Today, the Modi government presented its interim budget for the financial year 2018-19. The budget for this year has focused on tax reforms and sustainable growth. While the allocations made for the infrastructural development will ensure that India continues to be the fastest growing economy.

In the budget, the agricultural sector, rural economy, healthcare, MSMEs and infrastructure were majorly focused upon. The big announcement of increasing the income tax exemption limit to 5 lakh rupees in the interim budget stands out among the other decisions. The NDA government doubled the income tax exemption limit from the existing 2.5 lakh rupees. As of now, the tax on income up to 5 lakh rupees is 10 percent.

Not only that, individuals with gross income up to 6.5 lakh rupees will not need to pay income tax if they make an investment in provident funds and prescribed equities. Further, standard tax deducted for the salaried class has also been raised from Rs 40,000 to Rs 50,000. “Around 3 crore middle-class taxpayers will get tax exemption due to this measure,” said the Finance Minister.

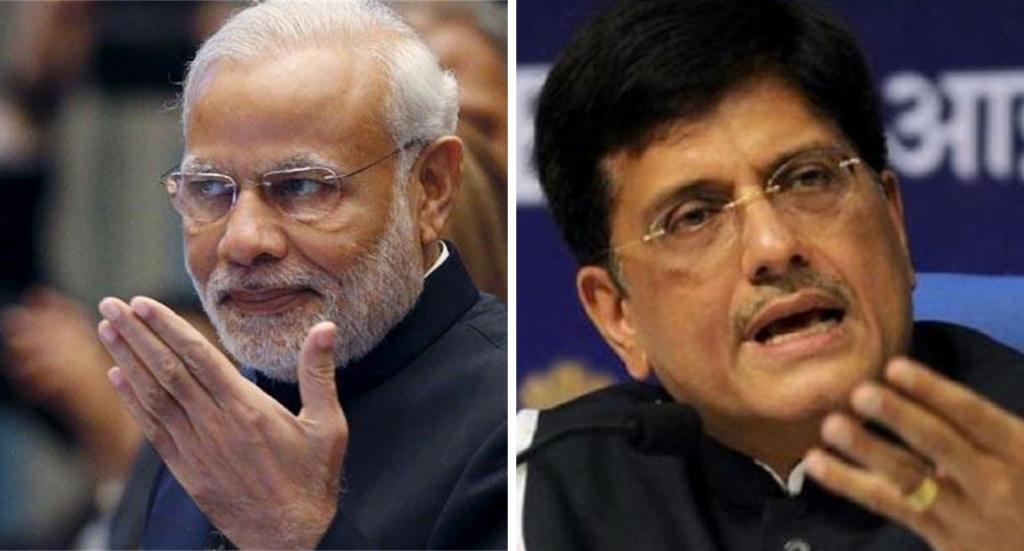

Further, in order to curb corruption, the Modi government plans to asses and verify Income Tax Return (ITR) electronically using an anonymous tax system without any tax official involved in it. Talking about the benefits of Goods and Service Tax (GST), Piyush Goyal stated that Direct tax collections increased from 6.38 lakh crore rupees in 2013- 14 to almost 12 lakh crore rupees. 99.54% of income tax returns have been accepted without any scrutiny. In January 2019, GST collections have crossed 1 lakh crore rupees.

The government has continued with its quest for development and has relied on the technological advancements to achieve this. Moreover, the interim budget also made some big announcement in the defense sector. The defense budget of India for the fiscal year 2019-20 will be more than 3 lakh crore rupees. “Our soldiers are our pride and honour. Our defense budget for the first time has increased to Rs 3 lakh crore and additional funds will be provided. Infrastructure is the backbone of any development. Over 100 operation airports in the country and domestic passenger traffic has doubled in last five years,” said Piyush Goyal while presenting the budget. This is for the first time in India’s history that defense budget of the country crossed 3 lakh crore rupees. The government has already disbursed the amount of Rs 35,000 crore rupees for the One Rank One Pension, as promised in the Bharatiya Janata Party (BJP) election manifesto for the 2014 Lok Sabha election.

Modi government in its tenure has put enormous efforts to improve the lives of farmers and the middle class through welfare schemes like Ayushman Bharat, increasing Minimum Support Price (MSP) for crops, crop insurance, GST, Demonetization etc. With this latest step of Modi government to check tax evasion, aimed at inclusive economic development, the message is loud and clear – it is time for India to become an economic superpower.