The Modi government has vowed to take strong measures to curb black money and use the collected amount for the benefit of the poor and downtrodden population of the country. It has been more than four years since the government came to power and it will be going for reelection in less than a year. So it is important to comprehensively analyze the steps taken by the government to curb black money and their merits and demerits. It will be interesting to see whether the government has been able to achieve something substantial on the ground in four years after its tall promises during the election campaign.

In simplest terms, black money is money on which the tax is not paid to the government. So the Modi government has taken the following decision to collect the taxes on the black money at home and abroad. The first step the government took to curb black money was through Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, under which it provided a one-time window for compliance from July 1 to September 30 in 2015 — to those who had undisclosed foreign assets. Under this scheme, Rs 4,100 crore worth of assets in total was disclosed by 650 people. After this, the government brought Income Declaration Scheme (IDS) in which anyone who had not disclosed their income or assets honestly in the previous assessment year got a chance to disclose it. Under this scheme, 64,275 people disclosed Rs 65,250 crore under the IDS. The last scheme to disclose black money was the Pradhan Mantri Garib Kalyan Yojana (PMGKY) in December 2016, under which assets worth Rs 5,000 crore were declared.

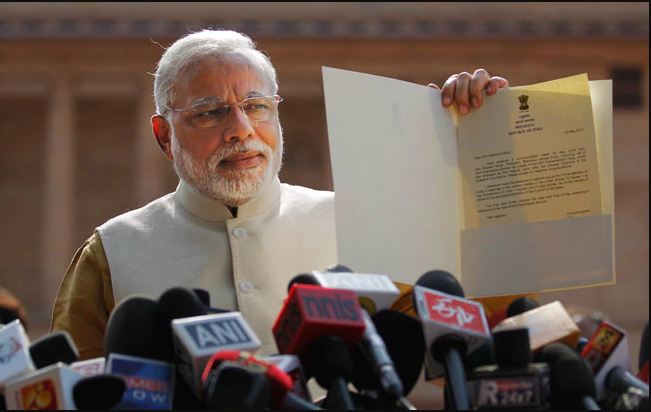

The biggest move by the government to attack black money was ‘demonetization’. On the evening of November 8, 2016, PM Modi declared that that Rs. 500 and Rs. 1000 notes which constituted almost 86 percent of the total currency in circulation have been demonetized. The total value of demonetized notes was Rs 15.44 lakh crore of which Rs 16,000 crore was not returned to the RBI. So, 1.04 percent of total value of circulated notes was saved due to demonetization. The demonetization has not been able to wipe out the black money as per expectations of the government but the monumental step created a sense of fear among black money hoarders. So there has been a substantial increase in the number of direct taxpayers and the amount of tax paid after demonetization.

The government amended the Benami property act in 2016 to crackdown the Benami transaction. According to Benami Property Act, a property bought by an individual, not under his/her name (or family’s name) is benami property which includes buying assets of any kind — movable, immovable, tangible, intangible. 24 dedicated Benami Prohibition Units were set up by The Income Tax (IT) department to clamp the Benami transactions. Minister of State for Finance, Shiv Pratap Shukla, said, “As on June 30, 2018, provisional attachments have been made in more than 1,600 Benami transactions involving Benami properties valued at over Rs 4,300 crore”.

Another important decision taken by the government to curb black money was to ring the death knell to shell companies. At present, the Modi government is probing deposits of almost 1 billion dollars in 20,000 such companies, indicating that the shadow economy of India runs deep, accounting for almost 25 percent of GDP. The shell companies are loosely defined as non-trading companies which are used for various financial transactions and kept dormant for future use in any other capacity, and mostly exist only on paper. The real problem is that the government has no ‘proper definition’ of shell companies. In the case of Nirav Modi’s fraud, almost 150 shell companies were identified. The shell companies in the Nirav Modi scam were registered in the name of his family members. The Nirav Modi scam cost billions of dollars to the Indian public sector banks with PNB alone losing $1.77 billion. The government and the Reserve Bank of India (RBI) has also begun discussions about making a database of all electronic payment transactions. This will help in establishing a money trail to probe money laundering cases and operations of shell companies.

So these were the steps taken by the government to curb black money at home, the actions taken to bring black money stashed in foreign countries or coming through fraudulent transactions from countries like Mauritius are as follows-

The Double Taxation Avoidance Agreement (DTAA) with Mauritius was amended on May 10th, 2016. The government could now levy a tax on the capital gains from sale or transfer of shares of an Indian company acquired by a Mauritian tax resident. It was an effective step towards blocking the Mauritius route of money laundering and black money generation. Another prominent decision taken by the government to keep a check on fraudulent transactions was the implementation of the General Anti-Avoidance Rules (GAAR) that came into force on April 1, 2017. To curb the Swiss bank deposits the government signed a pact with Swiss National bank on November 22, 2016, which would enable it to receive information on Indian account holders in Swiss banks from September 2019 onwards. The interim finance minister reported the parliament that since the Modi government came to power in 2014, the figure has dropped by 80 percent.

The changes in the country’s macroeconomy due to the government’s crackdown on black money are as follows-

The indirect tax collection has gone up substantially due to crackdown on black money and GST. In FY15, total indirect tax collection was Rs 5.46 lakh crore while in FY17 indirect tax collection stood at Rs 8.63 lakh crore and the estimates for FY18 is 10.05 lakh crore. So the indirect tax collection almost doubled in just four years under the Modi government. On the direct tax front, the number of direct taxpayers has gone up exponentially in the post-demonetization period. The income tax filers increased 10 crores in the last fiscal year from 6 million before demonetization. The tax buoyancy which is a ratio of the GDP growth and tax collection has doubled from 0.6 times in FY16 to 1.3 times in FY17 and 1.7 times in FY18. An amendment was made in the Income Tax Act in 2017 which made it easier for I-T officers to conduct a search and survey operation. The Income Tax Department also detected undisclosed income worth Rs 13,376 crore.

So Rs 1,14,110 crore worth black has been disclosed by the people under four years of Modi government which includes government’s income disclosure scheme (Rs 74,350), benami transactions (Rs 4,300 crore) and income tax raids (Rs 35,460 crore). Also, a drop in money stashed by Indians in Swiss banks since 2014 is close to $1.77 billion (Rs 12,139 crore). The tax collection has gone up on both direct tax and indirect tax front with the number of direct taxpayers almost doubled and the indirect tax collection also increasing substantially. The increase in collection has given the government fiscal space to spend money on infrastructure, health, education and other welfare schemes. Although the war against black money does not end here because the estimated amount of black money is still a quarter of country’s 2.6 trillion GDP.