The Global Investors, fearing victory of Donald Trump in the November Presidential Election, are selling Chinese stocks. As per a report by Bloomberg, the Global Investors have sold Chinese stocks worth 3.6 billion dollars in the last quarter as the new wave of Coronavirus sweeps many countries and US elections draw closer.

The sell-off of 3.6 billion dollars is the biggest since the second quarter of 2019, and this shows the fear of Donald Trump’s victory on the Chinese economy. The companies which were involved in the sale of duty-free products lost the most given the fact that the Trump administration is expected to impose tighter trade restrictions on China if re-elected. As per the data from Hong Kong stock exchange, China Tourism Group Duty-Free, the nation’s biggest franchiser of duty-free shops, liquor distiller Wuliangye and Apple supplier GoerTek were among the stocks that were sold most by foreign investors.

“The US risk-off trade ahead of November’s US presidential election has affected onshore/offshore sentiment for Chinese equities, adding to the negative sentiment including a new wave of Covid-19 cases in parts of Europe and weakness in US high-frequency data,” said Wendy Liu, head of China strategy in Hong Kong at the Swiss bank UBS Group.

The Chinese economy is heading for imminent collapse due to domestic as well as international factors. On the domestic front, the shadow banking industry, a 2 trillion dollars sector in China, is witnessing one default after another due to fraudulent transactions and rising Non-performing assets. The rise of China was due to the credit boom from non-banking financial companies which distributed loans like there was no tomorrow. However, now as the economy has been hit by the Coronavirus pandemic, most of these loans are turning to NPAs, because the companies now are unable to pay back.

On the international front, the countries around the world, including India, have imposed severe restrictions on Chinese imports. Moreover, the countries around the world, including friendly ones in Europe tightened their Foreign Direct Investment (FDI) norms to prevent the takeover of domestic firms by capital-rich Chinese investors.

For decades, the Chinese economy has been dependent on investment and exports, and the wave against globalization and free trade is harmful to the Chinese economy. The countries are not only hitting China with import restrictions, but the door is closed for Chinese capital, too. So, now China would be dependent on the domestic market for economic growth.

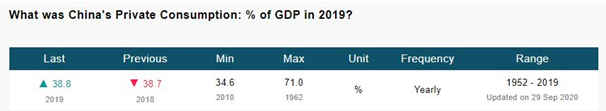

The share of domestic consumption never crossed 50 per cent of GDP in the Chinese economy since the Communist government opened up the economy and therefore the transition from an export-led economy to private consumption driven would be patchy. The Communist government is taking policy measures to boost domestic consumption and incentivizing the companies to produce goods for the domestic market, but, so far, it has yielded little results.

A Chinese economy without exports and investment means a crippled Chinese economy. When the incentives to boost domestic consumption yielded little results, the Communist government started opening up the economy to foreign players. Through this, it wants to address the complaints of the Western world that China continues to be state-led economy as well attract foreign capital at a time when global investors are shunning the second largest economy in the world.

Beijing has announced that it will allow overseas bond investors to transfer money into and out of the Communist country in a more unrestricted manner. Therefore, as the outside world threatens to de-link itself from China, the paper dragon is looking at easy access to its gigantic onshore bond market.

The People’s Bank of China and the State Administration of Foreign Exchange (SAFE) have issued a draft regulation stating that Foreign Institutional Investors (FII) including Central Banks, investment banks, wealth management firms and insurance companies, would be able to take out more money in the currency of their original investments without facing any restrictions.

The Chinese attempt to open up the economy shows its desperation to remain the pre-eminent economy of the developing world, a place for which now India and Southeast Asia is eying. However, if Donald Trump gets re-elected- which looks very much imminent- the Chinese strategy is set to fail because Trump’s government would take every possible step to throw China out of the global supply chain and make the country untouchable for global investors. The fear of Trump getting re-elected is already visible with the flight of global capital in the last quarter.