Much of the hullabaloo surrounding the depreciation of the Rupee has died down, now that it has been established that external forces, namely a fall in the value of the Turkish Lira, was responsible for the depreciation of the value of the Rupee to Rs 70.27 against the US Dollar. The depreciation had encouraged the critics of the Modi government, whether opposition leaders or so-called ‘journalists’, to point fingers at the government and make some bold and rather baseless claims regarding the performance of the Rupee in the last four years. Let’s analyse these claims with the help of concrete statistics to understand the performance of the Rupee under the Modi government, and compare it to the performance under previous UPA governments.

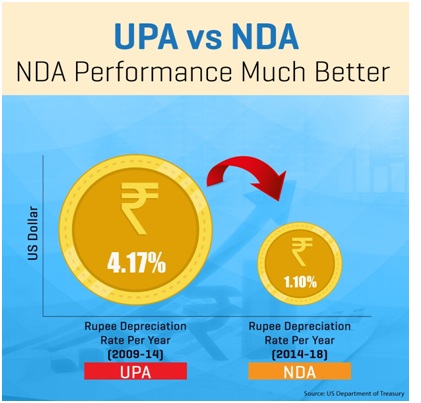

As shown in the figure below, according to the US Department of Treasury, the annual rate of depreciation of the Rupee fell from 4.17% in the years between 2009-2014 under the UPA to 1.1% in the period of 2014-2018 under the ruling NDA government. That is a fall of around 75% in the rate of depreciation from the previous UPA government. A reduction of this degree in the rate of depreciation is a clear indicator of the superior performance of the Rupee under the NDA government.

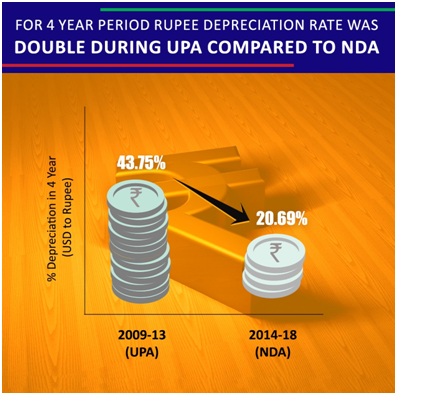

When taking into account the rate of depreciation over a 4 year period, i.e, between 2009-2013 and 2014-18, the depreciation rate fell from 43.75% under the UPA government to 20.69% under the NDA government, a tremendous fall of more than 50%. A depreciation rate of 43.75%, as was the case under the UPA government from 2009-2013, is alarming for the Indian currency. This puts into serious doubt the veracity of the allegations made by leaders like Rahul Gandhi, whose party was in power during that period.

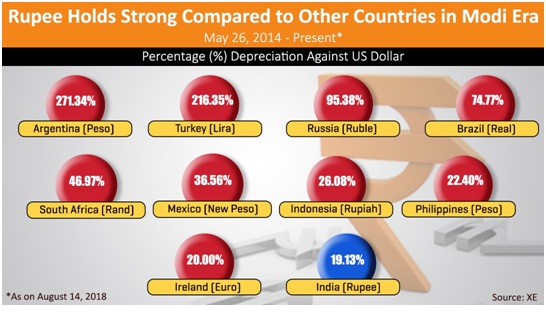

In order to ascertain the true nature of the Rupee’s performance, it would only be fair to compare it with the performance of the currencies of other emerging economies, namely South Africa and Brazil. The Brazilian Real has depreciated by a phenomenal 74.77% against the USD, with the South African Rand depreciating by a rate of 46.97%. Meanwhile, the Indian Rupee depreciated by a meagre 19.13%, a commendable feat when compared to the similar emerging economies of Brazil and South Africa.

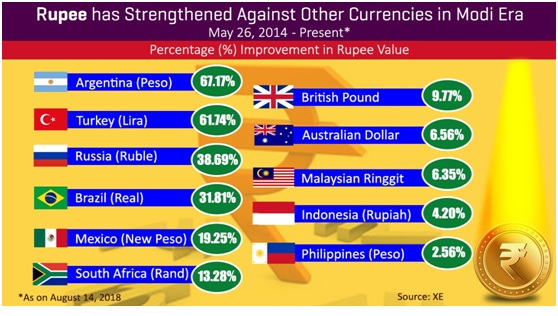

Apart from performing better in terms of lower rates of depreciation, the Rupee also made gains against several other currencies. While the 67% appreciation against the Argentinian Peso and the 61% appreciation against the Turkish Lira can be attributed to their respective domestic economic turmoils, a 32% appreciation rate against fellow BRICS member Brazil’s Real is a massive gain. The Indian Rupee also appreciated by 9.77% against the strong British Pound and by 6.56% against the Australian Dollar, another stable currency.

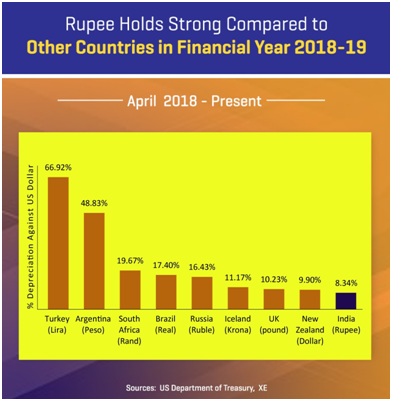

However, 2018-19 was a tumultuous year for currencies weak and strong, with strong currencies like the UK Pound and the New Zealand Dollar hitting depreciation levels of 10.23% and 9.9% respectively. Amongst emerging economies, fellow BRIC members South Africa (19.67%), Brazil (17.4%) and Russia (16.43%) also witnessed high levels of depreciation of their respective currencies. India on the other hand, also an emerging economy, saw the lowest rate of depreciation at 8.34% against the US Dollar, despite a rocky international scenario.

We live in the era of alt-facts, where events are either blown out of proportion with sensational headlines, or facts are selectively chosen and distorted as in a buffet to present a misleading narrative to the common man. The recent depreciation of the Rupee served that very purpose for media outlets and opposition leaders alike, who saw it as an opportunity to peddle half baked facts while concealing the reality of the Rupee’s terrible performance under the UPA government and its subsequent recovery 2014 onwards under the NDA government.

Headlines with sensational phrases like “nosedive”, “free fall”, “touching all time low”, “tanks” etc try to signal pessimism about the “weak rupee”. These wordings would naturally present an entirely different scenario to the common man. Morphing facts is a disservice to the nation. The reality is that the Rupee has performed exceedingly well under the Modi government over the past 4 years, and concrete, hard facts speak for themselves.