It has been one year since the historic midnight launch of GST by a gathering of Prime Minister Narendra Modi, former president Pranab Mukherjee, Arun Jaitley and other leaders on the midnight of June 30th 2017. The consensus on GST was brought after a struggle of more than two decades as states were not willing to give up their independence in the field of taxation. Since its implementation, the law has become an exemplary example of cooperative federalism and helped to unify the country economically. Still, there are some problems in its structure and implementation which needs to be solved to make the best out of it.

There were people and parties including Congress who were arguing for a single rate GST, but the government was very clear that essential and luxury commodities cannot be taxed at the same rate. The government’s stand was vindicated as a single slab GST rate failed in Malaysia. In Malaysia, the goods and service tax was implemented in 2015. The government imposed taxes on luxury cars and regular household goods at the same rate, and the people were angered over this elitist taxation system. Malaysia’s newly elected Prime Minister, Mahathir Bin Mohamad, announced that he would scrap the 6% GST rate. Indian policymakers studied Malaysia’s indirect tax structure closely and figured out that a flat GST rate of 6 percent was the biggest defect.

The Prime Minister on Sunday made it clear that the Modi government would not bring a single GST rate, he said, “It would have been very simple to have just one slab but it would have meant we could not have food items at zero percent tax rate. Can we have milk and Mercedes at the same rate? So, when our friends in Congress say that they will have just one GST rate, they are effectively saying they will tax food items and commodities, which are currently at zero or 5 percent, at 18 percent.

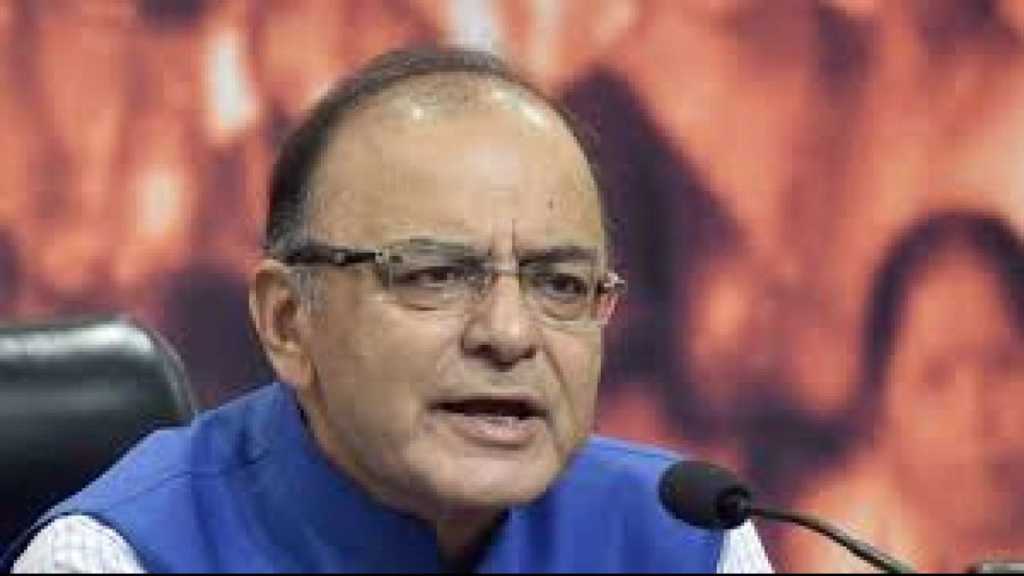

Although it is very clear that the Modi government will not bring all goods and services under a single rate, it is nonetheless committed to the simplification of the process and rationalization of tax rates. Arun Jaitley, the senior BJP leader and former Finance Minister said, “We will be busy in the process of shifting a large number of items from (the top rate of) 28% to the lower rate, The weighted average of the total taxation basket has significantly come down and therefore we are in the process of rationalizing the rates itself.”

The GST was expected to be disruptive and harmful to the Indian economy in a short run of one or two years. But it proved to be less disruptive than was expected by the Modi government. “After one year of experience, I’m not too sure whether I can use the word disruptive for GST reform. The smooth manner in which the change has taken place is almost unprecedented anywhere in the world” said, Arun Jaitley. India’s tax-to-GDP ratio is budgeted to increase to 12.1% in fiscal year 2018-19 as against 11.6% in 2017-18, 11.3% in 2016-17 and 10.8% in 2015-16. The Number of direct taxpayers increased from 6 million to 10.6 million in the fiscal year 2017-18. The exponential increase in the number of direct taxpayers was primarily due to demonetization, GST and other measures taken by the Modi government to curb black money and formalize the economy.

The implementation of GST as a single consolidated tax has had a significant impact even on direct taxes. Those who have disclosed a business turnover for the GST now find it difficult not to disclose their net income for the purposes of income tax. Last year, the impact of GST on direct tax collection was not visible. Since GST had been imposed in the middle of the year, its impact will be more apparent this year. India has had a direct tax increase of 18%, the advance tax deposit during the first quarter of this year has seen a gross increase of 44% in the personal income tax category, while there was a 17% increase in the corporate tax category. Arun Jaitley expressed his confidence that “The best of GST in terms of its contribution to society is yet to come.”