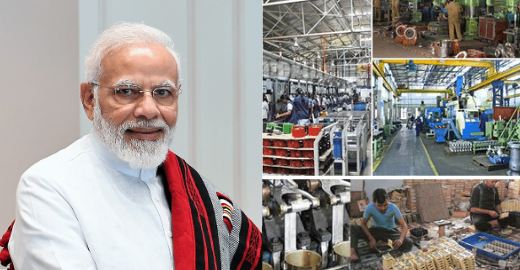

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of the Indian economy, accounting for around 30 per cent of the GDP and being the second-largest employer after agriculture. In the last few years, the MSME sector faced one crisis after another, and now the Modi government is taking steps to end their woes.

One of the biggest problems of the MSME sector that the Modi government is trying to solve is timely payments to the small companies from the ministries (union and state). The MSMEs have repeatedly raised concerns that their payments were not being released on time by different wings of the government.

A few months ago, MSME sector representatives had clearly told Finance Minister Nirmala Sitharaman and Union Minister of Micro, Small and Medium Enterprises, Nitin Gadkari that this is the single biggest problem of the sector. Various ministries, companies, societies, and departments under those ministries have thousands of crore rupees due to the MSMEs. The bureaucrats in the ministries sit on payments of the small companies to get kickbacks. The lack of capital from the market and untimely payments is pushing many of them towards bankruptcy as they cannot pay instalments on loans.

Therefore, the Modi government has told all its departments to compulsorily adopt Trade Receivable Discounting System or TReDS. TReDS, in simple terms, is a mechanism that will ensure that the MSMEs get paid immediately for the supplies that they have made to the government departments by a third party for a small fee, and then the government will pay to the third party. Such third parties will either be banks or Non-banking financial companies.

So far, only private parties were active on TReDS which were operated by RBI, but now all the union and state government departments will be on it. These changes came after the Parliamentary Committee of Finance, headed by BJP MP Jayant Sinha, suggested the same in the committee report on the Factoring Regulation (Amendment) Bill, 2020.

“…receivables coming from the Central and state governments should compulsorily be brought under the ambit of TReDS through this legislation so that payments pending which have already been approved for various MSMEs are made available to them on a timely basis,” reads the report.

“…receivables coming from the Central and state governments should compulsorily be brought under the ambit of TReDS through this legislation so that payments pending which have already been approved for various MSMEs are made available to them on a timely basis,” it added.

A few months ago, after meeting top officials of 21 key infra ministries, Finance Minister Nirmala Sitharaman had said, “No overdue payment should be with any ministry… My intention is to make sure that the government does not sit on the payments that are due. The government does not sit on capex than it has planned. I’m gearing up the machinery so that what is expected outside to happen should also be enabled from us.”

Moreover, the Finance Minister has given similar instructions to the CBDT about GST refunds in order to solve the issue of funds crunch being faced by MSMEs in the last few years. The government efforts to make payments on time will help the MSME units to operate more smoothly, pay instalments more comfortably, and will also give them the breathing space for expanding their businesses.