Indian Railways has come a long way since it was first introduced in India during the year 1853 by two companies, East India Railway and Great Indian Peninsular Railway, as a passenger rail service. It has always been an integral part of the Indian economy in many ways, mainly as a reliable and reasonable medium of transport not only for people but also for various basic items and industrial products. Indian Railways is the third largest rail network under a single management with 66,000 route kilometers covering more than 8000 stations.

Below are the few interesting facts about Indian Railways to give an idea about its gigantic size.

- Every day the distance travelled by trains of Indian railways is 2 & ½ times the distance from the earth to the moon

- Carries the population of Australia on its trains every day- 23 million people

- Transports 1097 million tons of freight annually

- A member of the exclusive billion ton club comprising of countries such as USA, China & Russia

- Supports 13 lakh people through employment- 2nd only to defence in providing employment in the organized sector

- Runs 21000 passenger and freight trains daily

- Transports 90% of total coal moved in the country- supplying 50 % of the power in the country

(Source: http://indianrailways.gov.in/)

Moreover, Indian Railways has always been different from any other ministry of Government of India. The way Indian Railways operates, it is more like a large corporate entity than a ministry; which has its own budget and an independent profit and loss account.

Current State of Indian Railway

Major underinvestment

However, in spite of it’s considered as ‘lifeline of the nations’ (that’s what the tag line of Indian Railways says), it has been somewhat of a neglected area in terms of investment within the infrastructure segment. Considerable under-investment has been the real problem for Indian Railways since long. Over the past 10 years, IR has received only 3.5% to 6.5% of the yearly capex of the central and state governments as compared to 10% to 14% for roads. (Refer figure below)

Currently, railways account for just 5% of the total public capital expenditure, as compared to 12% for roads. The main reason behind this chronic underinvestment is the fact that public investment in railways is solely undertaken by the central government. However, in case of roads, both the central and state governments contribute.

Over the years, the allocation of public sector resources to railways has declined rapidly as compared to other transport sectors such as roads. Including private sector contribution, the share of railways in overall (private + public) investments in the economy has fallen from an already low 2% in the 1990s to just 1.4% in FY15. (Refer chart below)

The severity of this fund crunch is more evident when you have a look at IR’s network expansion through this period. Over the past three decades, India’s road network has tripled, whereas the railway network (i.e. total track length in route km) has grown by just 11%. (Refer chart below)

Capacity constraints

Insufficient investment has obviously resulted in severe strains on current capacity, with 40% of the Railway routes operating at above 100% capacity utilization.

(Source: Indian Railways. *OTOS – One Train Only Systems)

Poor quality of service

Inadequate investment and severe capacity crunch over many decades has hampered the Indian Railways services, both passenger and freight services, to a great extent. And the continued sub-standard quality of services has rendered IR in-competitive and has affected its profit making capacity adversely.

Loss of revenue

In order to make up for increased subsidization in passenger fares (fares are much below the actual cost), IR resorted to frequent hikes in freight services. And the higher freight tariffs along with the slow speed (one more consequence of capacity strains) and delays on freight services; has resulted in IR losing market share to the roads sector for goods transport.

Deteriorating Operating performance

Loss of freight revenue and continuously increasing expenses (result of highly subsidised passenger fares, increasing employee expenses and rising pension costs and of course inefficiencies within the railway system) has only helped to deteriorate the operating performance.

Operating ratio has always been on the higher side historically. In the Railway Budget for FY17, the Ministry of Railways (MoR) targets an improvement in the operating ratio (OR) to 90.0

The vicious cycle

All the above factors together have pushed Indian Railways in a vicious cycle of chronic under-investment and poor performance and quality.

It’s not a surprise that to break this cycle, the government needs to step up investments in railway infrastructure.

