Everyone had their eyes glued to today’s RBI’s Bi-monthly policy; as this was the first policy discussion post the demonetization driven undertaken jointly by RBI and Government of India.

The demonetization led to removal of substantial liquidity from the system; with RBI Gov., Dr. Patel confirming the total re-deposits in banks now stand at INR 11.55 Lakh Crores. This a substantial amount compared to the Rs. 500 and Rs. 1000 notes in circulation worth ~INR 14.18 Lakh crore. As of today, we can say that the government has been able to get back ~81% of the monies. This should be way above Government expectation. Ideal target was ~66% . Moreover, of the said ~INR 11.55 Lakh crore, already ~INR 4.0 Lakh crore has left the system. This reduced money withdrawal or flight of currency is primarily because borrowing limitations.

There is a huge liquidity shock to the system. While, we as TFI have lauded this step, but have also been critical about execution. In fact, most of the criticism for across counters has been for the execution.

COMING TO THE RBI BI-MONTHLY POLICY:-

What was the expectation from RBI?

44 firms / analysts on Bloomberg had the following expectation on RBI Rates:

- ~71% expected 25 BPS rate cut

- ~11% expected 50 BPS rate cut

- ~18% expected NO rate cut

What we got?

In wake of these developments and surprise, the monetary policy committee (MPC) voted 6-0 in favor of keeping the policy repo rate unchanged.

Post the decision, the rates shall be:

- the repo rate at 6.25%

- the reverse repo rate at 5.75%

- the MSF rate at 6.75%

The RBI decided to roll back the recently-introduced measure of incremental CRR of 100% for the increase in NDTL between September 16 and November 11, effective from December 10.

RBI stance, its rationale and reasoning:

On inflation

- The CPI inflation target is set at 5% by Q4 of 2016-17 and the medium-term target of 4 % in a range of +/- 2%, while supporting growth.

- RBI pointed that while inflation has eased, they still feel, its not trending lower yet. There is an expectation that beneath the easing, there are still negative undercurrents which can push inflation higher due to a mix of factors such as a) increase in food prices including that of sugar, wheat, gram, b) increase in prices due to a combination of global price surge due to higher crude price, currency impact increasing import costs or statistical mean reversion, and c) hike in HRA allowance in 7th Given these negative headwinds, RBI remains watchful of inflation. Long story short, inflation can increase by anything better not to do anything.

On Growth

- In line with no-rate cut stance and demonetization, RBI has cut the GVA forecast from 7.6% to 7.1%.

- This 50 BPS cut in projection is driven by 35 BPS from Q2 downward revision and 15 BPS on account of demonetization. So, demonetization role in GDP growth contraction is still not clear.

- In fact, accurate impact on GDP fall is difficult to call and such exercise for such fall has not been undertaken. Moreover, I would not be surprised if GDP growth continues unabated despite the demonetization drive; as it is leading to shift in consumption and better tracking mechanism on account of increase in digital transactions. Further, the 7th CPC impact coupled with better agricultural may keep GDP growth buoyed in the near term. However, on the flipside the growth will remain consumption driven and not investment driven.

The RBI stated it will be accommodative. However, this accommodativeness frankly has not been visible.

Why we remain worried?

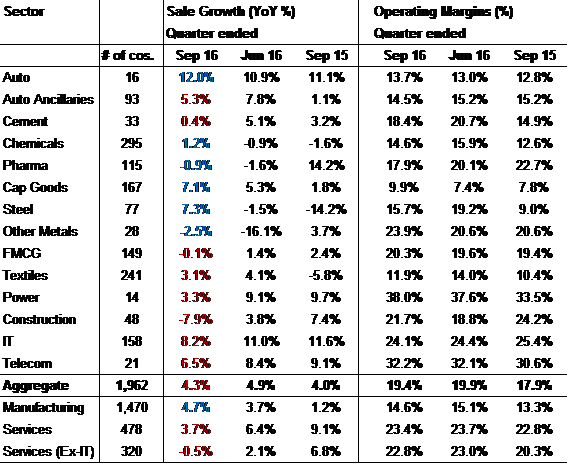

The following table shows an analysis of Sales Growth and Operating margin performance of the listed companies.

The above chart shows there has been contraction in growth in various sectors. The auto sector is doing well primarily due to Maruti Suzuki and Tata Motors Ltd (aided by JLR); however rest of the sectors are witnessing contraction. I would not count steel as sector doing good, because there is huge base effect.

