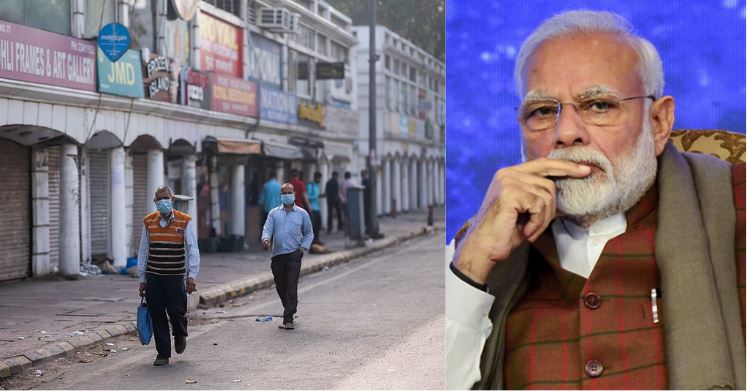

The Coronavirus lockdown is going to hit the economies around the world very hard. The global growth, estimated at around 3 percent before Coronavirus hit the surface, is now posed to dive into negative territory. Most of the major economies, except for India and China, have forecasted to register negative growth in 2020.

In India, too, the growth is expected to decline below 2 percent as against 6 percent estimated in Economic Survey. And the downward spiral of economic growth means the tax revenue collection of union as well as state governments is going to touch a new low. In fact, the central government is mulling over the idea to announce a stimulus package to make sure that companies do not go bankrupt.

On one hand, the expenditure of Union government is going to rise exponentially as it has already announced welfare package worth 1.5 trillion rupees while an industry support package worth at least 3-5 trillion rupees is on the way. At the same time, the tax collection of the union government is posed to dive deep into negative territory due to economic slowdown.

All the tax sources of central government are poised to register a decline due to Coronavirus lockdown. Union government is primarily dependent on direct taxes (Income Tax+ Corporation Tax), central GST, and Customs for revenues. Given the economic slowdown, the companies would ask for support from government instead of paying taxes, and it is very much possible that the government would announce tax breaks to support industries. Similarly, as the income of the people declines, the collection from personal income tax would also decline; around 30 percent of Income Tax which comes from MSMEs- sole proprietorship businesses- is going to be near zero as small businesses are hit hardest from lockdown. Imports of the country are at an all-time low, and therefore, there is not much space in this area, too.

Therefore, the central government is going to go bankrupt this year given rising expenditure and low tax collection. But, the state governments, whose primary sources of income are excise on alcohol and petroleum, state GST, and taxes on electricity, would surely recover the losses of lockdown.

Most of the state governments like Delhi, Uttar Pradesh, and Haryana have already increased taxes on alcoholic beverages and petroleum to compensate for the revenue loss in lockdown. Taxes from alcoholic beverages and petroleum constitute majority of state’s own tax collection, and therefore, while the union government goes bankrupt this fiscal year, state governments are going to manage situation very well.

The central government has already planned to borrow more than 7 lakh crore rupees (1 trillion= 1 lakh crore) to finance its expenditure but with Coronavirus induced economic slowdown, the total borrowing is going to cross 10 lakh crore rupees and fiscal deficit could be estimated around 5 percent of GDP.

Therefore, the onus to support the economy in this fiscal year lies with states, as the union government does not have much space for this. The state governments should wisely use the money earned from increase in taxes on alcoholic beverages and petroleum, and cooperate with union government to harness its expertise in supporting the economy to make sure that India remains the brightest spot of global economy amid this lockdown.