DISCLAIMER: The following post is educational and not an investment advice. The following post highlights certain stocks and mutual funds. The author is a Chartered Accountant by education and has more than 10 years of investing & equity research experience; and has worked professionally for large research houses. The author may or may not own or invest in the below stocks and mutual funds.

India has an illustrious stock exchange; in fact, Asia’s first stock exchange is Bombay Stock Exchange. The stock market performance is generally measured by movement of index of 30 large cap shares called as Bombay Sensitive Index or Sensex; while the National Stock Exchange (NSE) measures as an index of 50 share price NSE-50 or NIFTY. This sounds too basic, let’s get to the heart of the matter.

Samwat 2073 is approaching and no other better time to start investing in Market then now. You should be buying good stocks to invest into or good mutual funds where you can do SIP. SIP, simply put is systematic investing plan, wherein you invest on a monthly or fortnightly or weekly basis a set amount in certain company’s shares or mutual funds; with a long-term horizon. Without trying to add many words on the introduction, I would like to get into the article. One important thing, I would say if you guys invest based on tenets below, I would be most satisfied and honestly, it’s a very honest article and most satisfying one then those I have written till now.

Please note, this article has too many times usage of word IMPORTANT. But, I cannot help it, they are important rules. I began investing in 2003 when I was in F Y B. Com, when I first bought Union Bank of India shares at Rs. 16 in IPO borrowing Rs. 3200 from my father in IPO. Later, I invested in companies based on common sense in companies like Bharti Airtel at Rs. 50 onwards, which I sold at above Rs.500 or Reliance Industries, HDFC, etc. I have lost money too and lot of it. I have done derivative trading, leveraged trading, international market trading, commodity trading, investing based on tips, anything and everything you name it in investing. The article based on my work, study and investing experience of over a decade. I would like to read it well; if you have any queries do mention in comments.

MOST IMPORTANT THING: Investing is a serious thing. It needs to be looked like BUSINESS. It’s not fun, it’s not something to give you mental orgasm nor its something worth boasting. It’s a very very serious thing. It needs to be given time and dedication. THE IMPORTANT THING IS THAT ITS YOUR HARD-EARNED MONEY AND YOU CANNOT SQUANDER WITH IT. In fact, every rupee is so important, you should never waste it, its Goddess Lakshmi and not just piece of paper.

Having set the premise, lets jump in further.

MUTUAL FUND INVESTING: REGULAR SIP MAKES YOU HYPER WEALTHY; BE CROREPATI FASTER

I would like to say is do SIP or Systematic Investment Plan. SIP, simply put, is monthly investing like paying EMI.

I ran a study on multiple parameters to arrive at expected value of money that we may get investing over on say monthly basis over a long term. For example, say investing Rs. 2500 per month, which increases by say 5% every year so, Rs. 2625 in year 2 and Rs. 2756 in year 3 can generate anywhere between Rs. 18.17 Lakhs over 15 years to Rs. 1.85 cr., over 30 years. So, suppose you are 20 or 25 now and I assume you invest starting Rs. 2500 per month, it will be worth Rs. 1.85 cr., at the age of 55. The following tables show multiple ways returns over different time horizons and different returns over multiple SIP options.

We have taken following parameters:

- Expected monthly investment

- Increase in investment value every year

- Expected return from a Mutual fund

Now, plug these numbers in multiple ways to give you a table to show what kind of money you will make over long term horizon.

What is the investment that you would be doing?

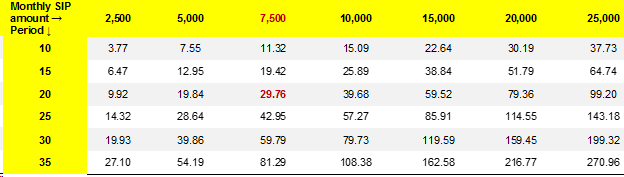

The table below shows the investment value over a period of multiple period. For example, the top column shows the monthly starting SIP, which ranges from Rs. 2500 per month to Rs. 25,000. The left first column shows years of investment starting from 10 years to 35 years. I have purposely kept 10 years as minimum period; as generally 8 years is a standard business cycle phase. For example, in the second column with heading Rs. 2500 show monthly SIP of Rs. 2500, which shall lead to say a saving of Rs. 3.77 Lakhs over 10 years or 6.47 Lakhs over 15 years (assuming an annual increase in investment amount of 5%).

Amount in Rs. Lakhs except the first row

What will be my above investment worth?

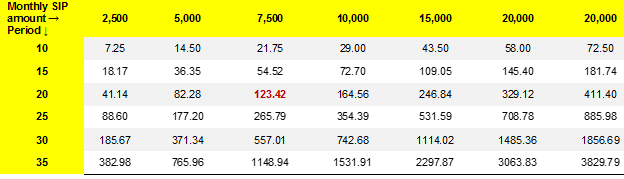

Assuming, the investment amount grows by 5% per annum and we can generate a long-term growth rate in mutual fund of 15%; the money due at the end of period as shall be as under:

Amount in Rs. Lakhs except the first row

Let’s focus on MAROON BOLD amount in Table 1 and Table 2. So, say you invest Rs. 7500 per month over a period of 20 years; which increases by 5% per annum and the mutual fund investment generate average return of 15%, the total investment of Rs. 29.76 Lakhs shall be worth Rs. 1.23 crore.

