When I dialed the gas agency to book a refill, I was forced to listen to one of Narendra Modi’s speeches. It was on how electronic payments could be made even without smart phones. Of course, I don’t like to use PayTM, for I didn’t like the idea of keeping my money in other’s custody (at least that was how I saw it). Of course, I have nothing against PayTM as such; and PayTM is not even the main topic of this column.

My grudge was about the controllers of Indian finance, from public domain. First, why these controllers have not advertised this message long ago. Apparently, this facility is not a new one introduced by the government to handle the crisis erupted post demonetisation scenario. This is the regular ‘indifferent’ attitude of a sarkari babu, who abhors common public, despite being a public servant.

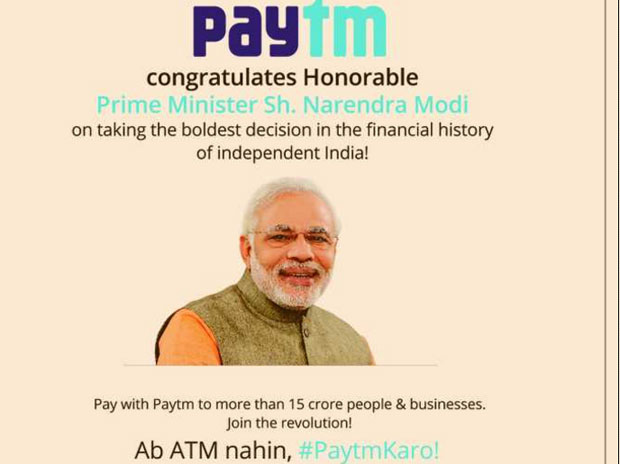

Considering nowadays everybody uses Prime Minister Narendra Modi as their model, by paying ₹500/- as fees(I read somewhere Jio had paid ₹500/- for using Modi’s photo in their advertisements), I really don’t understand, why this facility was not advertised in the last six months so that it reaches every nook and corner of the country. Post demonetisation announcement, even PayTM had used Narendra Modi’s photo to promote their wallet app.

Using Modi’s speech now to promote electronic payments is seen as an exercise that was forced upon the administration as a last resort.

Consider SBI Buddy, a wallet app from SBI – similar to PayTM, in force since August 2015.

How many have known that they can pay from their SBI account much similar way they use PayTM? SBI has started promoting Buddy – again only since demonetisation was announced. If PayTM, could take out full page advertisements and growing its business by adding one crore customers daily, what SBI is doing? They don’t even have to pay ₹500/- for using Modi’s photo, being a PSU Bank.

Of course, the general performance of SBI has improved over what it had been two decades ago and is now at par with private banks, if not better. But, in the ever changing scenario of electronic finance, how can they afford to remain stagnant? Is it sufficient to follow private inventions and adapt; that too at a slower pace? Each branch of SBI should have a picture of dinosaur and know that they don’t exist now. Considering the customer base of SBI, its failure to sufficiently market the SBI Buddy, is a crime.

How many of us know of “Unified Payments interface”, an initiative to link accounts across all banks to facilitate funds transfer? National Payments Corporation of India was incorporated in 2008 and business operations were commenced from April 2009. Seems this is functioning since April 2016, but not widely advertised. Nobody knows why.

On May 9th, 2016, Indian Express reported about Unified Payments Interface, that would make mobile wallets like PayTM, SBI Buddy etc., redundant. Yet, nobody advertised this facility. Why?

Was the infrastructure not in place to cater to the expected number of transactions that may increase exponentially? Or were there really vested interests? Or it is just the lethargy of public administration which likes to talk a lot and do nothing?

Despite mammoth financial support BSNL was killed over last two decades mainly because of corruption in the staff. In many remote areas, where BSNL was only serving to the villagers, private operators could enter, after suddenly BSNL services were not reliable! The technical staff of BSNL at exchanges were hand in glove with private operators and ensure BSNL phones face issues of various types, forcing their customers move to private operators. All this time, they drew salaries and expected more increments. BSNL case has nothing to do with the current scenario. But, it highlights the plight of public administration. We all cry about Vijay Mallya running away after making a hole to our Banks to the tune of ₹9000Cr. But, this amount is peanuts compared to the money that was drained through Air India.

Narendra Modi may be thinking he can implement better ideas. Better ideas need better implementation. Consider Pokhran II, which Atal Bihari Vajpayee executed without the world sensing. Of course, it was rumoured except for Geroge Fernandes, none in the cabinet were privy to the information. But, George could work in tandem with the scientific fraternity to make it successful, despite him being a union leader.

Considering the impact and reach of demonetisation spread across nation, Narendra Modi might have confided into Arun Jaitley.

Then, the preparations to implement the plan were not up to the mark. In future, Prime minister may note that before embarking any such feats, he need to overhaul the administration.

The other problem that has come to the fore after demonetisation was how much our bank officials are in connivance with hawala operators. Our bank officials are prone to corruption and to influences from businessmen and politicians. If Income Tax department could recover crores from private individuals in new currency, this shows the extent of leaks in our banking system.

Really, the opposition is the god’s gift to Narendra Modi. They ask all wrong questions, for the right questions would boomerang on to them. Modi is clever in arguing and proving the corrupt and inefficient banking system was an inheritance and not his own creation. End of discussion!

But, RBI should have really thought of a system to track and monitor the cash they were handing over to banks for distribution. There should have been a system to track any illegal movement of money. Finance ministry should have thought about unaccounted money getting deposited into Jandhan accounts. Is there any better avenue available for such an amount of huge cash? If they couldn’t expect what would be the response of common people as well as black money hoarders, what they expected? Black money hoarders were intelligent and so they were able to hoard it in the first place. Perhaps, they are more intelligent than the staff at Finance Ministry.

Hope, PM Modi would take a professional opinion and prepare sufficiently before announcing another big decision.

References:

http://www.npci.org.in/documents/UPI-Linking-Specs-ver-1.1_draft.pdf