The Indian markets love Modi government, the very day BJP won Lok Sabha elections under Narendra Modi’s leadership, Sensex rose by 0.9 percent. The investors in the market, whether domestic or foreign, like a stable government therefore when BJP came to power with a full majority the market responded positively. Investor sentiments were so high because, after 25 years of coalition governments, a party finally had a majority of its own. Ever since BJP came to power at the centre, the performance of the stock markets has been directly proportional to the party’s performance in every subsequent state assembly elections because if the same party is in power at centre as well as the state, there is coherence in policies. The reformist agenda of BJP is also responsible for uncanny sync in the performance of BJP and stock markets. And the center of it all is one man – Prime Minister Narendra Modi.

A few days before exit polls, the stock market surged on the hope of Modi government coming back to power. The Sensex and Nifty rose by 1.5 percent both, ahead of exit polls which are to be announced on Sunday after the last phase of polling. The investors were positive on private banks, financial, auto and reality stocks. If the Modi government comes back to power, the financial sector is expected to deepen while low-income housing scheme is expected to drive the housing sector. The automobile sector which was hit severely in the last two quarters due to consumer slowdown is expected to revive if the Modi government comes back to power.

The benchmark index of BSE, Sensex rallied by 537 points or 1.44 percent to close at 39,931 while Nifty, the barometer of National Stock Exchange gained 150 points, or 1.33 percent to close at 11,407.

However, experts suggested taking exit polls with a pinch of salt. “Exit polls have not been accurate for the last three national elections. In 2004, exit polls wrongly forecasted BJP-led NDA coalition winning again, while in 2009, they meaningfully underestimated Congress-led UPA’s seat share. In 2014, while exit polls correctly predicted a BJP-led NDA victory, they significantly underestimated the margin of victory,” said UBS, a Swiss multinational investment bank.

PM Modi has brought the macroeconomic status of the country to a significantly better condition than what he inherited from the previous UPA regime. The fiscal deficit has come down from about 5% of the gross domestic product (GDP) in 2012-13 to 3.5% of GDP in 2017-18. The inflation rate has been brought down to 4 percent from 10 percent in 2012. The GDP growth of the country has been remarkable under the Modi government. The sound macroeconomic conditions will help India to attain PM Modi’s dream of double-digit economic growth.

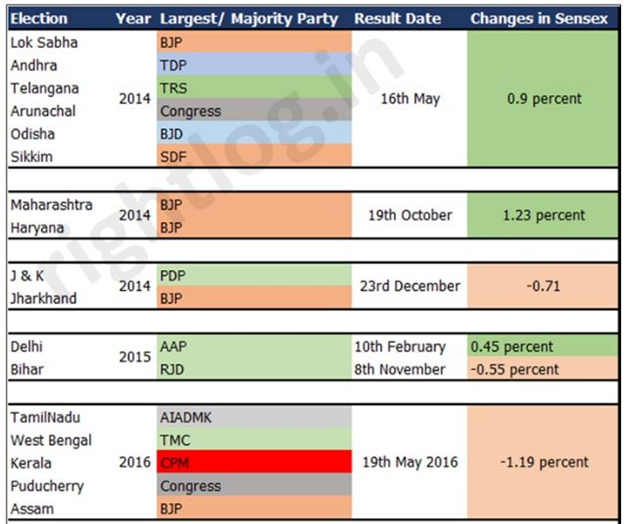

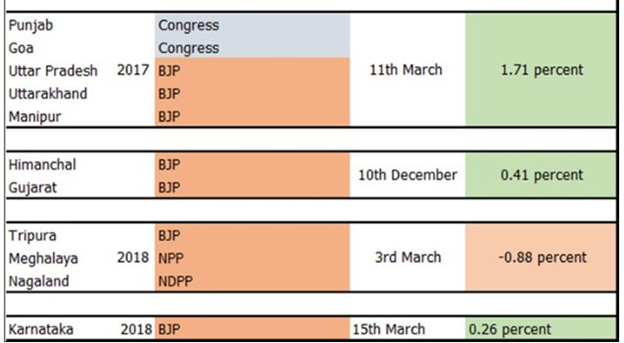

We analyzed the performance of Sensex with respect to BJP’s performance in state elections that took place after Narendra Modi won the historic 2014 Lok Sabha elections. The numbers present a very interesting story.

After coming to the centre as the prime minister of the country, he took some bold reforms like demonetization, GST, IBC to improve business conditions in the country. The impact of these reforms is visible in the improvement of ease of doing business and healthy economic growth. Even as the prime minister of the country. Narendra Modi is perceived to be business-friendly. PM Modi enjoys high trust ratings among international financial institutions like World Bank, IMF, rating agencies like S&P, Moody’s and many others, therefore, the foreign investors are bullish about Indian economy for as long as Narendra Modi is in power.