaheb Patil, NCP leader and Cooperation Minister in the current Maha Vikas Aghadi government will be heading the task force. Other than Patil, nominees of Congress and Shiv Sena and experts in the field of banking will be members of the task force too.

NCP spokesperson Nawab Malik said the Centre was trying to weaken the cooperative banking sector through changes to The Banking Regulation Act, 1949, and the NCP would stop its “game”.

Reported extensively by TFI, most cooperative banks and societies in Maharashtra are directly controlled by the NCP and fearing the power slipping from its hands, NCP is making last-ditch attempts to restore the parity.

I have written a letter to Hon. @PMOIndia Shri @narendramodi to express my deep concern about the preservation of the ‘Co-operative’ character of Co-operative banks having legacy of more than 100 years. pic.twitter.com/CZ6IBu4kZ1

— Sharad Pawar (@PawarSpeaks) August 18, 2020

NCP politicians are involved in the management of cooperative banks, and it is partly the reason why every year, news of fraud worth thousands of crores used to be unearthed from such banks. In Maharashtra, NCP, which was in power for years, had put a state guarantee on loans given by these banks. This means the local politicians who controlled the management of these banks would get loans worth crores from these banks and in absence of any real authority, would more often than not default on the payback.

The Fadnavis government ended the state guarantee on the loans provided by UCBs, but when the tri-party alliance came to power, it was again enacted, possibly at the behest of NCP.

So far, these banks were under dual authority with the power to appoint or change the management with the board and other regulatory functions lying with RBI. After the government order, 1,482 urban cooperative banks and 58 multi-state cooperative banks came under the direct supervision of RBI.

The Pawar family is the best example of how politicians use public offices to reap economic dividends. Sharad Pawar built the political and business empire by influencing agriculture and related industries through policy manipulation. The cooperative banks, sugar mills, agriculture market produce committee (APMC) were the instruments for Sharad Pawar to build the power base of the politics of the state.

With the complete control of banks getting in hands of RBI, the politicians fear losing out on easy money that these banks churned for them on a consistent basis and this may be the reason that Pawar is assembling his team to put up a frontier, albeit a failed one.