The first budget of Modi Government 2.0 will be out soon. The expectations from the first budget of Finance Minister Nirmala Sitharaman are quite high. In fact, in the recently concluded NITI AYOG meeting, the government has set a target for $ 5 tn economy. While there has been a lot of mudslinging on the GDP data with fireworks from all sides, the underlying intent is that the database needs to be streamlined to ensure better decision making.

Having said that, the daunting task ahead for Minister Sitharaman is balancing the budget by creating tax sops yet maintaining the fiscal deficit and financial health of the nation. I believe the central theme of the budget should be ‘Freeing up shackles on Capital’. India is a country poised for great growth now and there are multiple avenues of growth ahead, but the problem is, we are Capital Starved. And, Capital chases returns; so any investor, domestic or local, has to go around a maze of taxes to ensure adequate returns are generated for his capital; and no Equity investor ever settles for low returns. Some of the key items that need to be tacked are:

- Rationalization of dividend distribution tax: Currently, the Dividend Distribution tax is set at 20.3576% on the profits to be distributed as dividend. Mind you, dividend is a residual profit after the regular Income tax of (25% to 30% of corporate income tax is paid). The DDT, coupled with corporate tax, takes the overall effective tax rate for a company to 40%. Furthermore, the recipient of the dividend is also taxed for dividend income. The recipient, if received the dividend in excess of Rs. 10, 00,000, is taxed at 10%. This whole structure is extremely inefficient and kills the CAPITAL. The DDT for listed companies and private limited companies should be abolished. This would give a much-needed boost to the private equity / VC investments in new businesses. A substantial amount of returns are getting blocked in dividend distribution taxes.

- Extension of SEZ: As per Income Tax Act, any unit starting operations in SEZ on or before 31 Mar 2020 is allowed tax exemption for a period of 15 years with first five years 100% exemption, next 5 years 50% exemption and balance 5 years exemption subject to riders. The SEZs in India have played a strong role in improving exports, and generating jobs. These exemptions are lapsing from 31 Mar 2020. However, with a growth witnessed in the IT Sector and India’s plan for Make In India, it is of utmost importance that these exemptions should be extended in the next budget.

- Removal of Rs. 200,000 limit on overall cap for Income from House Property: Earlier the middle class and higher middle class ended up having 1 or more houses in the city. Houses on rent or deemed ‘let out houses’ would get full interest deduction, vis-à-vis a Rs. 200,000 cap on a self-occupied house. This loss was allowed to be set off against the Salary Income. However, in the past two years the overall loss from House Property is capped at Rs. 200,000. The government should remove this cap. Further, not just middle class or individual owners but Commercial Real Estate built in cities which were rented, were able to take benefit of this structure which allowed them to better their investment returns. This provision was especially helpful for Commercial Real Estate where the rental yields are 6% to 8% or Residential assets where the yield is 2% to 4%. The capping of the loss from House Property restricted at Rs. 200,000 should be removed.

- Rationalization of GST for Rented Assets: Currently, the government has formulated a scheme for residential real estate for either a set off of GST paid against GST collected from customer or a composite scheme of GST of 12%. However, in case of Commercial Real Estate assets, which are built but not sold, meaning held as inventory and rented out, the GST on the construction cost cannot be offset against the GST collected on rent. Thus, entire ~18% of GST on construction cost is a direct COST, which in turn affects the rental rates. The Government should allow to create a scheme for rationalization of GST paid vs GST on rent with some riders for example, to be set off over 3 years or 5 years, etc. This shall boost the REIT market in India.

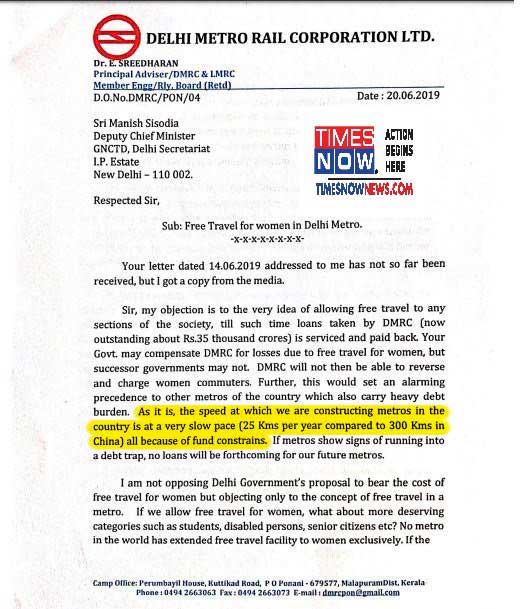

- Removal of long term capital gains: The government must remove the recently introduced long term capital gains. India is a capital-starved nation; we need to build assets and that is possible with huge external capital. Shackling this capital via DDT, Long term capital gain tax, only reduced the attractiveness of investment in India vis-à-vis other nations. The recent letter from Mr. Sreedharan mentioned an important point on Metros that China builds 300 Km of metro in comparison to India at 25 Km of Metro line per year, primarily due to funding constraint.

(PC: Times Now)

This one line points to the major constraint that we have i.e. CAPITAL. Any taxes levied on fair returns generated from capital deployment should be abolished. - Doing away with GAAR: GAAR has been a tool introduced by erstwhile Finance Minister Mr. Pranab Mukherjee, which enabled taxmen to tax foreign investor for assets involving Indian entities for assets in India, retrospectively. The GAAR implementation was deferred by Mr. Arun Jaitley. However, from AY18-19 GAAR is applicable and taxmen are invoking GAAR for domestic mergers, acquisitions, restructuring, etc. These provisions lead to unnecessary complications for investments planned by large entities and foreign investors. It is of utmost importance now that restrictions on capital should be removed.

- Abolition of Angel Tax: Startup India, StandUp India is the mantra of the Government along with Make In India. However, with the issue of Angel Tax popping up, there are apprehensions for the Startups where such taxes could cripple the genuine transactions. While the government has introduced a measure to ease issues, this tax needs to be completely abolished as there are adequate measures in Income tax provisions to check for tax evasions.

- Easing of tax brackets for Salaried Individuals: The salaried middle class needs a breather in tax. The last year’s move enabled substantial breather for the individuals having income upto a certain limit. However, there is still a need to do more on this front. The tax burden on salaried middle class needs to be reduced further in this budget.

- Measures to boost Capital by the government: Currently, the government has Rs. 150,000 limit under 80C covering multiple investments, insurance premia, and home loan principal, among others. Furthermore, an additional Rs. 50,000 is allowed NPS. Given the capital situation with various banks and need for an infra project, the government needs to introduce quasi-Equity Bonds carrying a IRR of 10% (combination of annual interest and redemption premium) whose investment and redemption is tax-free. The money collected should be centrally pooled either invested in the restructuring of banks, or infra projects. The effort should be to mobilize more than 100,000 crores. Such a central agency should be run by professionals and ensure efficient capital allocation and returns.

The above-mentioned measures are indicative. The growth in consumption and capital expenditure and a boost to the overall credit system is the need of the hour. An investor-friendly Budget coupled with clear roadmaps for taxes (either increase or reduction) shall ensure a smooth flow of capital.