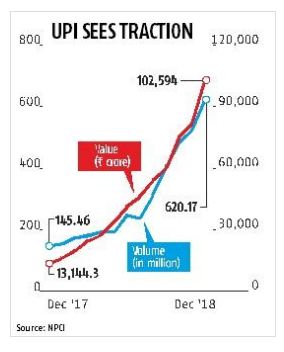

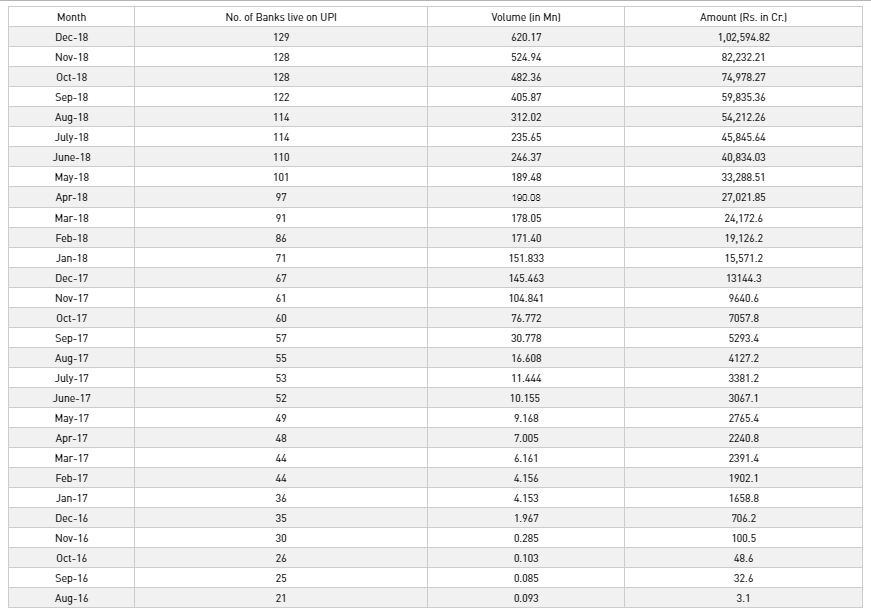

The Digital India campaign launched by the Modi government is turning out to be highly successful. The total number of transactions through United Payments Interface (UPI) is setting a record every day and month. As per the data from National Payments Corporation of India (NPCI), the total number of transactions in the month of December touched 620.17 million (Approx 62 crore) which is 18 percent more than 524.94 million (52 crore) in the previous month. The total transactions in the month of December translate into more than 2 crore transactions per day.

The amount transacted worth 1 lakh crore in comparison to 82 thousand crore in previous month. On average 3 thousand crore per day was transacted through UPI in the month of December. The push for UPI transaction by global players like Whatsapp Pay, and Google Pay is expected to propel the growth in volume as well as the amount. “UPI is cost-efficient and asset-light, compared to other alternatives and, in most cases, it can be activated by the recipient (merchant or business) on a self-serve model. It is indeed a much-needed feature added to a platform,” said Mahesh Makhija, leader-digital & emerging technology, EY India.

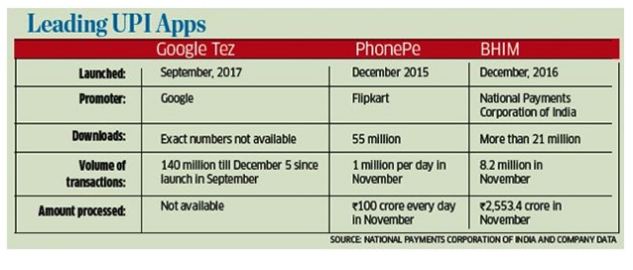

UPI is an instant real-time payment system launched by the government of India to facilitate hassle-free digital transactions. The interface is regulated by the Reserve Bank of India and works by instantly transferring funds between two bank accounts on a mobile platform. It is an umbrella organization for all public and private retail payments in the country. The major private players which operate on UPI are Paytm, PhonePe, Amazon Pay, and Google Pay and the public sector player is BHIM (Bharat Interface for Money) launched by PM Modi on December 30, 2016. The UPI and BHIM apps were developed by National Payments Corporation of India (NCPI) which is promoted by the country’s central bank, the Reserve Bank of India.

The step of demonetization played a very important role in accelerating the digital transactions growth. The order in which things took place shows that the decision of demonetization was a well thought out one. The government first created the infrastructure to reap benefits of demonetization and then announced the decision. The combined effect of demonetization helped India in its fight against black money.

NCPI launched UPI 2.0 on August 16 with several new features including the one-time mandate which became the biggest disruptor in digital transaction sector. “It can make the payment experience much more seamless, and at the same time give greater control to the customer. It can enable multiple use cases, which can help proliferate its adoption,” UPI was rated as best Immediate Payments Interface (IMPS) and was also rated topmost payments service in ‘Faster Payments Innovation Index’ by Fidelity National Information Services (FIS). The government made digital and card transaction free to promote digitization of financial system in the country. “India’s Immediate Payment Service (IMPS), which runs through the country’s Unified Payment Interface (UPI), has allowed money transfer apps to feature chatting capabilities. This further encourages public use of real-time innovation,” wrote FIS.

Soon wallets could be interoperable through UPI said RBI. This would boost the growth of digital payments further. NITI Aayog, the premier government think tank has estimated that the digital payments industry has the potential to become trillion dollar industry in the next five years.