What did Q2FY17 GDP Data Release say?

Q2FY17 GDP data was released on 30th Nov 2016. Yes, the economy grew by 7.3% in Q2FY17, but lower than consensus estimate of 7.5%. In growth was driven by consumption growth of 8.9%, but investment saw second worst contraction since FY02 coming in at -6.8%. This is worrying factor. This strong consumption without investment growth has led to a down tick in gross domestic saving coming in at 28.6% of GDP, a lowest level since FY05. The GDP growth is not worrying factor, but an investment less growth is becoming a problem.

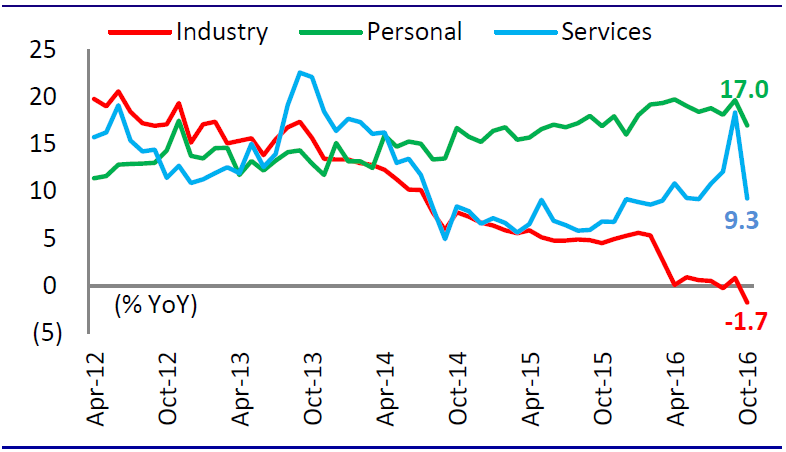

The credit growth is being tapering. The upcoming credit growth release on Dec 9 needs to be watched closely. Motilal Oswal Economic Team presented a brilliant chart on credit growth in its report dated 6 Dec 2016 re-printed below. The Industries credit has contracted first time since FY04, while person credit growth is stable at 20%. This contraction in credit growth shows lack of new factories or repayment of existing loans or industries apprehension in borrowing from banks. The equity market is seeing new IPOs, which is good, but industrial credit growth is important in assessing the growth in Industry.

What should be the next steps?

The Government needs to understand that RBI will remain interest rate focused. We have been apprehensive of this stand since Dr. Rajan days and our stand has not changed despite Dr. Patel in his shoes. In fact, with Monetary Policy Committee, the pressure on RBI is eased as interest rate cut is more of a committee decision than an individual decision. Having said that, the minutes of MPC meeting will be release on 21 Dec 2016 and needs to be watched closely.

The Government needs to come with a Fiscal stimulus package at the earliest. The demonetization drive albeit great on a long-term basis, but short term sentiment has taken a beating. Yes, as an honest middle class tax payer, I am happy to see that many non-tax payers will soon be facing income tax notices; but that’s a different story. The infrastructure spending needs to be picked up. The announcement of major projects is not reflected in earnings of corporates. The cement sector companies which shall be backbones for any kind of infrastructure are struggling with limited capacity. To give a perspective, the All-India cement sector capacity utilization is expected to hit ~70% for FY17, which is lowest since FY02. In FY2002, the number was ~75%. On the other hand excluding the South-India based cement plants, the capacity level was ~85% in FY2002, which went as low as 78% in FY2011 and is currently at 76% levels. Any pick up in infrastructure shall translate into growth in the ensuing period.

In conclusion, Fiscal stimulus coupled with a 50 BPS rate cut in Q4FY17 is the need of the hour. The Government needs to get to act together on infrastructure investments.

Key events to watch

December 9: Reserve money, broad money, credit and deposit growth

December 12: November CPI

December 9-15: November trade data

Sources:

http://www.mospi.gov.in/sites/default/files/press_release/nad_PR_30nov16.pdf

https://rbidocs.rbii.org.in/rdocs/PressRelease/PDFs/PR1442180097B2129E4DF09A7621227506B154.PDF

http://downloadpolicy3.rbii.org.in/PR1442180097B2129E4DF09A7621227506B154.PDF

https://rbidocs.rbii.org.in/rdocs/PressRelease/PDFs/PR14439B8769372462475EB9A3BBF05991871F.PDF

Motilal Oswal ECOSCOPE dt. 30th Nov 2016