If “Demonetization” announced by Modi govt. on 8th Nov 2016 was a revolutionary move for the Indian economy, then the launch of BHIM app and AEPS machine & apps is a master stroke.

Demonetization did cause some inconvenience to general public, but the govt. has remarkably and immediately come up with fantastic solutions to cater to people of all classes, right from a rural farmer to a middle classed salaried person to a rich businessman. This has its importance primarily due to the sheer size of the Indian population.

In this article we will try to dissect and try to understand these apps in a simpler way.

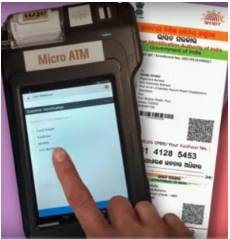

AEPS which is called as AADHAR ENABLED PAYMENT SYSTEM and has 2 types, one machine enabled and the other via smartphone app.

APES with machine also known as “micro ATM” is similar to a POS machine that uses a credit/debit card, the only difference being here it uses your biometrics (usually thumbprint) to authenticate the payments instead of the cards. A merchant who needs to accept payment will enter the aadhaar number and the amount in the machine using the touch interface provided. The customer then needs to authenticate the payment using his/her finger/thumb print. The amount will be deducted from a bank account that is linked to customer’s aadhaar number and credited to the merchant’s bank account.

AEPS with smartphone app is similar to above, except instead of the machine the merchant can use his smartphone with a small finger print scanner device. To make this work the merchant needs to register on this app using his Aadhaar number, next to accept any payment from the customer, the merchant needs to enter the customer details which include customer aadhaar number, customer bank name, and the amount to be paid by the customer. Finally the payment needs to be authenticated using the customer’s finger/thumb print using “finger print scanner device” and on successful authentication the amount will be transferred from customer’s account to merchant’s account.

(NOTE: – THIS APP IS IN A BETA VERSION, STILL UNDER TESTING BY BANKS AND WILL BE RELEASED COMMERCIALLY SHORTLY)

Next is the BHIM app which is dedicated to the architect of the Indian constitution Babasaheb Bhimaro Ambedkar. The Bharat Interface for Money (BHIM) is a simplified payment platform designed to make Unified Payment Interface (UPI) and USSD payment modes which are simpler and usable across feature phones and smart phones. The app, which can be downloaded from Google Play store, is currently available in Hindi and English. BHIM is interoperable with other Unified Payment Interface (UPI) applications and bank accounts.

After downloading the BHIM app from the Play store, the user needs to just register his/her bank account and set up a UPI Pin for it. The user’s mobile number will become the payment address. Also if a user’s phone number has already been pre-registered with his/her bank account, in that case the bank details will automatically be fetched by this app.

Once registered you can immediately start transacting using the BHIM app. What makes BHIM a winner is:-

– Its “very simple interface” for practically anyone to use it without any complication.

– The app is clutter free and does not requires any pre-loading of money from banks to its wallet (as done by the likes of Paytm, Freecharge, Mobikwik, etc.).

– The app interface is large and has been designed in such a way that it makes easy for the senior citizens to operate.

– The transfer of money is instant and is 24*7.

– Transaction using govt. operated BHIM is safe and secure.

– Its absolutely free, no charges charged on using BHIM.

– A user can send a min of Re 1 to Rs. 10,000 max in a single transaction and up to Rs. 20,000 for 24 hrs.

– Most of the banks support this app and many more are getting added.

– Users can send and receive money by linking different bank accounts. Can also check account balance, transaction details and other bank related options within this single app.

– Doing transaction using even the normal feature phones like the old “Nokia 1100 models” without internet and using the IVR options. No smartphone and internet required for this.

– Jan dhan accounts which do not have net banking enabled can now use BHIM to check account balance and transfer money in a simple format.

BHIM can do the following transactions:-

– Request or send money from BHIM payment address to another BHIM payment address

– Send Money to Aadhaar Number.

– Request or Send Money to a registered Mobile number.

– Send Money through IFSC code, Account No.

– In addition, you can use the scan QR code / mobile number and the pay option to Merchant (As done via Paytm).

Currently there are few issues, like not linking multiple banks simultaneously for transaction, the app is sometimes slow, need to include all the banks, include more regional languages, launch app for iPhone users, etc. which with most probability would be addressed soon. The technical team did confirm that it will take around 2 weeks for the app to stable down for no or less issues.

All in all, these initiatives by the PM Modi are great, constructive and practical solutions for him to achieve his mission of “Digital India”.

This is his contribution to the nation and we all know the opposition’s contribution including the likes of Rahul Gandhi’s and the Kejriwal’s and the Mamta’s and others did to end the woes of people post-demonetization.

SOURCE:-

https://upi.npci.org.in/static/faq/en_US/

http://thetechpert.com/pay-using-aadhaar-card/