Malaysia’s newly elected Prime Minister, Mahathir Bin Mohamad, announced that he would scrap the 6% GST rate. In Malaysia the goods and service tax was implemented in 2015. The government imposed taxes on luxury cars and regular household goods at the same rate. This eventually angered the people and they went against the elitist taxation system. GST rate was one of the main issues raised in Malaysia’s general election this year. Prime Minister Mahathir Bin Mohamad used scrapping of GST as a major poll plank in the election. Now, right after winning the election, he announced to set the GST at zero percent.

The Indian policymakers studied Malaysia’s indirect tax structure closely, and figured out that a flat GST rate of 6 percent is the biggest defect. In India GST is categorized into five tax slabs – 0%, 5%, 12%, 18% and 28% ,because a single rate would have concluded that the rich and poor pay the same amount of taxes. This would have created inequalities of wealth issues in India. But then the Congress argued over the five different tax slabs. The Congress President Rahul Gandhi tweeted last year on 11th November “India needs a simple GST, not a Gabbar Singh Tax”.

Congress GST= Genuine Simple Tax

Modi ji's GST= Gabbar Singh Tax =''ये कमाई मुझे दे दे"

— Rahul Gandhi (@RahulGandhi) October 24, 2017

“We are not happy. We want the ‘Gabbar Singh Tax’ to be abolished and people get one tax slab of GST. We want only one 18 percent tax slab. If BJP does not do it we will do it in 2019”, said Rahul Gandhi from a campaign trail in Gandhinagar last year.

Taking the example of the current situation in Malaysia if our policymakers would have gone according to the Congress President’s suggestion, perhaps India would have had to scrap the tax a few years later, because a single rate tax is not viable. Congress economic luminary former Finance Minister, P Chidambaram was also against multiple slab rates, “This is a very, very imperfect law. This is not the good and service tax that we [the UPA] had envisaged…What has been implemented is a goods and service tax with seven, or possibly more, rates. It is a mockery of GST,” Mr. Chidambaram said, adding, “When we have [percentage] rates like 0.25, 3, 5, 12, 18, 28 and 40, and possibly more, because of the discretion vested with state governments, how can we call this a ‘one nation, one tax regime’?”

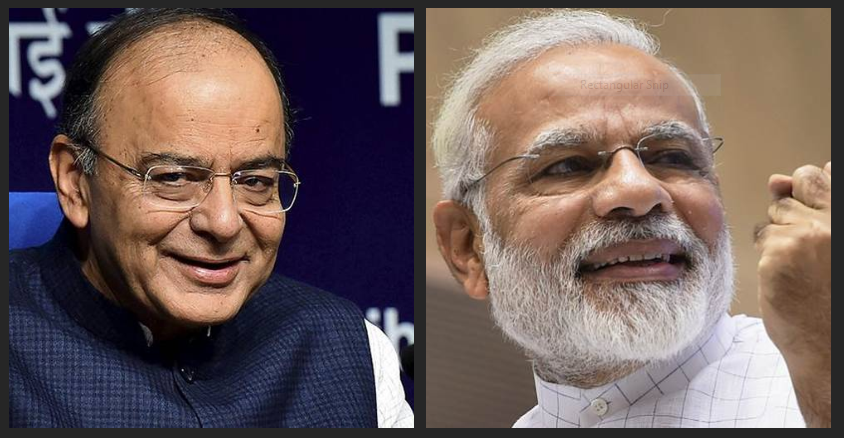

On the latest GST developments in Malaysia, former chairman of the Central Board of Excise and Customs said “Malaysia had an absurd situation of a single GST rate of 6 percent for all goods and services. That is not sustainable. A cycle and a BMW cannot be taxed at the same rate. That is why for India the different rates will work”. The BJP government in the center and its Finance Minister Arun Jaitley were very clear that India would not have a flat rate GST since the beginning, which proved to be a blessing for India. According to the Finance Minister Arun Jaitley , asserting a single rate Goods and Service Tax (GST) is not possible since the purchasing power of the people is not uniform. Last year he also said “Let me make it clear, though, a single rate GST is not possible in India. We cannot have a tax system which has the same rate for a Hawai chappal and Mercedes car”.

Regarding the reforming of the GST and its phase-wise expansion, M S Mani-partner- Deloitte, said, “It would be good if a phase-wise plan on the additional reform requirements such as expansion of GST into real estate, electricity, petroleum products, etc and changes such as reverse charge, tax collection at source are announced.” He added it would provide a road map for businesses to plan ahead and assured all stakeholders that further reform measures were on track.

Now after taking all the points into account regarding the benefits of multiple tax slabs, Congress should take this as a lesson and co-operate with the government at the center rather than opposing just for the sake of opposition.