Two years after the Anti-Sterlite protests shook the nation, Anil Agarwal, one of India’s most successful businessmen, has pledged all of his shares in the Mumbai listed Vedanta Limited to an American asset management firm, OCM Verde Investment, to secure a loan to repay its debts.

“A subscription agreement dated 23rd December has been entered into between Vedanta Holdings Mauritius Limited and the other promoters of Vedanta Ltd with OCM…Under the agreement, the issuer shall issue US$ 400,000,000 notes of nominal value $1 in favour of OCM,” said a statement by OCM Investment in the BSE filing on Tuesday.

With the secured loans, the company will fund the outstanding debt of 900 million dollars and increase the promoter’s stake in Vedanta Group, which suffered huge losses due to the anti-Sterlite protests of 2018, by 11.5 per cent. “The funds raised will be used to fund the tender offer for any and all of Vedanta Resources Limited’s outstanding US$ 900 million of 8.25% bonds due in 2021…and any proceeds shall be used to service debt of VRL or other subsidiaries,” the company said in its BSE filing.

Today, the India-based promoters are forced to pledge their stake in the company to foreign asset management firms due to closure of its Tamil Nadu based plant after the anti-Sterlite protests, which accounted for more than 50 per cent of the total profits of India-based operations.

At a time when the Modi government is trying to promote Aatmanirbhar Bharat campaign, the Indian promoters are forced to pledge shares to foreign companies because some NGOs forced its most profitable operation to close down using Chinese money.

Though Anil Agarwal and his family will remain the sole controllers of Vedanta, if the company is not able to pay back the loans, the ownership can change.

“It is something called an encumbrance, meaning banks have taken additional security so that there is no change in control. For the shares pledged against the debt taken, an encumbrance is created so there is no change in control,” said an analyst.

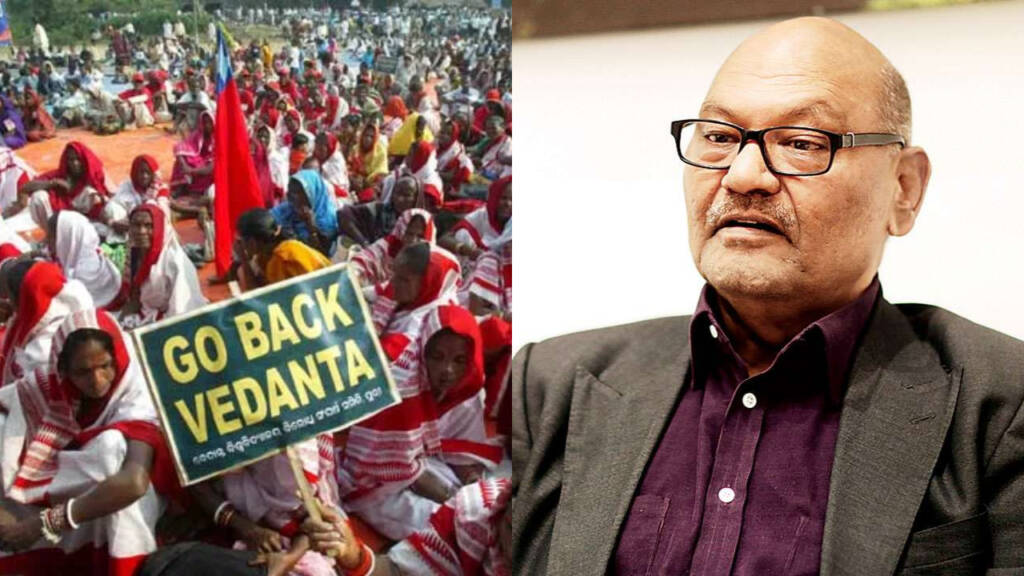

Two years back in March 2018, a few China-supported environmental NGOs and the local churches collaborated to protest against the Sterlite Copper, a subsidiary of Vedanta Limited which produced more than 40 per cent of India’s copper and played a crucial role in meeting domestic demands.

The owner of Sterlite Copper Plant, Anil Agrawal led Vedanta Group, had told the Madras High Court that the anti-Sterlite protest was funded by Chinese companies which will benefit from the closure of the plant. “These companies promoted and funded the agitations and protests against Sterlite. India’s import bill for copper is $2 billion, the demand was being met by Sterlite earlier,” claimed Aryama Sundaram, the legal counsel for Vedanta Group before the special bench of the court comprising Justice T S Sivagnanam and Justice V Bhavani Subbaroyan.

In the aftermath of the anti-Sterlite protests and the closure of Vedanta’s plant, 38 per cent of the country’s copper demand is being met through imports from foreign firms.

“There is a direct economic, financial interest of the foreigners in this,” said Sundaram.

“Foreign manufacturers are benefiting from this and the profit goes to them. The import bill for copper is $2 billion, which Sterlite used to satisfy earlier,” he further added.

India became a net importer of copper from being a net exporter- due to the anti-Sterlite protests. Sterlite manufacturing unit in Tamil Nadu was a milking cow for the company, generating a significant chunk of revenue of the metals and mining conglomerate. Moreover, it accounted for more than 50 per cent of the company’s total profits. Had the unit remained operational, Anil Agrawal would not be forced to pledge shares to a foreign company to secure loans to pay back the debt.