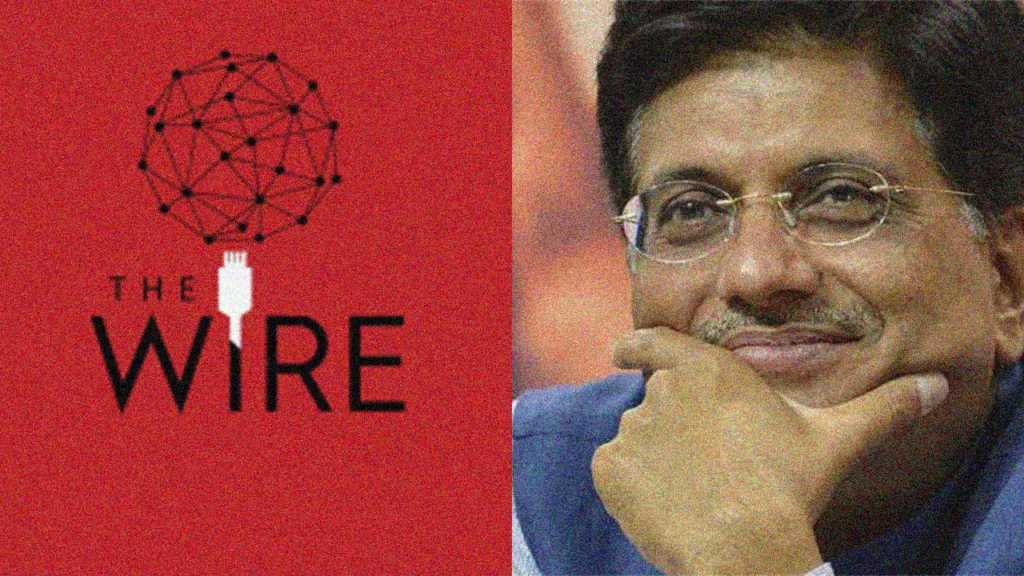

Leftist publication ‘The Wire’ has emerged over the last few months as the primary platform that peddles anti-BJP propaganda. Its agenda-driven stories have been routinely exposed. One of its reports about BJP president Amit Shah’s son Jay Shah landed the publication in a legal conundrum, with its management allegedly attempting to delay the case. But when your only journalistic parameter is to serve the interests of one family and its cartel, legal cases and public ridicule hardly ever derail you from your agenda. The publication targeted Railway Minister Piyush Goyal earlier this week, in a piece filled with factual inaccuracies and insinuations.

With the NPA scam, touted as the biggest scam of the UPA era, unraveling itself, the Congress Party and its cronies in the media have desperately tried to establish some link between this scam and the present government which has actually exposed it. Unsuccessful in their attempts, they have manufactured links where none exist. The Wire’s story links Piyush Goyal and his family to a defaulting company, but the insinuation about the minister or his family being even remotely responsible for the default, seems to be a pathetic attempt at linking the present regime to the scam. This is because the company in question performed brilliantly when Piyush Goyal was associated with it, debunking the insinuation that The Wire’s article makes. We have chosen to focus on this perspective. Several other problems with the article and its contents have already been dealt with in this detailed piece by OpIndia.

Piyush Goyal joined Shirdi Industries’ board of directors on 25th April 2008. This was two months after he was relieved as a director of State Bank of India (SBI). He was appointed a director at the state-owned bank during Manmohan Singh’s tenure as the prime minister. When Piyush Goyal joined Shirdi Industries’ board of directors, the company had no outstanding loans from SBI. They had repaid everything they owed to SBI by 12th February 2008. Keeping these facts in mind, the need to mention Piyush Goyal’s SBI directorship in this context does not arise. However, since the modus operandi of the Wire article isn’t lost on anybody, the mention of Piyush Goyal’s directorship in the bank prior to his directorship at the company in question, seems but natural.

Piyush Goyal’s directorship at the company ushered in a new era of prosperity. His strategic direction to the company increased its profitability manifold. Before Piyush Goyal joined the board of directors, the company registered a profit after tax (PAT) of Rs. 7.5 crores in the financial year 2007-08. Piyush Goyal joined the board of directors less than a month into the financial year 2008-09 (26th April 2008), and continued to serve as an executive/whole-time director till halfway into the next financial year (2009-10). He ceased to be an executive/whole-time director on 30th September 2009, but continued to serve on the board till 1st July 2010. In the financial year 2008-09, the company registered a PAT of Rs. 17.3 crores. In the next financial year (2009-10), the company’s PAT rose once again, this time to Rs. 26 crores. This goes on to show that in the two financial years that Goyal was on the company’s board as an executive/whole-time director, the company’s PAT more than tripled.

A Crisil report of 2010 reviewing the company’s proposed IPO, has been quoted in The Wire’s article. The report was published on 26th November 2010, more than a year after Goyal ceased to be the company’s executive/whole-time director. And yet, this is the report that The Wire uses to project Goyal in a bad light. Even if one were to go according to this report on the basis that Goyal’s earlier decisions might have affected the company’s fate, The Wire has selectively quoted from the report to demonstrate that the company’s prospects were looking bleak back then. However, this is not the case.

The Crisil report underlines several positives about the company as well. The company’s first-mover advantage, its new and upcoming manufacturing facilities, the saleability of its product, the potential increase in demand for the product, how people in the management were playing an instrumental role in the company’s success, and how the company had finally started making payments on time, are some of the many positive attributes mentioned in the same report. Unfortunately, those peddling propaganda under the guise of journalism see only what they want to see. Half-truths and selectivity is the only way they can validate their point.

The profitability of the company increasing manifold during Goyal’s tenure as a director is irrefutable. Moreover, the Crisil report that The Wire uses, states that by July 2010, the company began making payments on time. There was a liquidity problem before that, because of the company’s expansion plans and high working capital requirement. But if the company began making payments on time by July 2010, the same time that Goyal’s tenure on the board of directors came to an end, one can conclude that by the time Goyal finished his tenure, the company was not only profitable but had also attained a position wherein it was making its payments on time. If this is proof of anything, it is that Goyal steered the company expertly and brought it around to a healthy state. What this also proves is that even if the company’s loans went on to become non-performing assets later, Piyush Goyal had nothing whatsoever to do with it.

The Wire seems to have attempted yet another hit-job. And as usual, it has fallen flat. Perhaps they can peddle this sort of propaganda among those who cheer whenever the entitled prince speaks one sentence coherently. Based on their levels of both sycophancy and IQ, it is the only place where such propaganda is likely to resonate.

The research for this piece was conducted by Abhishek Bhardwaj. The figures can be corroborated with official sources on company data.