The story of rise and fall of Yes Bank is not just story of bank, but of a family too. Right from its inception, the story of Yes Bank was also the story of Kapur family; the story of friendship; of relationship; and of backstabbing. In 1999, Ashok Kapur (ex-country head of ABN Amro bank), and Rana Kapoor (ex-head of corporate finance at ANZ Grendlays Bank) came together to start a non-banking financial company in partnership with Rabobank of Netherlands. Basically, two top level ex-bankers and some professionals wanted to start a new bank in partnership with a foreign entity.

Given the clout of Ashok Kapur and Rana Kapoor, the entity got banking license in 2004 and went for IPO in 2005. Going for IPO just after a year of establishing the business was something unheard in India; however, Kapur’s successfully listed the bank at the stock market. Ashok Kapur was chairman of the group while Rana became MD and CEO of the company, looking after its day to day operations.

The Kapur’s turned their professional relationship into personal one with Ashok’s wife Madhu’s sister marrying Rana Kapoor. So the Kapoor’s became brother in law and the company as well as the family life was going great until the 26/11 attack of Mumbai.

In the attack, Ashok Kapur, staying at the Trident hotel, was killed. After death of Ashok Kapur, Rana tried to sideline the former’s family from the management of the company. Not just this, Rana also tried to remove the name of Ashok Kapur from company’s history and in 2012, when at a company function; he presented a brief history of the company, with the no mention Ashok Kapur. He tried to project himself as the sole founder and father figure of the bank.

This, obviously, did not go well with the Ashok’s family. Given the fact Ashok Kapur’s family held 10.29 percent share in the company, just a little less that Rana’s 11.77 percent, the former’s daughter Shagun tried to resist. She filed up for the nomination in the Yes Bank’s board, which was not approved by Rana faction and ultimately both landed up in court.

In June 2015, the court gave verdict in favour of Madhu getting berth in the board of Yes Bank. Since mid-2010s, the Ashok Kapur family and Rana Kapoor family has been in constant tussle and in the last five years, the financial operations of the bank also moved in red zone. Although, Rana Kapoor tried to mask the failure of loans and rising NPAs through creative accounting, but, RBI got the signal that everything is not OK with the Yes bank which had become darling of the private investors in the last few years.

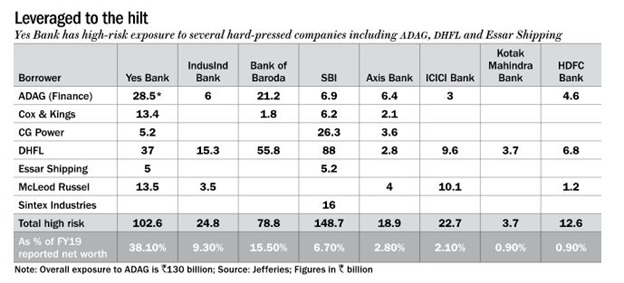

In the last few years, almost all the companies whom Yes Bank loaned large sums without much scrutiny like-Dewan Housing Finance, Essel group, CG Power, Anil Ambani group, and Videocon, have gone bust.

Among the industrialists, it is well known that even if all banks refuse to give money for a project, Rana Kapoor led Yes Bank will surely lend. Yes Bank gave huge loans for many projects, which were unviable in assessment of other banks, at an interest rate higher than that of peers.

Finally, as majority of the companies to which Yes Bank had lent have gone bankrupt in last few years, the company has suspended the operations, and RBI had to take over the management. The story of Yes bank is also story of Rana Kapoor’s talent; his greed; his betrayal to friend’s family after friend’s death; and last but not the least, of his risk taking and ambition.