Source: http://jagoinvestor.com/calculators/html/Increasing-SIP-Calculator.html

Why have I assumed 15% annualized return?

I have written quite confidently for an average 15% growth in investment per annum; and you may argue what’s the assurance of getting that kind of return, hence I went on to analyze the returns on BSE Sensex since the time information on index value is available. So, now I have information starting from 3rd Apr 1979 to 28 Oct 2016. The Sensex was 124 points on 3rd Apr 1979 and is now 28 Oct 2016; thus, over a period of 38 years the Sensex is up 225 times; which if you annualize translates to 15.5% return; which is more than the FD rate of interest.

This 15.5% return is of large cap stocks; the return would be very high in case of Mid Cap companies & small companies. So, to generate ideally a 15% return over long term, you should invest is a mix of mutual funds which invest in Large Cap, Mid Cap & Small Cap.

Here are some Mutual Funds worth considering:

Large Cap Mutual Funds:

- SBI Blue Chip Fund

- Motilal Oswal – MOSt Focused 25 Fund

- ICICI Pru – Focused Blue-chip Equity Fund

Midcap Funds:

- Franklin – India Prima Fund

- Motilal Oswal – MOSt Focused Midcap 30

- HDFC Midcap Opportunities Fund

Small Cap Fund

- DSP Blackrock – Micro Cap Fund

- Franklin India Smaller Cap Fund

- Reliance – Small Cap Fund

IMPORTANT POINTS ON MUTUAL FUND

- Invest with a minimum 10-year horizon

- The funds are indicative list, you may refer to moneycontrol website and check CRISIL rating on fund, or valueresearchonline site for top rated mutual funds.

- Avoid investing in Thematic fund like Banking focused, Pharma focused, infra focused, these do well in Short term, but are difficult bets in long term

- Generally, invest in fund which has more than 10 years of history; except Motilal Oswal; I am highly biased towards Ramdeo Agarwal, as I learnt a lot on investing from his interviews, reports, videos; hence both of his funds feature there.

- Depending on your appetite your ideal mix of Large Cap, Mid Cap & Small Cap can be as under:

- Relatively lower risk: Large cap: 50%, Mid Cap 30%, Small Cap 20%

- Bit more risk: Large cap: 40% Mid Cap 30% Small Cap 30%

- Equal Weight: Large cap 33%, Mid Cap 33%, Small Cap 33%

- Do not invest more than 35% of your SIP amount in Small Cap funds

- Have a proper financial advisor, don’t be investing any stuff.

- Do not fall for TIPS, you are in the long run and market rewards long term players

DIRECT INVESTING IN STOCK MARKET

Direct investing is a difficult activity. You must be proficient in either Fundamental Analysis or Technical Analysis.

Myth Busting: Technical analysis is NOT what the likes of Ashwani Gujral or his friends coming on CNBC preach about Buy Today Sell Tomorrow or XYZ Stop Loss. It’s a very complex science and takes years of experience, learning before one can figure out what is right or wrong. Don’t fall for it.

NO TIPS, DO NOT INVEST YOUR HARD-EARNED MONEY ON TIPS

HOW TO FEND OFF TIPSTER?

If your known friend tries to give you tip, ask him following questions:

- What is the RoE of the company?

- What is the debt equity ratio?

- What is the sales growth over last 3 years?

- What is the profit growth over last 3 years?

- What is the PE ratio of the company, what is historical PE and what is peer average?

Without going technical, I will give you cheat-sheet answers:

- RoE must be more than 15%, you may ask why? The average RoE of Indian companies (except banking) is 15%

- Debt equity ratio less than 2:1 is preferred

- Sales growth must be more than 15% per annum

- Profit growth must be more than 15% per annum

- PE ratio has no set criteria, some companies trade at 10x while some trade at 40x. You may ask how do we judge then, since I have included this question. PE ratio for companies with profit growth more than 20% can range from 15x to 20x.

If anyone is unable to answer the above questions, you know it’s not worth your HARD-EARNED MONEY. So now, you are armed with the right questions and right answer, if anyone gives you unfounded TIP.

DON’T FALL FOR TIPS

Now, direct investing in Stock market is frankly difficult, however here I put forth summarized observations based on something called as “Wealth Creation Study” published by Mr. Raamdeo Agarwal of Motilal Oswal. Please -engrave the following principals in your head?

Key observation from wealth creation history is that the most consistent wealth creators are a) nine out of 10 companies were consumer facing, all businesses were non-cyclical, b) all companies were leaders in respective business segments, c) companies had a higher return on net worth.

The above line is most important and look to invest in companies that satisfy the above criteria.

