In a major move, the Union Finance Minister on Friday announced the decision to merge ten public sector banks into four. This move will bring down the number of state-owned banks to 12 from 27 in just two years.

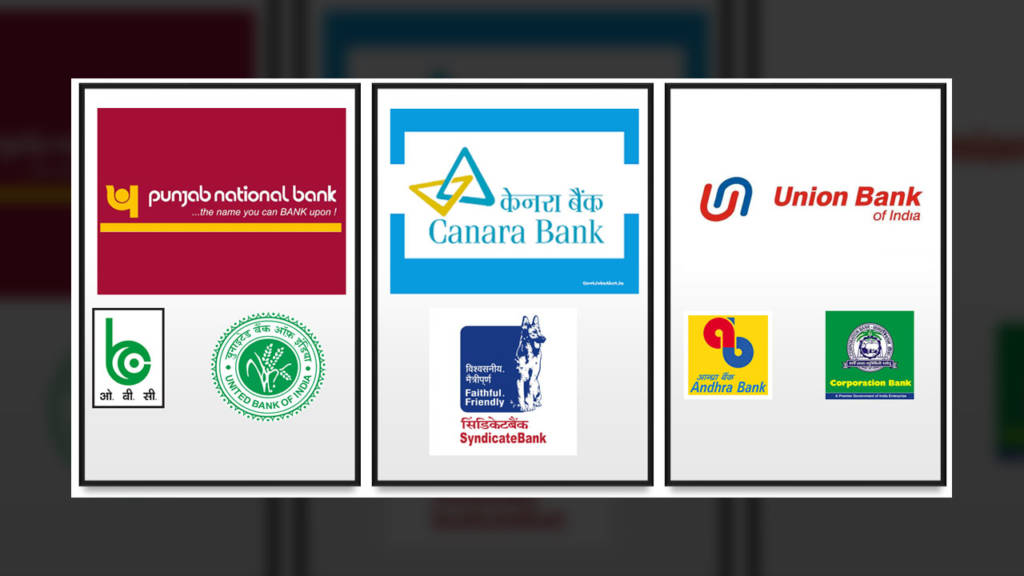

In 2017, the then RBI Governor Urjit Patel had stressed for the need of merger of PSBs to help in dealing with the problem of stressed assets. The presence of cooperative banks and micro-financial institutions to provide community-level banking has paved the way for the merger of banks, which will result in fewer but healthier banks. While SBI remains the largest state lender with a business of Rs 52.05 lakh crore, the merger will see Punjab National Bank overtake Bank of Baroda to become the second-largest state-owned lender after it absorbed Oriental Bank of Commerce and United Bank of India with a combined business of Rs. 17.94 lakh crore. The rationale behind this merger is based on the logic that bigger banks have much more ability to absorb shocks, reap economies of scale as well as the capacity to raise resources without overly relying on the government.

It seems that the government has also learnt a lesson from the merger of BOB-Dena-Vijaya Bank merger where the criteria of the merger were geographical compatibility and the merger subsequently faced technological challenges due to varied operating systems and hence, this time around the government’s criteria for the merger was technology integration rather than geographical compatibility. Finance Minister Nirmala Sitharaman explained the rationale behind the selection of banks for mergers and said that while the large overall capacity of one bank was chosen, the technology-driven capacity of the other and the deposit franchise of the third was identified before the list of mergers was chalked up.

While the Punjab National Bank led entities will have a strong presence in North India, the south will be greatly benefited by the merger of Canara and Syndicate Bank who have a strong presence in Kerala and Karnataka. The mergers of Andhra, Allahabad, Corporation and Indian Bank have an almost uniform presence across the country. The consolidation of banks will see the rationalisation of branches instead of the workforce, with overlapping presence. This could lead to the sale of real estate where branches are redundant as well as offering voluntary retirement schemes to manage headcount and adding younger, tech-savvy personnel. The merged entities will now have an increased appetite for lending as scaling-up and reduction in the cost of operations will result in reduced lending costs as well.

The Finance Ministry has infused Rs 2.5 lakh crore in public sector banks since FY15 and plans to spend another Rs 70,000 crore this year. However, the market capitalisation of the state-run banks continues to stand at a dismal Rs 5 lakh crore. As it stands, the weaker banks are losing market share and the stronger banks are gaining market share which is a positive sign particularly for Private Sector Banks.

It seems that the government is following the roadmap laid down by the committee headed by PJ Nayak, former Chairman and CEO of Axis Bank who came out with a report 5 years back urging the government to dilute its stakes in PSBs. This restructuring will pave the way for government to reduce its stakes in PSBs to below 51% as improved market evaluations and balance sheets of the megabanks will present an opportune moment for the government to divest some of its stakes which would subsequently reduce the amount that the government needs to inject into the banking sector to deal with NPA’s and stressed assets. If the government indeed goes for divestment at a later stage, it would fit perfectly well with Prime Minister Modi’s principle of ‘Minimum Government and Maximum Governance”.

There is no doubt that such a large scale restructuring would lead to some hiccups in the short term but just like Goods and Services Tax, this move has the potential to deliver structural benefits and allow the banks to become profitable. It’s refreshing when a government bucks the trend and opts for a long-term solution rather than a quick fix. Now, the government without any further delay should pass the Financial Resolution and Deposit Insurance Bill which it withdrew due to pressure from the opposition. This bill would be important in the large scheme of things as at present there is no roadmap on how to resolve a bank, should it be forced to declare bankruptcy.