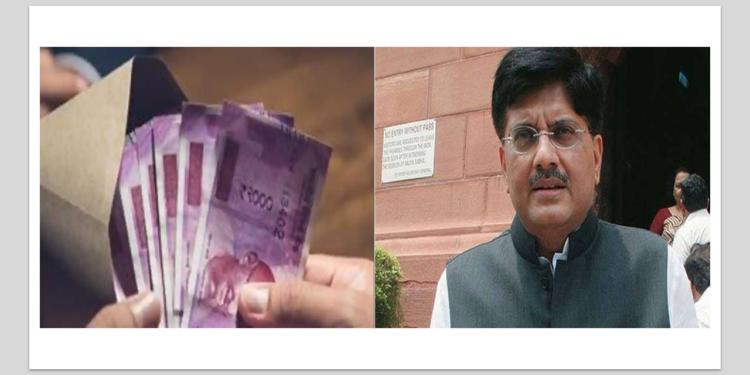

In the 2019 Interim Budget, the Modi government has taken the bold step of raising the income tax exemption limit to 5 lakh rupees. The NDA government has doubled the income tax exemption limit from the existing 2.5 lakh rupees. As of now, the tax on income up to 5 lakh rupees stands at 10 percent. With the current announcement, the taxpayers will get a full rebate on the tax paid for the income up to 5 lakh rupees. The limit of ‘standard deduction’ has been increased from 40,000 rupees to 50,000 rupees per year. A standard fixed amount of deduction – in this case, an amount of Rs 40,000 which can be reduced by salaried taxpayers, from their gross salary.

The taxpayers will now be able to save taxes further if investment is made in areas such as Employees’ Provident Fund (EPF) & Voluntary Provident Fund (VPF), Public Provident Fund (PPF), Life Insurance Premiums, Equity Linked Savings Scheme (ELSS), Home Loan Principal Repayment, Sukanya Samriddhi Account, National Savings Certificate (NSC), Five-year Bank Fixed Deposits (FDs), Senior Citizen Savings Scheme 2004 (SCSS), Five-year Post Office Time Deposit (POTD) Scheme, NABARD Rural Bonds, Unit-linked Insurance Plan (Ulip), Payment of Tuition Fees are tax deductible under 80C of Income Tax act. Any individual making an investment of 1.5 lakh rupees in these schemes can save taxes.

Therefore, the income up to 7 lakh rupees can come under tax exemption in case the person opts for standard deduction with an investment of 1.5 lakh rupees in the schemes aforementioned. The taxes on a further income of 50,000 rupees can be saved by investing this money in the National Pension Scheme (NPS). The taxes on another 50,000 rupees can be brought under the exemption if health insurance of senior citizens is opted for. This further takes the exemption limit up to 8 lakh rupees per year. Also, if a person takes housing loan and pays 2 lakh rupees in the year for the same, no tax can be applied on this 2 lakh income. Therefore, if a person belonging to middle class earns 10 lakh rupees per year, has taken a home loan and chooses to invest strategically, s/he would not need to pay anything in the form of income tax. The increase in income tax exemption limit comes as a gift for the middle class by the Modi government. Earlier, the middle class was benefitted from the implementation of reformative measures like GST and IBC. According to research based on consumer expenditure data, a household has been saving Rs 320 every month under the new indirect regime.

The good news for the middle class does not stop here, as it has been benefitted by the budget, in more ways than can be summarized in one go, while also keeping up with some mammoth reforms like demonetization and GST. The wellbeing of the poor as well the health of the economy and its PSUs is paramount to the nation’s progress and it can well be credited to the honest taxpayers.