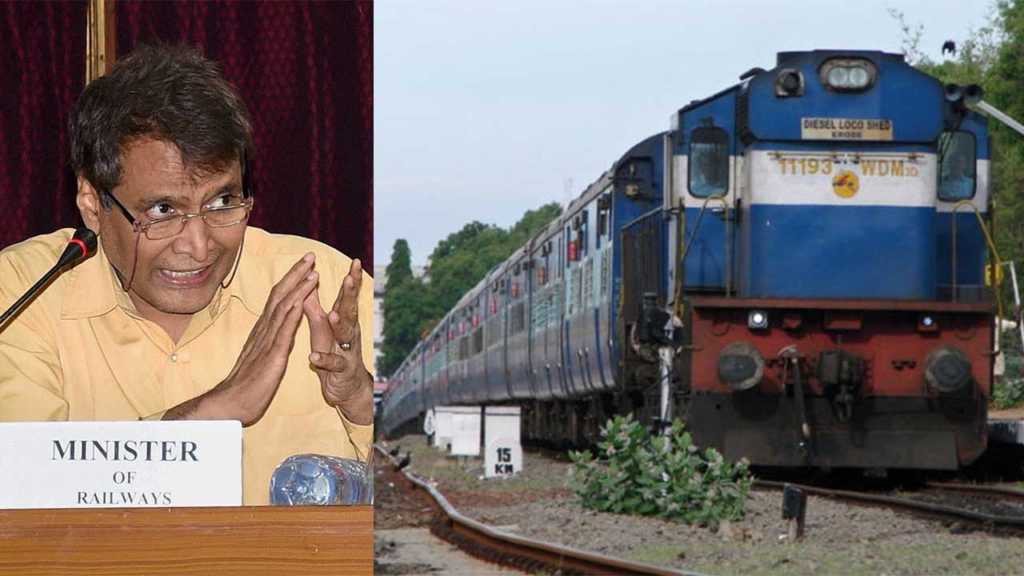

The Indian Railways minister, Mr. Suresh Prabhu, seems to understand this dire need for investment. He recently announced that Indian Railways will invest $140 billion over the next five years with a focus on developing infrastructure and especially on building more efficient transportation facilities. He also stated that his main concern is to increase revenue mainly in the non-fare segment, i.e. revenue from freight services.

His intentions to implement the railway investment plan with the prime objective of addressing the chronic under-investment over the past several decades were clear from the recent Railway Budget following a series of presentations made by senior railway officials including the Union Minister for Railways himself.

A brief picture of the proposed investment plan (quiet ambitious one) is as follows:

The table above highlights the heads on which the government is planning to incur capital expenditure. Clearly, the thrust is on network decongestion and expansion; other focus areas are safety, rolling stock, station redevelopment and high-speed rail (HSR).

The other focus areas of railway ministry are as follows:

- Significant emphasis on line-doubling projects as part of its drive to increase capacity – 11,100 kms of lines planned for doubling

- Focus on the electrification of broad gauge lines as the ministry is targeting 10,000km of electrification by FY20 and already 9,000km of projects are under various stages of execution/ordering

- 4,000 kms lines planned for gauge conversion

- 17200 kms lines planned for commissioning

- At least three stations will be redeveloped to international standards

- Station spaces to be provided for skill development activities by local authorities

- In addition, the emphasis on regaining freight share is visible as the ministry seeks to complete the Dedicated Freight Corridors (DFCs) by Dec 2019.

Funding this investment and Public Private Partnership opportunities:

The aforesaid capex plan of Indian Railways envisages that the investments in coming years will have to be significantly scaled higher.

It is normally financed by budgetary allocation for public expenditure, internally generated cash flow, debt and institutional financing. And finally, the remaining funding will need to come from private funding from public sector companies, Joint ventures with state governments and bilateral/multilateral organizations.

Historically, the Public Private Partnerships (PPPs) has not seen much of success mainly due to simple reason of feasibility of the projects as IR was unable to figure the profitability of specific services/projects which can be outsourced to private players. However, it is visible in many ways that IR is set to change this trend. It has developed Model Concession Agreements based on the various way of offering PPP projects. These are intended to boost private sector involvement especially in projects such as New lines, High Speed Rail and Station redevelopment. So there is a huge potential for private players in Indian Railway. This initiative by IR will be a game changer for PPP sector.

Implications of this ambitious investment plan:

Any kind of Infrastructure development is crucial to developing economy. It not only boosts the employment opportunities but also has a long term impact on output generation of that economy. Channelling public resources for railway infrastructure will not only directly add to India’s GDP growth (like any other infrastructure investments) but also have significant indirect multiplier effects on the economy, via:

1) Strong backward and forward linkages;

2) Linking new markets/regions and providing last-mile connectivity to raw materials;

3) Boosting price competitiveness of manufacturing by lowering transportation costs (lower input costs);

4) Boosting productivity through logistic efficiencies; and

5) Crowding in private investments

Though it seems like an extremely optimistic picture, the intention of the ministry to bring the change in itself will help to set a clear vision for Indian Railways which it had been lacking since decades. With a really ambitious investment plan and path-breaking reforms, the Indian Railways minister Mr. Suresh Prabhu, seems determined to put the Railways on a track of recovery and growth.

It is of course very palpable to encounter some skepticism towards the radical changes being implemented. However, at the least what we can say is that IR finally has a minister with the right intent and who prioritizes IR’s needs over political ambition. And that Indian Railways has a chance to transform, slowly but surely.