The 30 share benchmark index of the Bombay Stock Exchange (BSE) completed 40 years on 1st April 2019. The benchmark index was launched four decades back on 1st April 1979 when the index was set at 100. On 1st April 2019, it reached another milestone to reach at 39,000 points – the highest ever in the last four decades. “It is a matter of pride for BSE that the Sensex has completed 40 years. It was the first real-time index of India and caught the imagination of the investing public. Till date it represents India’s stock markets in public imagination,” said Ashish Chauhan, chief executive officer, BSE Ltd.

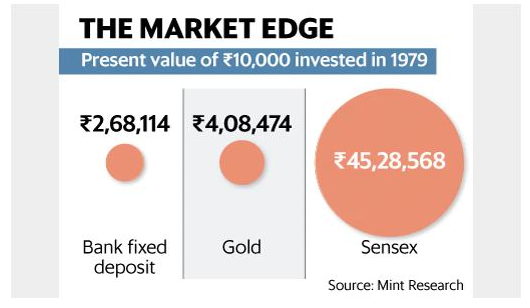

The return on the benchmark index has been 16.1 percent in last four decades in comparison to 10 percent on gold and much less on fixed deposits. “Over the last 40 years, the Sensex has given a CAGR of over 17% which is the highest return given by any asset class in India. It is a true reflection of growth of India over all these years,”said Chauhan. Investment of 10,000 rupees in the basket of stocks of benchmark index would be valued 45 lakh rupees today. On the other hand same amount of investment in gold and fixed deposit would be valued at 4 lakh rupees and 2.5 lakh rupees respectively. Therefore the investment in Sensex would have provided 100 times more than gold and 190 times more than fixed deposits.

In last few years especially after demonetization, Indian middle class shifted the savings from real estate and gold to equities and mutual funds. This will be hugely beneficial to Indian economy as gold and real estate are deal investment and money circulation stops if invested in these assets class. The investment in securities market takes off the load from bank for capital. The Indian market is moving from a bank led market to equity led market like that of United States.

The investment by domestic investors was highest ever in the last five years of Modi government. The investors diverted the money from real estate and gold to mutual funds given the high return. The government efforts to bring household saving in stock markets from the dead investments of real estate and gold reaped dividend and investment in MF has been 1,41,769 crore rupees in FY 18 and 90,042 in FY 19.

The number of retail investors has grown exponentially in recent years. The number of registered investors at Bombay Stock Exchange (BSE), one of two major stock exchanges in India has witnessed 14.22 percent growth last year.According to the data available with BSE, registered investors or clients (direct equity investors and mutual fund investors using BSE platform) has grown to 4.01 crore as on August 24, riding on 49,95,854 new investors added last year.

The Modi government’s crackdown on black money through steps like demonetization, closing down of lakhs of shell companies, strict regulations in real estate sector, upgradation of Benami property act has left no destination to hide the untaxed money. Therefore, from the investor’s perspective, if he/she has to give taxes in any case, might as well invest in securities because they are giving better and guaranteed returns when compared to the ever fluctuating gold and dismal real estate sector. If the investment is in the stock market, then the company gets the money and invests in further projects, which increases market activity and hence spurs economic growth.