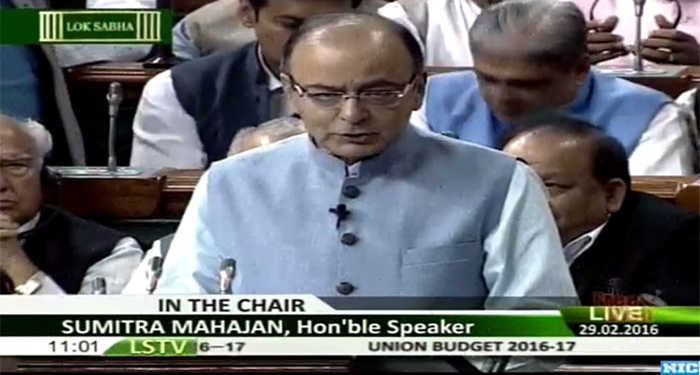

We will be doing a detailed piece on the #budget2016, its impact on various sectors, spending trends, and some information on key changes impacting individuals, etc. The following is a 2 page summary of key budget expenditure planned and certain important tax rebates.

Our take: The #budget2016 is well rounded and grounded to Fiscal Discipline. The need of hour is boosting investments, kick-starting rural economy, removing farmers’ plights, and rationalizing taxes. Some measures seem unnecessary, but still it’s a huge win-win. Importantly, from investors point of view, #budget2016 has touched on Bank recapitalization, ARC reforms, listing of insurance companies, newer derivative products, relooking RBI committees, among others. Further, NITI Ayog is coming into play to rationalize monetizing of assets from CPSE i.e. PSUs, which is a huge positive. The change in name of disinvestment board, will entail better mission statement and ensure no under-selling of government assets. A detailed piece shall follow.

#Budget2016: Following are key Summary Items of Expenditures, Tax Measure by the Government

| No. | Allocation | Sub Amount | Amount |

| 1 | Agriculture and Farmers’ welfare | 35,984 | |

| 1.1 | ‘Pradhan Mantri Krishi Sinchai Yojana’ to be implemented in mission mode. 28.5 lakh hectares will be brought under irrigation | ||

| 1.2 | 89 irrigation projects under AIBP fast tracked | ||

| 1.3 | Long Term Irrigation Fund under NABARD with an initial corpus | 20,000 | |

| 1.4 | Program for ground water resources | 6000 | |

| 1.5 | 5.0 L ponds & 10 L compost pits | ||

| 1.6 | 2000 model retail outlets for fertilizer along with soil & seed testing | ||

| 1.7 | Unified Agricultural Marketing ePlatform | ||

| 1.8 | Interest rate subvention scheme | 15000 | |

| 1.9 | Agricultural Insurance | 5500 | |

| 1.10 | Diary projects | 850 | |

| 2 | Rural Sector | ||

| 2.1 | Allocation for rural sector | 87,765 | |

| 2.2 | Grant in aid to Gram Panchayat & Municipalities | 287,000 | |

| 2.3 | MNGRES | 38,500 | |

| 2.4 | Key developments planned | ||

| 2.4.1 | District Level Committees under Chairmanship of senior most Lok Sabha MP from the district for monitoring and implementation of designated Central Sector and Centrally Sponsored Schemes | ||

| 2.4.2 | Digital Literacy Mission Scheme for rural India to cover ~6 crore additional household within the next 3 years | ||

| 2.4.3 | National Land Record Modernisation Programme has been revamped | ||

| 3 | Infrastructure | ||

| Total road sector investment (including PMGSY) | 97,000 | ||

| Road allocation | 55,000 | ||

| NHAI Bonds | 15,000 | ||

| Total infrastructure outlay | 221,246 | ||

| 4 | Social Sector Outlay | ||

| Total allocation including education & healthcare | 151,581 | ||

| New LPG connection for BPL population | 2000 | ||

| Health Protection (100,000 per family and additional 30,000 for senior citizens) | |||

| 3000 new medical stores under Pradhan Mantri Aushadhi Yojana | |||

| Skill development | 1800 | ||

| 5 | Other key allocation | ||

| 5.1 | PSU bank recapitalization | 25,000 | |

| 5.2 | Mudra Yojana Target for disbursement | 180,000 | |

| 5.3 | Price stabilization fund for pulses | 900 | |

| Additional finnce mobilization for NHAI, PFC, REC, IREDA, NABARD and Inland Water Authority by raising bonds | 31,300 | ||

| Total Plan Expenditure | 5,50,000 | ||

| Total Non Plan Expenditure | 14,28,000 | ||

| Total Expenditure | 19,78,000 |

#Budget2016: Key other measures requiring detailed reading of fine print:

- End of plan & non-plan categorization and all expenditures to have sunset clause and review

- Digitization of land records

- Automation & digitation of 300,000 fair price shops

- Comprehensive review and rationalization of Autonomous Bodies

- Amendments in the SARFAESI Act 2002 to enable the sponsor of an ARC to hold up to 100% stake in the ARC and permit non institutional investors to invest in Securitization Receipts

- Statutory basis for a Monetary Policy framework and a Monetary Policy Committee through the Finance Bill 2016

- RBI to facilitate retail participation in Government securities

- Reforms in FDI policy in the areas of Insurance and Pension, Asset Reconstruction Companies, Stock Exchanges

- Action plan for revival of unserved and underserved airports to be drawn up in partnership with State Governments

- Revitalize the PPP mechanism

- 100% FDI to be allowed for marketing of food products manufactured in India

Taxes

- Increase in presumptive tax limits to Rs. 2.0 cr

- Phasing out of key rebates:

- Accelerated depreciation reduced to 40%

- R&D spend limited to 150%

- SEZ benefits available only if unit started until 31 Mar 2020

- New mfg companies can have 25% tax rates with riders

- Lower tax for companies with turnover less than Rs. 5.0 cr., at 29% plus surcharge plus cess

- Complete pass through of income-tax to securitization trusts including trusts of ARCs. Securitization trusts required to deduct tax at source

- Additional tax at the rate of 10% of gross amount of dividend will be payable by the recipients receiving dividend in excess of Rs. 10 lakh per annum

- Sur-charge to be raised from 12% to 15% on persons, other than companies, firms and cooperative societies having income above Rs. 1 crore

- Krishi Kalyan Cess, @ 0.5% on all taxable services, w.e.f. 1 June 2016

- Infrastructure cess, of 1% on small petrol, LPG, CNG cars, 2.5% on diesel cars of certain capacity and 4% on other higher engine capacity vehicles and SUVs. No credit of this cess will be available nor credit of any other tax or duty be utilized for paying this cess.

- ‘Clean Energy Cess’ levied on coal, lignite and peat renamed to ‘Clean Environment Cess’ and rate increased from `200 per tonne to `400 per tonne

- Excise duties on various tobacco products other than beedi raised by about 10 to 15%

- Multiple individual tax friendly measure announced such as e-assessment, lowering penalties on concealment, etc.

- 13 cesses, levied by various Ministries in which revenue collection is less than Rs. 50 crore in a year to be abolished

- Interest at the rate of 9% p.a against normal rate of 6% p.a for delay in giving effect to Appellate order beyond ninety days

- No change in individual tax rate

- Introducing Voluntary Disclosure of Income scheme with aggregate tax of ~45%

- One-time scheme of Dispute Resolution for ongoing cases under retrospective amendment