Lessons in Investing

- A review of Wealth Creation study reports reveal that companies having consistent 25% CAGR in earnings have created maximum wealth

- Companies with higher or better than peer RoE & RoCE enjoy higher PE multiple and in turn valuation. Generally, businesses with higher entry barriers either in operating or financial way, have higher RoE. For example, Pharma companies, or large FMCG companies such as HUL, PGHH, ITC, etc.

- RoCE of wealth creating companies in India generally tends to be substantially, higher than the prevailing interest rate.

- Earnings yield on Index level closer to debt yield, makes case for huge long term investment opportunity. In 2002, G-Sec rate corrected from 14% in 1996-98 to nearly 6.0% in 2003; while Sensex earnings yield was at 9% make equities significantly attractive. Eventual upsurge in market was a certainty, albeit a matter of time.

- Average RoCE of wealth creating companies moved from 20.4% in 1992 to 24.5% in 1996. Generally, companies having RoCE exceeding these values should be looked at.

- Exponential growth in PE ratio possible, where EPS growth is more than 50%. Generally, EPS growth at 10% leads to 1x PEG; at 50% growth rate the PEG jumps to 1.48x i.e. PE Ratio of ~74%. However, for a higher EPS growth, the PEG can range between 1.5x to 5.1x; thus, taking companies to blue sky valuation scenarios. Monitoring RoE, EPS growth, and PEG are key to delivering earnings and establishing price to buy stocks.

- In times of stress, for blue-chip companies (in non-cyclical industry), two key factors determine investment philosophy, a) Dividend yield & PE lower than10 year median and b) Dividend yield more than 3%.

- For Indian companies, RoE must be more than 15% which is the benchmark index cost of equity.

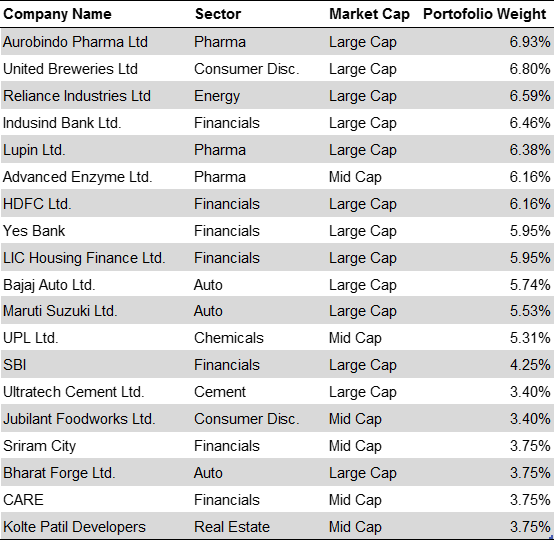

Some companies I love:

The above list does not include IT stocks, but, I have few in mind, once the valuation reduces further, I might consider them. Importantly, this list needs to be updated every result seasons. It cannot be thought of as a sacrosanct list.

Important notes:

- DO NOT INVEST ALL YOUR MONEY IN SINGLE STOCK, INVEST IN MULTIPLE COMPANIES ACROSS SECTOR

- Initial level of investment should be in companies that are industry leaders. For example, Home loans then HDFC, LIC Housing Finance; or Pharma be Sun Pharma, Aurobindo Pharma, etc.

- Even large cap companies can see drastic change, for example Suzlon, Ranbaxy; in case of events which are expected to cause companies drastic problem, then get out an investment even if it’s at loss

- Avoid investing in commodity companies like companies dealing in metals, etc., where prices go in cycle. In times of Boom, these companies more than double in a year time, but in Bust phase they sink to heavy lows. For example, Hindalco, Vedanta, Sterlite, etc.

- Invest in consumer facing businesses, like Bajaj Auto, Maruti, etc.

- Do not base your investment decision of value of stock price. For example, Eicher Motors at say Rs. 20,000 is still a good bet, then a Suzlon at Rs. 30. The stock price is a function of company’s profits, better then profits better the share price. If Eicher Motors profits doubles faster than share price will keep rising

- Do not hesitate to book losses in bad investment; and always keep buying good shares even if price keep increasing. I have been buying Aurobindo Pharma from Rs. 250 till Rs. 800 even today, in small quantities.

CONTINUING KNOWLEDGE:

Some people say don’t watch CNBC etc., they are too much noise. The following are the people whose opinions matter, and make it a point to listen to what they say, and their reports:

- Raamdeo Agarwal of Motilal Oswal

- Ridham Desai of Morgan Stanley

- Rakesh Jhunjhunwala

- Nilesh Shah

- Prashant Jain of HDFC MF

Do watch Wizards of Dalal Street on CNBC; look for the insights they speak of and don’t try to focus on stocks. Do read all Wealth Creation Studies by Raamdeo Agarwal.

International voices:

- Aswath Damodaran

- Howard Marks

- Warren Buffet & Charlie Munger

I hope this is not a far too technical article. I also, hope this Samwat you start investing, in case you are not already. Shoot any queries you have. Also, today is Muhurat trading day, let’s hope today can be your day to start systematic investing.

Key abbreviations:

RoE – Return on Equity

RoA – Return on Assets

RoCE – Return on Capital Employed

PE – Price Earning Multiple

PEG – Price Earning Growth