Demonetization is done. Loads of black money is getting recovered on daily basis and the government machinery is busy counting. There cannot be two thoughts about demonetization that it has been a herculean task which required strength, will and integrity at the very core to make it happen and the PM Modi proved that his fabled 56 inches’ chest is not just a sales-pitch. There are few who complain about its after effects, but then someone very well described it “that if a house is renovated, there will be slight inconvenience while the renovation is done, but it will all look great once the house is completely renovated with room for everyone”.

A Pune based financial NGO (Arthakranti) proposed a roadmap, which listed many ingredients of modern economy like demonetization, making the country digital, reduction of high denomination notes and cashless payments and seems that the current govt. is almost following it.

In this article, we will try to dig a bit deep to understand if this exercise can indeed make our lives beautiful and simple?

The proposal is to get rid of variety of taxes in our country counting as high as 25 and introduce only a single Banking Transaction Tax or BTT. BJP President Amit Shah in a media conclave around 10 days back did indicate it when he said “the country needs to take a giant leap. There is a need to push the economy forward. Each and every transaction has to be taxed. Few people had got accustomed to keeping themselves out of the tax net. This will not happen any longer.”

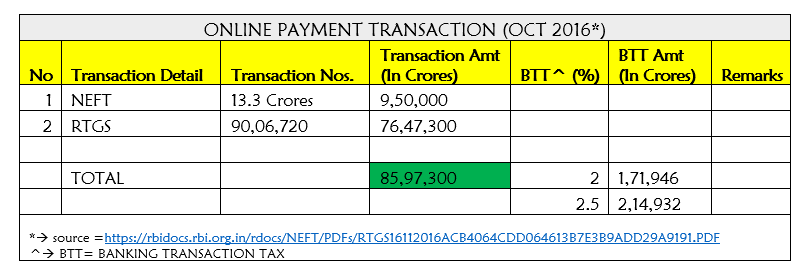

The arithmetic is simple, instead of taxing few people with higher and multiple taxes the BTT will tax everyone with lesser and one tax & I will demonstrate this with an example:-

Now if we do this for a yearly calculation the amount will be

Total = (approx. 85 Lakhs crores) Rs. 85,97,300 cr ==> 8597300 * 12 = (approx. 10.3 crores crores) Rs. 103,167,600 cr / year

2% Bank Transaction Tax (BTT) = 2*103167600/100 = 20,63,352 crores per year

OR

2.5% Bank Transaction Tax (BTT) = 2.5*103167600/100 = 25,79,190 crores per year

For the year 2014-15 the total direct and indirect tax collection by Central and state governments has been around 22,02,886 cr / year (source = https://www.rbi.org.in/scripts/PublicationsView.aspx?id=16556).

Now if you see the estimated tax collected using BTT for a year comes to almost the same or more amount than currently collected using the complex web of uneven taxation system. This data is also of pre – demonetization period (Oct 2016) and with the current govt. emphasis on online transaction the transaction count and amount is going to increase exponentially for days to come.

This looks great… right, but there is a catch, this model will work only if higher denomination notes like 500, 1000 and 2000 rupee notes are scrapped and the 100 rupee note is very less in circulation thereby making people to transact only via the payment gateway. The Modi govt. has already made it clear that the circulation of new 500 & 2000 is less than 15 % and that too has been introduced to reduce the impact of demonetization on public at large, govt. supporters have already indicated that both 500 & 2000 notes are temporary and will be phased out within a period of 5 years or earlier.

BTT is so evenly designed that the rich will be automatically taxed more and the poor will be taxed less. Let’s take a few example to understand the logic.

Ghamshyam is a rich business man and assuming he sold Rs. 100,000,000 (10 Crores) worth of his products yearly, with the current setup he was either paying very less or NO tax. With BTT he will have to pay 2.5 % which translates to Rs. 25,00,000 per year.

Ram is a salaried middleclass person earning Rs. 10,00,000 (10 Lakhs) per year, with the current setup say he is paying around 25 % tax which translates to around Rs. 2,50,000 per year. With BTT assuming he spends the complete earned salary of Rs. 10,00,000 he will still pay just 2.5 % which translates to Rs. 25,000 per year, effectively saving Rs. 2,25,000 per year.

Shyam is a poor person working as a daily laborer, say he earns Rs. 1,80,000 per year, with current setup he may not be paying any tax because of no taxes for 2,50,000 tax slab. But assuming if he transacts his complete salary he may end up not paying more than Rs. 4,500 per year. Now the low denomination currency of rupees 10, 20 & 50 comes very handy for such people for transaction by cash and have to pay no taxes, also the govt. by law can refund the taxed money collected for such people directly into their accounts as have been transferring the subsidy money.

Apart from this the icing of the cake will be the complete removal of indirect taxes which are levied on almost all the products that we use in our daily lives. For example “Petrol”, which say has a pump retail price of around Rs. 66.45 / litre and that includes excise duty + VAT + pollution cess surcharge = Rs.35.61, now with BBT in place and removal of indirect taxes, petrol will cost people at pumps at just Rs. 30.84 (66.45-35.61).

The country being in the safe hands of the “PRADHAN SEVAK”, rest be assured it is just a matter of time for the lost glory to return.

References:

https://rbidocs.rbi.org.in/rdocs/NEFT/PDFs/RTGS16112016ACB4064CDD064613B7E3B9ADD29A9191.PDF

https://www.rbi.org.in/scripts/PublicationsView.aspx?id=16556

http://www.mycarhelpline.com/index.php?option=com_latestnews&view=detail&n_id=417&Itemid=10