The Modi government may take another step to revive the Micro, Small and Medium Enterprises (MSME). The GST council could ease the compliance burden for the MSMEs. The council will consider raising the sales threshold for the sector anywhere between 50 lakh rupees and 75 lakh rupees from the existing 20 lakh rupees, said a person close to the development. The decision could be taken in the January meeting of GST council.

Earlier, PM Modi, in an interview with news agency ANI, had suggested that the government could raise the threshold to 75 lakh. PM Modi also argued that GST is an evolving ecosystem and will be simplified further. “Whatever difficulties faced by MSMEs that comes to our notice, are placed before GST Council. Our resolve is to simplify GST and give benefits to consumers. The process of simplifying and rationalizing GST will continue,” said PM Modi. GST council is also planning to cut the rates on under-construction flats from existing 12 percent to 5 percent. After the implementation of GST, purchase of under construction flats almost halted because ready-to-move-in flats are virtually exempt from any indirect tax. The move will clear the slug in the real estate sector.

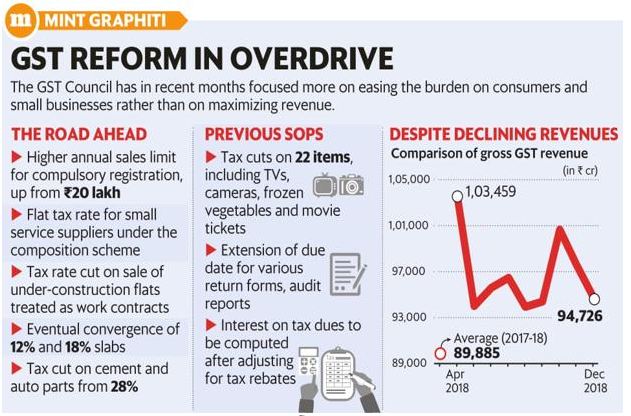

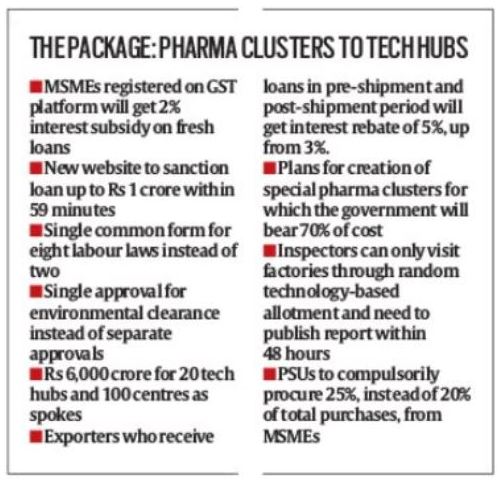

Modi government gave New Year’s gift to middle-class consumers in the 31stmeeting of GST council. The total number of items in the highest tax bracket has been reduced from 34 to 28. Monitors and Television screens, Tyres, Power banks of Lithium-ion batteries have been brought to 18 percent tax slab from the earlier 28 percent slab. Movie tickets above hundred rupees were also put in 18 percent slab from 28 and tickets below 100 were put in 12 percent from 18 percent slab. Earlier the government announced Diwali bonanza to Micro, Small and Medium Enterprises (MSME) sector on Friday. The government announced many steps to support MSME sector including faster approval of licenses, easier and cheaper credit. The MSMEs registered under GST will get 2 percent interest subsidy on new loans. The government also launched a website named psbloansin59minutes.com to provide easier and time bound access to loans for MSMEs. “Yeh naya Bharat hai, isme bankon ke baar baar chakkar lagana khatam (This is New India, here you don’t need to go to banks again and again for loans),” said Modi while addressing MSME players from across the country.

The MSME sector was struggling for loans since the crackdown on public sector banks started during Raghuram Rajan era. In the light of rising NPAs, RBI implemented strict norms for loans and credit to MSMEs almost halted. Big companies have multiple sources of capital like foreign direct investment, foreign portfolio investors (FPIs), foreign institutional investors (FIIs), debentures and equities. But MSME sector companies are largely dependent on loans from banks for capital requirements. The hawkish policy for NPAs cleanup made loans scarce and this led to slowdown in the economy, especially in MSME sector.

With the change at the helm of administrative affairs with a relatively liberal governor, RBI allowed the restructuring of loans to MSME sector. “RBI has decided to permit a one-time restructuring of existing loans to MSMEs that are in default but ‘standard’ as on January 1, 2019, without an asset classification downgrade,” said RBI in a statement. The initiatives taken by the government and RBI to cut the red tape and provide easy access to credit will definitely help the MSME sector, which happens to be the second largest job creator after agriculture.